Qantas airlines is about to receive its first 787-9. Alan Joyce has lead the Qantas survival in the highly competitive airline market. Back in 2009 Qantas canceled a boatload of 787's by moving some product to its subsidiary Jetstar and then promptly canceling its confirmed order book while maintaining 45 options. Qantas was in a dire position and being a Boeing star customer became a pipe dream at that time.

Great disappointment spread across Boeing's aspirations at the time. Since then, "countless" orders poured in for Boeing's 787 family of aircraft totaling about 1,300 large mid bodies ordered today. Boeing got over Qantas stalling out over Everett, Wa.

Eight and a half years later, Qantas is about to receive its first 787-9 out of eight on order. In currently owns a fleet of 787-8's on its Jetstar fleet of eleven. Lucky for Qantas its 747's held together another eight years. The eight 787-9's it had ordered will now make Qantas a world player instead of looking like an old Pan Am travel folder. Somehow the lucky eight is in sight of China's lucky number.

There are two schools of strategy available from a Qantas position. The first is the industry norm, "Build it and they will come". The second is is "Best practices". Alan Joyce has taken the later.

Back in the 1990's the term "best practices" was all the rage at business seminars. It could be defined, use the means that are proven to be the best for gaining success. Alan Joyce pulled Qantas up and over the mountain staying within its best practice. It took care of business first by never absorbing an enormous 787 Boeing order before it could fix its business model.

The best practice here was to keep old equipment like the 747, until squeezing out its last revenue dollar possible before an airplane failure could occur. Using paid for and depreciated equipment was cheaper than its fuel burn inefficiency. The cost of buying 787's in vast quantity would sink the Qantas financial ship. Alan Joyce had to make some hard decisions before becoming a Boeing star customer. It canceled its 787 order book, but held onto a significant number of options for future purchases. The future is now.

The first 787-9 arrives today out of eight booked. The future is also tomorrow as Qantas holds onto production slots with further 787-9 orders to be confirmed at its own pace. Alan Joyce choice by not building before they come is working out of a best business practices strategy. Making an idea work before scaling up is the theme. The only damage done to Qantas is some of its pride was bruised back in 2009. Now that its 747-400 are depreciated on the books sufficiently, the opportunity arises for the 787 fleet expansion. The only regret is Qantas had the position of being a world 787 leader when it would have started receiving its first 787-9's back in 2014 instead of 2017.

The best practice of growing an airline within its own available resources seams to have worked at the expense of some pride and a few routes lost. Late to the ball worked for Cinderella after all. The main thing is to make the main thing, the main thing! Alan Joyce best practices motto leads his charge. He is rebuilding Qantas into a world player one air frame at a time.

The Qantas door has opened years late but is now able to learn from the 787 pioneers for what mistakes not to make. It kept its powder dry until seeing the green in the bank. The best practice was to wait until all the bugs were worked out of its fleet operations. Now Qantas can resume from 2009. It was not a lost opportunity but more of taking its turn after meticulous preparation. Building an airline empire when so few passengers may come was a recipe for disaster. Alan Joyce just wrote the book on business due diligence in the airline industry.

My Blog List

Monday, October 16, 2017

Sunday, October 15, 2017

The 797 Unique-Ubiquitous and In The GAP 797

The Great Air Plane (aka GAP) may be called the 797 and it will be incomparably unique. The gap is an airplane space void of any typical tubes flying east and west. Boeing is taking its time before announcing its gap filler aircraft. The A-321 NEO flies around the GAP edge in an endless circle leaving the 737 single aisle segment stumped. There is a 5,000 unit GAP capacity for no known or existing airplane.

The Boeing company is taking its time for announcing a new class of aircraft. Probably because it took too long for a buying customers waiting for its 787 program. Ten years is a long time for holding airplane expectation after an announcement. Boeing is muting customer expectation when waiting by and already going forward with a mid body in secret steps.

Announcing too early will drive customer nuts during a long wait. The wait has already started before announcing the aircraft but its development is on-going getting ahead of any impatient waiting like the 787 experienced.

A second point under consideration is that its chief competitor does not know how to counter something not yet publicly announced to all commercial aviation customers. The secret sauce: Boeing is waiting for milestones to be reached before announcing. The guarantee must be five year entry into service from date of market announcement. Additionally, the design deviates from the norm and all development stoppers are mitigated away from critical eyes. No bad press please. Boeing has its work cut out for making a timeline from its initial announcement to a five year entry into service deadline.

Boeing is also moving developmental operations in the vicinity of area 51 or somewhere near Burbank California for assembly. The Dream-lifter can and will move parts towards a quaint building near jack rabbits and sage brush. Every part of the mystery aircraft can be airlifted into an engineering/assembly area not found near Seattle, Wa. When the prototype flies comes an announcement to an Airshow near Paris. The newly created front office for the 797 can handle mail forwarding and phone calls coming into some Boeing rented space near the "Needle". The office answering machine answers every phone call with a " Welcome to the 797 program, please leave a message and we will return your call at the nearest time available" beeeep message sequence.

The Seattle Times has assigned an aviation columnist to the project and offers sage opinions on a weekly basis. Winging It regurgitates any opinion as its standard issue.

If a 797 is needed by a customer, call Boeing's marketing arm, they are taking names and kicking tail.

The whole idea is to choreograph an announcement where Boeing can deliver a unique aircraft in ubiquitous quantities before the competition can even read the blue print on such an aircraft. A five year window is needed for this operation using a ten year development run-up for the 797. The year 2019-2020 should allow time for a prototype and an announcement year in Paris. Boeing has learned it needs to jump the competition for any forward leaning ideas.

The Boeing company is taking its time for announcing a new class of aircraft. Probably because it took too long for a buying customers waiting for its 787 program. Ten years is a long time for holding airplane expectation after an announcement. Boeing is muting customer expectation when waiting by and already going forward with a mid body in secret steps.

Announcing too early will drive customer nuts during a long wait. The wait has already started before announcing the aircraft but its development is on-going getting ahead of any impatient waiting like the 787 experienced.

A second point under consideration is that its chief competitor does not know how to counter something not yet publicly announced to all commercial aviation customers. The secret sauce: Boeing is waiting for milestones to be reached before announcing. The guarantee must be five year entry into service from date of market announcement. Additionally, the design deviates from the norm and all development stoppers are mitigated away from critical eyes. No bad press please. Boeing has its work cut out for making a timeline from its initial announcement to a five year entry into service deadline.

Boeing is also moving developmental operations in the vicinity of area 51 or somewhere near Burbank California for assembly. The Dream-lifter can and will move parts towards a quaint building near jack rabbits and sage brush. Every part of the mystery aircraft can be airlifted into an engineering/assembly area not found near Seattle, Wa. When the prototype flies comes an announcement to an Airshow near Paris. The newly created front office for the 797 can handle mail forwarding and phone calls coming into some Boeing rented space near the "Needle". The office answering machine answers every phone call with a " Welcome to the 797 program, please leave a message and we will return your call at the nearest time available" beeeep message sequence.

