Boeing has long proposed its 737 MAX is the undisputed winner of

the Single Aisle Airplane Wars. Airbus says not so fast people, the A320 NEO

reigns supreme. Who is correct in this assumption?

The answer is in sales numbers for various reasons.

- Fleet renewal

opportunity

- Commonality

Curve

- Oil Prices

become a non-purchase factor

- Time

- Paper vs Metal, Flying version wins orders.

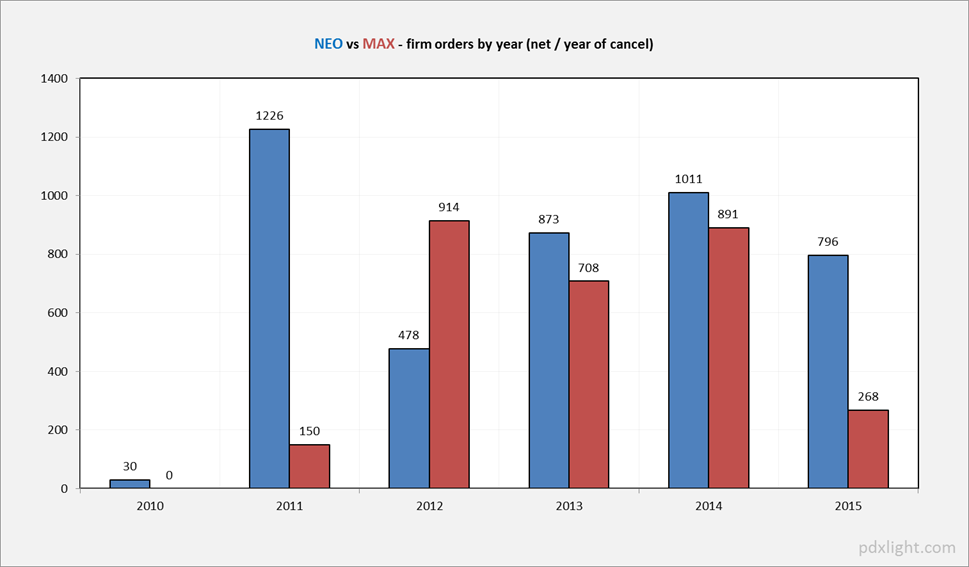

Airbus had an eleven month jump in time over Boeing announcing in

2011 its NEO single Aisle. Boeing lost the advantage of time and was set

backwards by about 1200 NEO's ordered in the first year. The first 787 was

delivered in 2011 and Boeing was flummoxed by an early 787 debacle and couldn't

counter punch Airbus at that time until the next year when orders came surging

in for the MAX.

However, Airbus was in perfect sync with market realities. They

kept going forward with its customers filling its order book.. Boeing could

only try to stay on the same lap around the development stage with orders.

So far, so good until 2015. Airbus is ready to lap Boeing on

single Aisle orders. This leads me to ponder that oil prices do not make a case

for Boeing, for buying its MAX over the NEO. The fuel efficiency difference for

the two is a non-decider.

Commonality found in Airbus product is further along, than Boeing's

conversion towards its theme of "fly like a 787" on all models.

Customers new to Airbus, may have bought into the price offering from a single aisle

discount. Boeing strapped for program profit may have held firm with its

pricing in order for it to avoid any development hit on its bottom line for the

MAX.

Airbus stole the march on Boeing in 2011 and timed the world fleet renewal

window perfectly. The lower oil prices have just began shrinking purchase power

in 2015. Boeing drew the short straw when leasing aircraft becomes a tool and side

effect from lower fuel prices.

However, as dismal as the 2015 period appears for Boeing Single Aisle

purchase orders, it has built a significant internal construct for its

marketing. The multitude of 787 sold, and the 777X launch success will make the

case for having a top to bottom family of Boeing aircraft. Boeing's out of sync fleet "renewal

opportunity surge", will catch-up by 2018 to the NEO book numbers. The year 2015

is bottom hitting for Boeing's Single Aisle effort. In fact Boeing will book some more

MAX this month but won't catch Airbus. Boeing will have aligned its timing, commonality

factor, and fleet renewal windows by 2018.

The flying version wins orders for Airbus as Boeing sketches out the Max on the CAD, its paper version loses momentum with orders during 2015. The third round of this fight will begin with Boeing having bloody cuts and bruises from the fight. The Boeing metal version rolls towards towards its corner in the shop awaiting the next round.

The flying version wins orders for Airbus as Boeing sketches out the Max on the CAD, its paper version loses momentum with orders during 2015. The third round of this fight will begin with Boeing having bloody cuts and bruises from the fight. The Boeing metal version rolls towards towards its corner in the shop awaiting the next round.

Update:

Boeing jumps some net orders for

the 737 before year's end, and slightly closes single aisle gap. It is a good

indicator Boeing is in the fight to win it.

| 2015 Net Orders | 563 | 2 | 49 | 58 | 71 | 743 |