The Seattle Times has assigned an aviation columnist to the project and offers sage opinions on a weekly basis. Winging It regurgitates any opinion as its standard issue.

If a 797 is needed by a customer, call Boeing's marketing arm, they are taking names and kicking tail.

The whole idea is to choreograph an announcement where Boeing can deliver a unique aircraft in ubiquitous quantities before the competition can even read the blue print on such an aircraft. A five year window is needed for this operation using a ten year development run-up for the 797. The year 2019-2020 should allow time for a prototype and an announcement year in Paris. Boeing has learned it needs to jump the competition for any forward leaning ideas.

Saturday, October 14, 2017

The Accretive Max

I am so glad this is not finals week at some University of higher learning. In some class whether its math, business, or science. A popularization of the word "accretive" would show up in a question. The finals question may read this way.

What accretive example can be given from the aviation Industry?

Answer:

(a)The first accretive example is Boeing's 737 MAX. First there was the 737 Max -7 followed by the 737 Max 8, and then came the -nine after which came the -ten. It becomes "Accretive" with all its expansion of types, as it battles a competitor's enormous backlog of 5,202 A-320 NEO types ordered. As of September 30, 2017 Boeing has gained firm orders for its 737 Max family in a number of 3,902 units. The fastest accretive rise in Boeing's history for any of its vast airplane types ever made.

(b)Then the business school guy chimes in "wrong answer!" Boeing has made a clean switch going from its 737 NG to the 737 Max on the factory floor. It has already delivered 30 Max types while maintaining a high monthly production rate. The cash upside is incredible and the stock value is off the charts at this time by quickly going past the accretive position into hyper value drive.

(c)Not so fast the science guy chimes in, "while working with the physics of the problem it was discovered that the 737 NG could fly about 2,900 miles on an a full plane load of passengers and luggage into the wind. The accretive nature of the Max program has added passengers, luggage and can go 3,500 miles. This (me) science guy is catching a flight to the Hawaii observatory from the mainland on an Southwest Airline 737 Max 8 as proof of this concept."

Can that be done?

(d)The FAA guys have the accretive proposition for a Hawaiian flight under advisement. Its not a matter of if, it's a matter of when!

When all stories are compared with one another it was was 4-0 in favor the 737 Max was accretive and not just an excellent answer after a recent PW engine Airbus test flight.

The correct test answer is: (b)

Accretive is the process of accretion, which is growth or increase by gradual addition, in finance and general nomenclature. An acquisition is considered accretive if it adds to the item's value or corporation's earnings per share.

The business school answer using the 737 Max as an aviation example is the correct answer on this test.

What accretive example can be given from the aviation Industry?

Answer:

(a)The first accretive example is Boeing's 737 MAX. First there was the 737 Max -7 followed by the 737 Max 8, and then came the -nine after which came the -ten. It becomes "Accretive" with all its expansion of types, as it battles a competitor's enormous backlog of 5,202 A-320 NEO types ordered. As of September 30, 2017 Boeing has gained firm orders for its 737 Max family in a number of 3,902 units. The fastest accretive rise in Boeing's history for any of its vast airplane types ever made.

(b)Then the business school guy chimes in "wrong answer!" Boeing has made a clean switch going from its 737 NG to the 737 Max on the factory floor. It has already delivered 30 Max types while maintaining a high monthly production rate. The cash upside is incredible and the stock value is off the charts at this time by quickly going past the accretive position into hyper value drive.

(c)Not so fast the science guy chimes in, "while working with the physics of the problem it was discovered that the 737 NG could fly about 2,900 miles on an a full plane load of passengers and luggage into the wind. The accretive nature of the Max program has added passengers, luggage and can go 3,500 miles. This (me) science guy is catching a flight to the Hawaii observatory from the mainland on an Southwest Airline 737 Max 8 as proof of this concept."

Can that be done?

(d)The FAA guys have the accretive proposition for a Hawaiian flight under advisement. Its not a matter of if, it's a matter of when!

When all stories are compared with one another it was was 4-0 in favor the 737 Max was accretive and not just an excellent answer after a recent PW engine Airbus test flight.

The correct test answer is: (b)

Accretive is the process of accretion, which is growth or increase by gradual addition, in finance and general nomenclature. An acquisition is considered accretive if it adds to the item's value or corporation's earnings per share.

The business school answer using the 737 Max as an aviation example is the correct answer on this test.

DARPA's Mission: Well It Flew!

Defense Advanced Research Projects Agency or AKA DARPA, has billions of invisible money. Money that isn't even printed since it is invisible to the public's eyes.The topic is the UCAS Boeing X45 and Grumman X47. Boeing was first to come on board and then Grumman's was last to take-off the carrier. The Unmanned Combat Air System is the autonomous aircraft that looks like a flying...

The big story is the X47 program was mothballed after a successful campaign of launching and landing with Aircraft carriers at sea. The last word is that developers are making a military version in the meantime with bigger payloads and longer ranges.

The disadvantage is it wasn't stealthy in the first iterations. The advantage is that it flew and worked well. The program is scalable and transferable. Software loads from the autonomous aircraft can move to existing manned aircraft where refueling and flying of manned flights are then made autonomous for most military aircraft. Personnel on board could manage other duties.

Expect a public reveal where the next generation of UCAS to become stealthy with a 4,000 pound payload capability and cheap enough as a multiplier in the battlefield. Working with a F-35 type platform going into the battle space, the F-35 would be used as a bad uncle pounding radar, missiles and any defenses intended for the UCAS wing of aircraft.

Any armed adversarial wings would become overwhelmed by a combination of F-35's and other fourth generation aircraft having a multitude of X47 "bomb trucks" flying into harms way. The GBU class bombs from 500-2000 pound class would surgically take-out the ground installation and military options in moments where the 5th generation aircraft fly cover and give management for the whole battle space.

Satellite communication links would engage operators in warehouses, trailers and Naval ships a half a world away into the fracas even without an American human causality. The first few moments of any battle is where the risks arise for the incoming equipment. After the initial defensive barrage, all weapons location would be identified and neutralized. In fact the onslaught of cruise missiles may take out a majority of the ground weapons before the air armada arrives.

Butte, Montana Pasty

X47B Grumman Flying Pasty

Carrier Autonomous Launch photo

Boeing-s 2000-2000? X45 Version

The big story is the X47 program was mothballed after a successful campaign of launching and landing with Aircraft carriers at sea. The last word is that developers are making a military version in the meantime with bigger payloads and longer ranges.

The disadvantage is it wasn't stealthy in the first iterations. The advantage is that it flew and worked well. The program is scalable and transferable. Software loads from the autonomous aircraft can move to existing manned aircraft where refueling and flying of manned flights are then made autonomous for most military aircraft. Personnel on board could manage other duties.

Expect a public reveal where the next generation of UCAS to become stealthy with a 4,000 pound payload capability and cheap enough as a multiplier in the battlefield. Working with a F-35 type platform going into the battle space, the F-35 would be used as a bad uncle pounding radar, missiles and any defenses intended for the UCAS wing of aircraft.

Any armed adversarial wings would become overwhelmed by a combination of F-35's and other fourth generation aircraft having a multitude of X47 "bomb trucks" flying into harms way. The GBU class bombs from 500-2000 pound class would surgically take-out the ground installation and military options in moments where the 5th generation aircraft fly cover and give management for the whole battle space.

Satellite communication links would engage operators in warehouses, trailers and Naval ships a half a world away into the fracas even without an American human causality. The first few moments of any battle is where the risks arise for the incoming equipment. After the initial defensive barrage, all weapons location would be identified and neutralized. In fact the onslaught of cruise missiles may take out a majority of the ground weapons before the air armada arrives.

Thursday, October 12, 2017

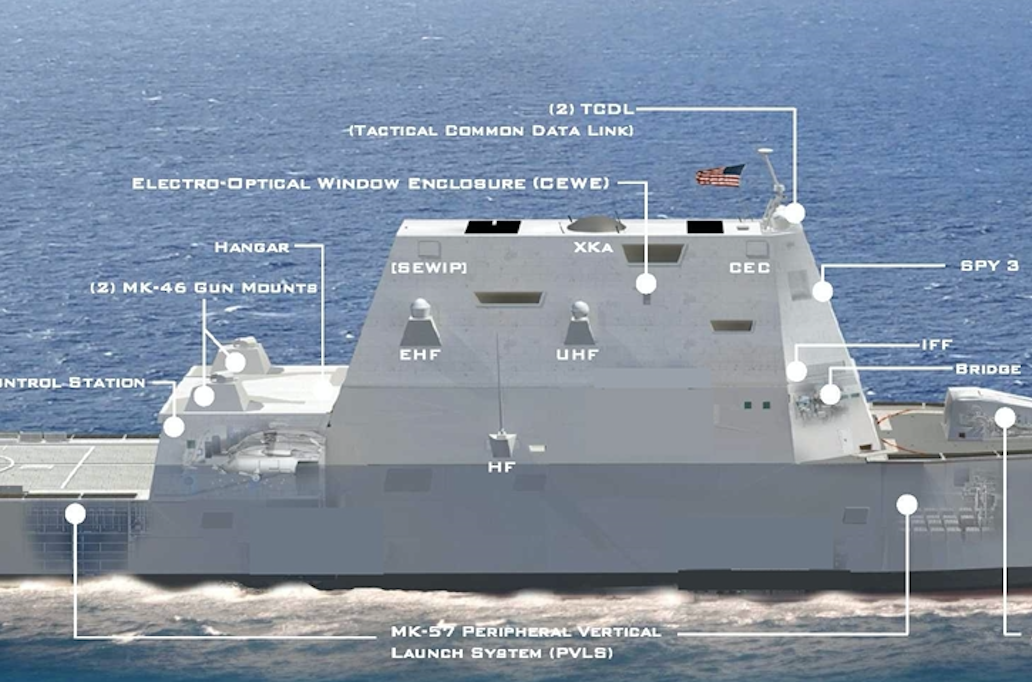

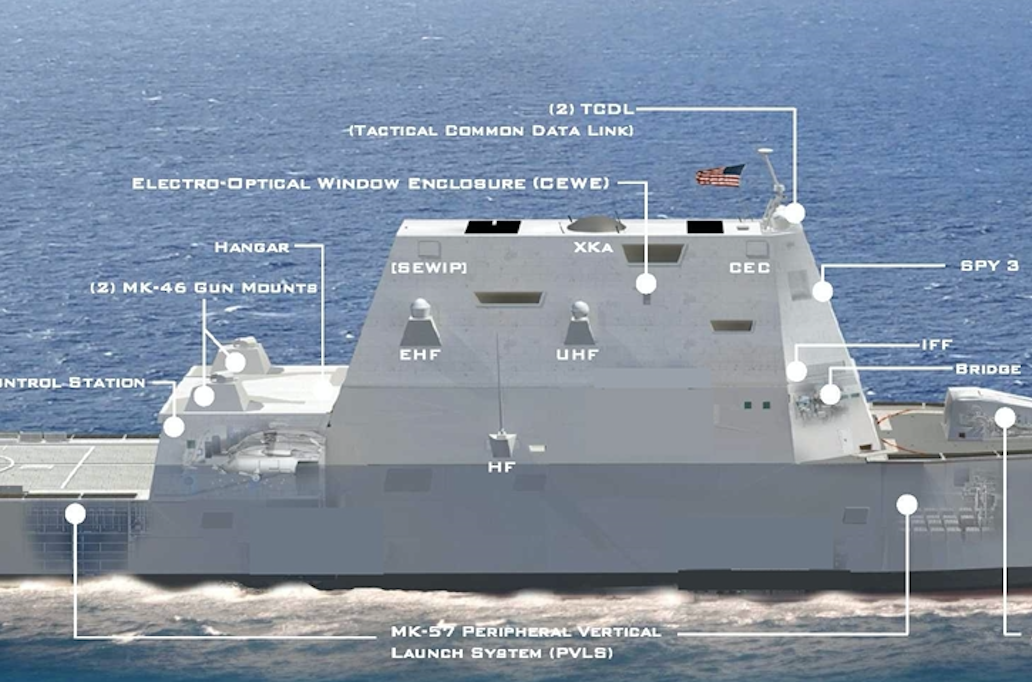

Its Been Awhile Since Mentioning The Zumwalt

Back in early April 2016 an article was posted about the

Zumwalt.

It was a walk through in words and pictures of the Zumwalt DDG

1000 dress rehearsal before acceptance trials. It mentioned in this article it

would be about two years before its weapons load would be accomplished. The

Zumwalt at that time was bare of weapons and munitions. The weapons systems

were not on board but awaited a San Diego port duty station for up grading DDG

1000 of its weapons. In fact a debate was on whether to install a rail gun

which turned out to be a punt on fourth down procurement cycle. A later

follow-on Zumwalt class destroyer would be fitted with the "Rail

Gun".

USNI News photo

The interim period of time from then to now, the Zumwalt has been

fitted with a vast variety of weapon systems, which have yet to be completed

throughout an estimated June 2018 time frame. All first time installations and testing’s

of a new class of ship such as a Zumwalt should expect time to drag on until

the Navy knows what it has or will have.

Seven months out from June and 18 months since builders trials the

Zumwalt has gained funding for the final phases of equipment and systems

installations.

The Zumwalt will rapidly become ready for war in a way potential

adversary will have an almost impossible task of stopping its capability. The

North Korean turmoil will miss the Zumwalt's presence in the current situation.

The former Zumwalt-Winging It article mentioned the ship was similar to a

submarine configuration as all activities would be held under its skin except

aviation access and a few other "outside" sea going tasks. Everything

else would be held under closed view from natural light.

It becomes mind boggling as to what this ship will able to do. If

the F-35 is a flying computer synchronizing the battle space from above, then

the Zumwalt has the same only from the surface. It will have in the future an advanced dual band

radar AN/SPY-6 just for

the navy.

The summary of it all is a 3D radar system that

can capture and lock down movement of any objects from a specific or broad band

sensing. Currently the most advance Radar systems being installed are on the

CVN 78 Gerald R Ford i.e. AN/SPY-3 types.

The AN/Spy-6 is so classified there is no other

capability existing in the world. The Zumwalt will be able to coordinate current

military systems outside the ships battle space under and above the seascape.

Expect the Zumwalt to be loaded with a

full array of destroyer type missiles, torpedoes and other hidden weapons of

mass destruction. All will be automated, plug and play type systems for which

the recent funding award will hook-up.

Wednesday, October 11, 2017

Jet Airways of India Inks 75 Max 737's

It may have been a well known deal in the making or maybe it wasn't, but Jet Airways did sign in on the 737 Max for 75 units as a firm order. What is further a big get for Boeing is another 75 possibilities are on option from Jet Airways. The Boeing single aisle is taking over the Airbus single aisle bookings for 2017.

When Airbus closes its order year it will have to have some big late year A-320 NEO orders to even hold the Boeing surge off. It is becoming increasingly difficult for Airbus to wall off a Boeing single aisle order surge since its backlog is so very large and its rate of production currently has slowed down for the A-320 family of aircraft.

Boeing can now add 75 single aisle units to its order book, which was standing at 398 gross units at the end of September. Back in April 2013 and then in March 2014, Jet Airways had ordered 75 Max Jets with 50 and 25 respective unit orders. It was announce this last June 2017 that Jet Airways was in the market for up to 100 narrow bodied aircraft. However, about 100 days later comes the news that Jet Airways just firmed up another 75 Max 737's, This recent disclosure would make Boeing's single aisle order book bounce upward towards 490 gross single aisle orders during YTD October 2017. Airbus at the end of September had booked a gross of 263 of its single aisle aircraft. Without having any Airbus order data an assumption is made, Boeing has about a 227 gross order lead over Airbus for the single aisle type at this time.

If this order relationship remains constant until the end of the year, Boeing will have significantly reduce the Single Aisle order lead Airbus currently holds.

When Airbus closes its order year it will have to have some big late year A-320 NEO orders to even hold the Boeing surge off. It is becoming increasingly difficult for Airbus to wall off a Boeing single aisle order surge since its backlog is so very large and its rate of production currently has slowed down for the A-320 family of aircraft.

Boeing can now add 75 single aisle units to its order book, which was standing at 398 gross units at the end of September. Back in April 2013 and then in March 2014, Jet Airways had ordered 75 Max Jets with 50 and 25 respective unit orders. It was announce this last June 2017 that Jet Airways was in the market for up to 100 narrow bodied aircraft. However, about 100 days later comes the news that Jet Airways just firmed up another 75 Max 737's, This recent disclosure would make Boeing's single aisle order book bounce upward towards 490 gross single aisle orders during YTD October 2017. Airbus at the end of September had booked a gross of 263 of its single aisle aircraft. Without having any Airbus order data an assumption is made, Boeing has about a 227 gross order lead over Airbus for the single aisle type at this time.

If this order relationship remains constant until the end of the year, Boeing will have significantly reduce the Single Aisle order lead Airbus currently holds.

Tuesday, October 10, 2017

AirAsia X Has(d) 66 A330 NEO's

AirAsia X has entered negotiations with Airbus into converting 66 A-330-900's it had already ordered into a like number of A-350-900's. It also mentioned talking to Boeing about its 787 as if an insertion into this news slice. This also opens up a huge topic for Airbus. It only shows 206 A-330-900 NEO's ordered program-to-date, noting zero booked for 2017. If it does switch that order to 66 A-350's, it would harm the A-330 NEO program immensely. As an Airbus A-350 switch deal confirmed, Airbus could then show only show 140 A-330-900's in a one for one deal. AirAsia X holds the the life force of the Airbus aspirations for its A-330 NEO campaign.

Currently, Airbus has Booked 858 A-350's with 114 of its type delivered. An AirAsia X switch to the A-350 from the A-330-900 NEO would effectively stun the Airbus NEO program. The other part of the program is the A-330-800 with only 6 ordered. The NEO program would shrink to 146 A-330-NEO's booked which places that Airbus program as a lost leader program feeding into its A-350.

Airbus plan "B": If an Airbus deal is struck for switching to 66 A-350's from the A-330 NEO's it will not catch Boeing's hold on the medium wide body market. In fact this may be something of Airbus' own making. In addition the deal may only involve going from 66 A-330 NEO's to 50 Airbus A-350's. There are many possibilities in this transaction, but all have Boeing's gun held to the Airbus' head.

Airbus could conceivably flip its A-330 NEO customers into A-350 customers as a last ditch maneuver. If it did do a flipping maneuver it, would signal the A-330 is a non starter and the A-350 needs support from its other offerings. Sixty-six is a big number and Airbus could make a better impression on the wide body market place by turning AirAsia X into a large A-350 customer since it already has 10 A-350's on order.

Boeing was mentioned earlier, and it would seem it has little or no chance disrupting this situation. The mere mention of Boeing to Airbus through media reporting benefits AirAsia X for receiving a favorable pricing offer from Airbus. It has a disadvantage with AirAsia X for it too can lever a favorable market price offering. It's an AirAsia X gotcha effort.

If Boeing were to give away the 787 to AirAsia X in a bid, Airbus would be inclined to do so in response. It's coming down to a medium wide body end-game.

If AirAsia X wants to kill the A-330-NEO program it can by accepting an A-350 like order. If Boeing wants to kill Airbus aspirations in this market segment it can give away some airplane as if making an Airbus kill shot targeting two of its programs at the same time.

However, Boeing may have more fish to fry elsewhere and will probably defer its WB order efforts in a different direction and let Airbus kill 66 of its own A-330-NEO's and enhance its A-350 order using low ball pricing for AirAsia X. Boeing will go north of 1,300 787 orders this year without squeezing off an forced deal in this direction.

Currently, Airbus has Booked 858 A-350's with 114 of its type delivered. An AirAsia X switch to the A-350 from the A-330-900 NEO would effectively stun the Airbus NEO program. The other part of the program is the A-330-800 with only 6 ordered. The NEO program would shrink to 146 A-330-NEO's booked which places that Airbus program as a lost leader program feeding into its A-350.

Airbus plan "B": If an Airbus deal is struck for switching to 66 A-350's from the A-330 NEO's it will not catch Boeing's hold on the medium wide body market. In fact this may be something of Airbus' own making. In addition the deal may only involve going from 66 A-330 NEO's to 50 Airbus A-350's. There are many possibilities in this transaction, but all have Boeing's gun held to the Airbus' head.

Airbus could conceivably flip its A-330 NEO customers into A-350 customers as a last ditch maneuver. If it did do a flipping maneuver it, would signal the A-330 is a non starter and the A-350 needs support from its other offerings. Sixty-six is a big number and Airbus could make a better impression on the wide body market place by turning AirAsia X into a large A-350 customer since it already has 10 A-350's on order.

Boeing was mentioned earlier, and it would seem it has little or no chance disrupting this situation. The mere mention of Boeing to Airbus through media reporting benefits AirAsia X for receiving a favorable pricing offer from Airbus. It has a disadvantage with AirAsia X for it too can lever a favorable market price offering. It's an AirAsia X gotcha effort.

If Boeing were to give away the 787 to AirAsia X in a bid, Airbus would be inclined to do so in response. It's coming down to a medium wide body end-game.

If AirAsia X wants to kill the A-330-NEO program it can by accepting an A-350 like order. If Boeing wants to kill Airbus aspirations in this market segment it can give away some airplane as if making an Airbus kill shot targeting two of its programs at the same time.

However, Boeing may have more fish to fry elsewhere and will probably defer its WB order efforts in a different direction and let Airbus kill 66 of its own A-330-NEO's and enhance its A-350 order using low ball pricing for AirAsia X. Boeing will go north of 1,300 787 orders this year without squeezing off an forced deal in this direction.

Azerbaijan plans to buy six-ish Boeing airplanes

This tittle is just a sampling of what's behind the Boeing curtain before year's end 2017. If reading further the discovery for ten 737 Max, four 787 Dreamliners, and two making 16, could be finalized before year's end. However, the back story does not end there. Winging It has for some time stuck to its guns by saying the wide body 787 family will rip up the stalled order year. It has already gained 83 net 787 orders. There are orders not to be gained but more of to be signed since many orders are in MOU limbo. Boeing will close in on a multitude of finalized 787 orders by year's end.

Using a tack of caution will sensibly move the 787 book close to 100 units ordered by year's end. Additionally, the Max book has not been lying idle this year as it is consistently outpacing the Airbus A320 NEO order book throughout the year. This statistic causes analyst to pause over Airbus single aisle order book. There is a limit to everything and perhaps Airbus has booked its easy customer orders while Boeing is beginning to gobble up the "reflective" single aisle market during 2017. Problems that Airbus encountered with its productive success have been marred by engine failure or supplier lag. It has addressed those issues, but created an opening for Boeing's Max with a more reliable CFM 1B engine and is moving seamlessly forward with enhancing its 737 Max production after its first 30 units delivered and maintaining the NG production pace. Boeing has waited a long time for making more single aisle per month than Airbus. Boeing delivered 57 NG/Max 737 during September, 2017. Boeing booked 61 single aisle orders in September. Airbus delivered 40 and confirmed 40 orders of the A320 NEO/CEO single aisle in the same period.

Its obvious to see Airbus has been longer, at building the A320 NEO, but lags behind Boeing in its production pace by 17 units tallied in September.

Furthermore, during 2017 Boeing has confirmed 398 gross single aisle orders to Airbus' 263 gross single aisle orders. Ten months is long enough time for some kind of trend conclusion, Boeing has turned a positive corner and Airbus a negative corner. Boeing has more potential and Airbus has spent its potential in the single aisle category.

Going back the the WB division it is clear Boeing is sustaining a stable order influx for its 787 family of aircraft and the year 2017 has had a surprising 787 order strength in a "down year". It may exceed 100 787's ordered and become one of Boeing's strongest 787 order years. Not only has it garnered 777 orders but the 747-8F has not died. A steady trickle of 747-8F orders are emerging and several more will be added to Boeing's order book at the close of the year. It's still only "life support" and the urgency from customers ordering continues before a program could close. Qatar and Azerbaijan are ordering the 787-8F and "others" are considering 747 orders. The few orders hanging are considerably more than the A-380 non orders.

It's still too early to dismiss Airbus from expanding its order book as they often hold announcing year end orders until the first week of the following year or the last week of any given year. Boeing, is of course beginning to play this game as well, and it is expecting a robust December order book emerging, wrapping up most of its hanging orders it has since filed from the Paris airshow. A majority of the Paris deals had MOU's or LOI signed during the event. It has already closed some of the Paris LOI deals since June 2017. There are about 236 MOU units remaining from Paris as not finalized, and many should be by years end. The Paris count goes as Follows by Winging It. The are about 225 MOU's outstanding both for Max 8's and Max 10's. There are about 9 MOU's for the 787 and 2 MOU's for the 777's from the Paris Airshow last June. These paper intents could be finalized by year's end.

Boeing vs Airbus for 2017 Orders

Using a tack of caution will sensibly move the 787 book close to 100 units ordered by year's end. Additionally, the Max book has not been lying idle this year as it is consistently outpacing the Airbus A320 NEO order book throughout the year. This statistic causes analyst to pause over Airbus single aisle order book. There is a limit to everything and perhaps Airbus has booked its easy customer orders while Boeing is beginning to gobble up the "reflective" single aisle market during 2017. Problems that Airbus encountered with its productive success have been marred by engine failure or supplier lag. It has addressed those issues, but created an opening for Boeing's Max with a more reliable CFM 1B engine and is moving seamlessly forward with enhancing its 737 Max production after its first 30 units delivered and maintaining the NG production pace. Boeing has waited a long time for making more single aisle per month than Airbus. Boeing delivered 57 NG/Max 737 during September, 2017. Boeing booked 61 single aisle orders in September. Airbus delivered 40 and confirmed 40 orders of the A320 NEO/CEO single aisle in the same period.

Its obvious to see Airbus has been longer, at building the A320 NEO, but lags behind Boeing in its production pace by 17 units tallied in September.

Furthermore, during 2017 Boeing has confirmed 398 gross single aisle orders to Airbus' 263 gross single aisle orders. Ten months is long enough time for some kind of trend conclusion, Boeing has turned a positive corner and Airbus a negative corner. Boeing has more potential and Airbus has spent its potential in the single aisle category.

Going back the the WB division it is clear Boeing is sustaining a stable order influx for its 787 family of aircraft and the year 2017 has had a surprising 787 order strength in a "down year". It may exceed 100 787's ordered and become one of Boeing's strongest 787 order years. Not only has it garnered 777 orders but the 747-8F has not died. A steady trickle of 747-8F orders are emerging and several more will be added to Boeing's order book at the close of the year. It's still only "life support" and the urgency from customers ordering continues before a program could close. Qatar and Azerbaijan are ordering the 787-8F and "others" are considering 747 orders. The few orders hanging are considerably more than the A-380 non orders.

It's still too early to dismiss Airbus from expanding its order book as they often hold announcing year end orders until the first week of the following year or the last week of any given year. Boeing, is of course beginning to play this game as well, and it is expecting a robust December order book emerging, wrapping up most of its hanging orders it has since filed from the Paris airshow. A majority of the Paris deals had MOU's or LOI signed during the event. It has already closed some of the Paris LOI deals since June 2017. There are about 236 MOU units remaining from Paris as not finalized, and many should be by years end. The Paris count goes as Follows by Winging It. The are about 225 MOU's outstanding both for Max 8's and Max 10's. There are about 9 MOU's for the 787 and 2 MOU's for the 777's from the Paris Airshow last June. These paper intents could be finalized by year's end.

Saturday, October 7, 2017

Assets Equals Liabilities 101

What’s Boeing Worth and other accounting 101 confusion? The

asset is a valuation of what a company owns even though it may have borrowed

money for its ownership. An asset is typically valued by amounts of cash in the

bank, buildings and other material items. The liability is a matter of debt

value when acquiring its assets. Market capitalization is the value of

outstanding stock it has with its stockholders. It falls on the Liability side

of the balance sheet. Remember Assets equals Liability and outstanding shares

of stock is a liability equaling, in part, its asset value. A corporation

uses stocks to expand its existence. In other words, it issues more stock as a

financial source for corporate uses.

When a liability is reduced, then the asset must reduce as

well with same value. A better understanding of corporate stock value clears up one part of the balance sheet. Outstanding stock is a liability until

the corporation buys back its outstanding stock. In order to do this the

cash/asset position is reduced by the same amount of the current stock buy back value.

It gets weirder, when considering all the liability meanderings on

the right side of the balance sheet. There is another category or two such as

Owner Equity and Dividend paid out. We are just getting started and accountants

are paid the big bucks for just taking care of one item off its balance sheet. When

all the flows trickle through the accounting cycle there could be an increase

to Owner’s equity while offsetting some sort of liability or Asset proposition.

Dividends declared reduces cash while paying out a value to its stockholders

but does not reduce its own stock capitalization value. You now know it as

outstanding shares with corporate market values, which sounds kind of like a debt or

liability where it may offset the asset by the same amount (left side) of the balance

sheet. Stockholder trading is different than corporate trading. Therefore the usual accounting entries become a nominal exercise. Sometimes

a reduction in a liability is offset by an increase of a liability found within another

account. Sometimes a reduction of an asset (i.e. cash) is offset by an asset acquisition

such as equipment. Accounting becomes an Organized Mess at this point.

Back in my university days a very wise professor told the

freshman accountants to-be, “all accounting is a bunch of numbers that add up

to zero”. I wrote that down just in case it was on my next test. Back to Market

Caps before I digress with zeros. There is a stock called “treasury stock”. It

is not outstanding nor is it a liability, so it must fall on the left side of

the balance sheet as an asset nominally. The company owns it and will issue it

(outstanding) as a reserve source of cash liquidity.

If it does sell the stock, the sale value becomes an “outstanding”

liability in the same amount of what is deposited into its asset cash vault. It also becomes another owner’s equity liability. So what was the liability offset

before the treasury stock was sold? Some kind of debt on the books I suspect.

When the company sold its treasury stock for cash it may have paid off some of

its debt reducing the asset and liability netting another zero somewhere on a

journal near you. Accounting is getting fun as a board game of Monopoly.

Capitalization value is the total value of outstanding

stocks sold having a value in some point in time. There is a whole another

accounting floor taking care of Market Cap values. Boeing has a Market Cap and

it shows with its dichotomy of various share value outstanding over its

history of company issued stock transactions. Boeing can issue new stocks on the market

increasing its Market Cap. It can buy back shares thus reducing its Market Cap

by the sell price of each share.

The stock market is driven by stock sellers and

buyers and not by Boeing in this example. However, perceptions drive the market

giving stock a perceived value. Many things drive the open market value of

stocks. Just look at the news and watch stock values rise or tumble with the

news. However, Market Caps comes from the value of stock sold by the issuing

company and not the stock traders or investors. A perceived "Corporate Market Cap" affects stock

pricing traded in the open market. It could represent how much a corporation has in "outstanding share value" which may shadow its asset values to some extent. Bringing clarity to the forefront is Winging It's goal of bringing the score to null.

Boeing September Orders and YTD Summary

Below is an exclusive Winging It Chart which tries to track what Boeing documents not what the press reporting has indicated. These are two different world's. Boeing post's only what the customer has confirmed as an order and additionally only reports the customer's name when that same customer allows its naming on Boeing's web site. Sometimes the press becomes vague with its assertions and results in reporting intents as firm orders and firm orders as intents. This becomes a general confusion for aviation followers who seek firm answers.

Boeing added firm orders in September 2017 by 72 units for all of Boeing types. Boeing also reported it had delivered 78 units for all its types during September 2017. The important metric of book to bill rate is .92 for September. The goal each month is a solid "1" for a book to bill rate. Boeing fell six orders short having only 72 orders when examining the above chart. The chart also reflects an annual net YTD order total 498 units. The adjustments or cancellation metric is a -67 units applied to the gross orders. Boeing has already pushed forward with 565 gross orders for all its airplane types offered.

A special tracking by Winging It is for Boeing's medium wide body 787 aircraft since it needs to retire a 27 billion deferred cost amount. Boeing has now expanded its 787 accounting block to 1,300 units. The accounting block's intent is an analytical position for when Boeing will retire all costs held in suspense after each 787 delivered profits money. That profit margin on each 787 goes towards retiring its program deferred start-up debt. The accounting block becomes a marker on the trail towards ultimate profitability. Boeing will not pay-off its 27 billion remaining deferred costs during the next accounting block. Tracking Boeing 787 orders is an important key for estimating when it will reaches its program milestone of retired costs.

Boeing has now booked 1,283 units of its 787 family of aircraft. An important footnote for the program is that it has less than 100 of its more costly production 787-8 type, and the more production efficient 787-9 and 787-10 will contribute with a higher per unit margin over the 787-8's smaller deferred cost reductions.

Charting the monthly and YTD booking numbers indicates the long term health for Boeing's commercial division.

The US3 and The World Too

The US3 aka United, American and Delta Airlines are firmly entrenched in a winner takes all battle with other world airlines. The Middle East, or aka: Qatar, Emirates and Etihad Airlines are the usual suspects in this foray of political intrigue, are confronted by the US3. A worthy moniker must be identified for the Middle Eastern concerns, hence the label, ME3. It's a battle between US and ME. Damn the "Open Skies" and full steam ahead.

"US has a big stake in the invasion coming from ME !", as it filters through the aviation lobby in Washington DC.

As a passenger, I only look at a competitive features concerning price, location-location-location, and comfort. It almost sounds like a real estate promo. ME is squatting on US real estate as it expands using its oil based wealth when buying Boeing Aircraft. Boeing is a US corporation and it too has a lobby in congress.

However, ME3 (not too but three), comes all the way to the Everett, Washington's Boeing delivery center celebrating a 747-8F delivery, and dances in the face of the US3, and what's wrong with that?

The US just took in a half a billion in US dollars coming from ME3 sourced from oil/gasoline sold to the US. ME3 took delivery of its 747-8F and displayed a 777-300-ER doing test flights while parking its 777-200 next to the 747-8F.

It was a display of what ME3 can do for US too. ME3 is not the color brown as it is more of a desert sand color slipping through US's fingers.

The US3 must embrace competition and fair trade. It must make clear what its complaint is rather than issuing generalities which no one can get its arms around. Rather than saying the ME3 is squatting on US3 property, it must make a succinct case first before sounding off.

WE2 (World Entities of Passengers and Airlines) cannot understand what the problem has become and any generalities clouds the issues entirely. The history of US3 fair trade must be made so WE2 can understand what is fair and what is not fair after ME3 lands in Miami, FL. We don't even understand what the often quoted term "Open Sky" treaty actually represents.

"US has a big stake in the invasion coming from ME !", as it filters through the aviation lobby in Washington DC.

As a passenger, I only look at a competitive features concerning price, location-location-location, and comfort. It almost sounds like a real estate promo. ME is squatting on US real estate as it expands using its oil based wealth when buying Boeing Aircraft. Boeing is a US corporation and it too has a lobby in congress.

However, ME3 (not too but three), comes all the way to the Everett, Washington's Boeing delivery center celebrating a 747-8F delivery, and dances in the face of the US3, and what's wrong with that?

The US just took in a half a billion in US dollars coming from ME3 sourced from oil/gasoline sold to the US. ME3 took delivery of its 747-8F and displayed a 777-300-ER doing test flights while parking its 777-200 next to the 747-8F.

It was a display of what ME3 can do for US too. ME3 is not the color brown as it is more of a desert sand color slipping through US's fingers.

The US3 must embrace competition and fair trade. It must make clear what its complaint is rather than issuing generalities which no one can get its arms around. Rather than saying the ME3 is squatting on US3 property, it must make a succinct case first before sounding off.

WE2 (World Entities of Passengers and Airlines) cannot understand what the problem has become and any generalities clouds the issues entirely. The history of US3 fair trade must be made so WE2 can understand what is fair and what is not fair after ME3 lands in Miami, FL. We don't even understand what the often quoted term "Open Sky" treaty actually represents.

Wednesday, October 4, 2017

Airplane Mini Recession?

Recently, Lufthansa huddled about its long standing 777X order made in 2013. Monarch airlines went out of business holding 30 Boeing Max 737 orders. Is this an airplane mini recession or just the normal churning of aircraft orders in the daily business cycles of risk adverse management?

The Emirates wide body order looms large in a holding pattern over the Dubai airshow. Its order intent may lose fuel and come crashing down at this year's show citing a lessening passenger demand while causing some industry re-thinking.

A deeper study from every business goal and intent may reveal a small aviation trend where orders are in a flattening order spin over the last several years. Its getting harder to find mega orders for any class of aircraft. The buyers swamp has been drained, a little bit. However, an order storm cloud is gathering an ominous view via the intent route. Airlines are ordering (sort of) using MOU's or LOI's. The customer retains a golden LOI parachute when intending a purchase, thus making it a mini airplane recession.

Buying aircraft outright is an indicator of awesome demand or when negotiating for six months is an indicator financial ducks are not in a row. A mini recession could be measured in how long it takes to confirm an order. The longer the confirmation time taken, the more of an indication of its airplane customer's financial well being.

When would a current mini recession evaporate? Remember the reference to a storm cloud, it too can evaporate with the right cross-winds. The expectation for a returning demand market is controlled by

every conceivable action from the world's social/political environment. It is also affected by the environment itself. Aviation's business models are in the gate awaiting the bell and a gate swaying start. The occasional bankruptcy and the re positioning of billions of dollars are all micro-recessionary influences which can and will pass through as a wisp in the morning fog. The main thing in the current market is the end of year measure by mega aircraft builders. Both Boeing and Airbus each have its own worries but tend to look through mini recessions.

Within a annual cycle these events would lend to a bump in the order road.

The current trend is for a mix of rough air and smooth flying until early 2018. The one off problematic encounters for each of the mega framers will go under cover thus indicating a visible normal cycle creating a market balance until what few mega sales remaining are announced.

The Emirates wide body order looms large in a holding pattern over the Dubai airshow. Its order intent may lose fuel and come crashing down at this year's show citing a lessening passenger demand while causing some industry re-thinking.

A deeper study from every business goal and intent may reveal a small aviation trend where orders are in a flattening order spin over the last several years. Its getting harder to find mega orders for any class of aircraft. The buyers swamp has been drained, a little bit. However, an order storm cloud is gathering an ominous view via the intent route. Airlines are ordering (sort of) using MOU's or LOI's. The customer retains a golden LOI parachute when intending a purchase, thus making it a mini airplane recession.

Buying aircraft outright is an indicator of awesome demand or when negotiating for six months is an indicator financial ducks are not in a row. A mini recession could be measured in how long it takes to confirm an order. The longer the confirmation time taken, the more of an indication of its airplane customer's financial well being.

When would a current mini recession evaporate? Remember the reference to a storm cloud, it too can evaporate with the right cross-winds. The expectation for a returning demand market is controlled by

every conceivable action from the world's social/political environment. It is also affected by the environment itself. Aviation's business models are in the gate awaiting the bell and a gate swaying start. The occasional bankruptcy and the re positioning of billions of dollars are all micro-recessionary influences which can and will pass through as a wisp in the morning fog. The main thing in the current market is the end of year measure by mega aircraft builders. Both Boeing and Airbus each have its own worries but tend to look through mini recessions.

Within a annual cycle these events would lend to a bump in the order road.

- A mini-recession would last no longer than six months

- Its spread would encapsulate a handful divergent airlines

- A possible and immediate change to a demand cycle exists within this period.

- A mini recession is difficult to track.

- Airshows tend to balance the outlook for any recessions and demand

- Airshows tend to point to absolute trends.

The current trend is for a mix of rough air and smooth flying until early 2018. The one off problematic encounters for each of the mega framers will go under cover thus indicating a visible normal cycle creating a market balance until what few mega sales remaining are announced.

Monday, October 2, 2017

Boeing's WB Pole Position Laps Competition

The gathering lines of customers are eager to have a photo op at the winner's circle. Boeing's had the pole position when it first announced its WB 787 offering back in the 2002-2003 period. Its been fifteen years since the Idea was unveiled. How has it changed the world?

Below is the paper shuffle for new 787-9' intents MOU's or agreements. These all need an order placement for a booked order.

It is also important to note these sales (papers) represent an active and ongoing market viability beyond the 78 net ordered. It is also significant that the Dubai airshow next month could give Boeing another shot at its order book arm, even though Emirates has backed off from its pre show announcing of new orders, there remains an opportunity for more Boeing/Dubai WB announcements.

2017 order synergy ='s a backlog becoming manageable, pricing is very competitive and the 787 business plan is working extremely well for all its customers.

Boeing could book 200 WB's in 2017 counting 787's and 777X's.

Below is the paper shuffle for new 787-9' intents MOU's or agreements. These all need an order placement for a booked order.

Information from All Things 787 for Egypt Air transaction.

2017 order synergy ='s a backlog becoming manageable, pricing is very competitive and the 787 business plan is working extremely well for all its customers.

Boeing could book 200 WB's in 2017 counting 787's and 777X's.

Saturday, September 30, 2017

Cul-De-Sac The Book Chapter One: It's The Water

The highest priced property should be found in a Cul-de -sac. It is an island within a sea of people. Having never living in one before this year, I found out about the little nuances of Cul-de-sac: With a front window position for viewing in an arena setting; Watching the semi circle of things going on in everyone's life; you are changed. The lack of traffic going through as its flow is exclusive to only those who live in the semi circle, makes the magic happen. The vision of the cul-de-sac is similar to a tribal village on the river of life. Neighbor's canoes put-in on its drive ways where expressions on neighbors faces tell the whole story of the day. One neighbor drives fast coming in, spinning around the circle and backing into its driveway. The other (new) neighbor doesn't know the rules of trash yet and puts out a huge TV box for which the city disposal won't pick-up.

After pealing back of layers of the Cul-de-sac culture reveals a trash day for yard leaves in November. I got this tip from my other neighbor on my starboard side. He wanted to know who did my re-roofing. Then went on to explain how he wanted me and himself to get on the irrigation board for the sixteen homes in the two adjoining cul-de-sacs. The system is for pressurized lawn watering coming from one well making this "water district". Somehow, I felt important by this subliminal offer for a neighborhood power play.

My other neighbor didn't even live in the Cul-de-sac. He was from Vancouver, Wa and bought the house for his daughter, who just moved in with her three children. She just went through a nasty divorce as her ex went to live with his boy-friend. Oh-my, unplug the cable TV. I don't need it, its all happening out the front window. She's the one who whips her car around and backs-in her drive-way several times a day. She is rattled and it shows. Another neighbor in the circle is a single guy about age 31 is having trash issues on garbage day. His neighbor on his other side within the semi circle is a single women in her mid twenty's. She is never home during the year I've lived at the crown of the circle for almost a year. Her dad owns the house and she is never home.

So far I've got this going for this analysis. One neighbor bought his house back in 2005 without even walking through it before buying. The Vancouver Guy drove-in one day and bought his house for daughter because he liked the feel of the Cul de sac. The next "neighbor" a 31 year old, had looked months at countless homes and found this one at an affordable price and bought the day he saw it.

Twelve months ago we turned the corner into the circle when looking at homes and before we got out of the car "we mentally bought the house". The Cul de sac had cast a spell on us within 30 seconds and once walking through the home my son made an offer on the spot for the home. Here we are and it is like living on an Island surrounded by other far flung neighborhoods, only they have continuous flow through traffic and noise.

The must be something going on here that is missed. Maybe it's the water and the water board guy was on to something. Five homes on the semi circle and five buys with the same story. The houses were sold the day the buyer turned the corner into the cul de sac. No matter the condition or size the house was sold and the tribe began to grow around the circle. Within a year's time we have become a community whether or not it was intended from the start. Being a reclusive soul. I have talked more and gotten to know more in one year of time than ever before in my life. In fact a strange thing happened. The estimated value of our home has increased price by $66,000 in ten months the other homes around us have increased in value with only a nominal increase over the same period of time. The strange part is all we did was just mow the lawn, that's it!

There is magic in the air and now I am considering being a member of the two person water committee within the sixteen homes near us. People have a story to tell but they need to sit in a semi circle to tell it and that is what a cul de sac does. It makes neighbors be neighbors, then friends and finally they have your back (or at least your back fence).

After pealing back of layers of the Cul-de-sac culture reveals a trash day for yard leaves in November. I got this tip from my other neighbor on my starboard side. He wanted to know who did my re-roofing. Then went on to explain how he wanted me and himself to get on the irrigation board for the sixteen homes in the two adjoining cul-de-sacs. The system is for pressurized lawn watering coming from one well making this "water district". Somehow, I felt important by this subliminal offer for a neighborhood power play.

My other neighbor didn't even live in the Cul-de-sac. He was from Vancouver, Wa and bought the house for his daughter, who just moved in with her three children. She just went through a nasty divorce as her ex went to live with his boy-friend. Oh-my, unplug the cable TV. I don't need it, its all happening out the front window. She's the one who whips her car around and backs-in her drive-way several times a day. She is rattled and it shows. Another neighbor in the circle is a single guy about age 31 is having trash issues on garbage day. His neighbor on his other side within the semi circle is a single women in her mid twenty's. She is never home during the year I've lived at the crown of the circle for almost a year. Her dad owns the house and she is never home.

So far I've got this going for this analysis. One neighbor bought his house back in 2005 without even walking through it before buying. The Vancouver Guy drove-in one day and bought his house for daughter because he liked the feel of the Cul de sac. The next "neighbor" a 31 year old, had looked months at countless homes and found this one at an affordable price and bought the day he saw it.

Twelve months ago we turned the corner into the circle when looking at homes and before we got out of the car "we mentally bought the house". The Cul de sac had cast a spell on us within 30 seconds and once walking through the home my son made an offer on the spot for the home. Here we are and it is like living on an Island surrounded by other far flung neighborhoods, only they have continuous flow through traffic and noise.

The must be something going on here that is missed. Maybe it's the water and the water board guy was on to something. Five homes on the semi circle and five buys with the same story. The houses were sold the day the buyer turned the corner into the cul de sac. No matter the condition or size the house was sold and the tribe began to grow around the circle. Within a year's time we have become a community whether or not it was intended from the start. Being a reclusive soul. I have talked more and gotten to know more in one year of time than ever before in my life. In fact a strange thing happened. The estimated value of our home has increased price by $66,000 in ten months the other homes around us have increased in value with only a nominal increase over the same period of time. The strange part is all we did was just mow the lawn, that's it!

There is magic in the air and now I am considering being a member of the two person water committee within the sixteen homes near us. People have a story to tell but they need to sit in a semi circle to tell it and that is what a cul de sac does. It makes neighbors be neighbors, then friends and finally they have your back (or at least your back fence).

Friday, September 29, 2017

If Boeing Bought Bombardier Then...

This whole Boeing fiasco with Bombardier C-series getting 1.5 Billion in front money from its Canadian government really, really, irks Boeing. Boeing is going for some kind of Pyrrhic Victory-kill shot. In some strange circumstance the audacity for having Mr. Toadian mania exists. (Sarcasm font) "Boeing doesn't really want to sell Canada or UK military its vast military product line when it slams an Irish wing plant supporting Bombardier's C-series. Boeing doesn't care if another 20 F/A 18's are not sold to the Canadian military."

It wants its pound of flesh through US tariffs attached to every Delta C-series delivered. The US government is happy when it receives hundreds of millions from Bombardier/Delta tariff money assessed.

The tariff idea is effective but not efficient as the DoD spends billions more on each of Lockheed's F-35 contracting batches and additionally on its F-35 R&D upgrades or flawed concept corrections.

Boeing loves it when a plan comes together with its "B" team. The cheering from its legal department is deafening or is it screaming we hear as the Boeing wolves find bottom after reaching terminal velocity when biffing up its leap towards Bombardier C-series. AKA, "going off the edge".

Forbes values Bombardier at 3.6 billion US or the equivalent of about 24 Boeing 787's at list price. Just buy 51% of Bombardier then let it sell all the regional aircraft, locomotives and ATV's into infinity that it wants to. Boeing would sell more F/A 18's, Chinooks and "other Military industrial complex stuff to Canada, Ireland and Great Britain as it helps Bombardier grow in Canada. Also invite Canada to supplement more funds to Bombardier/Boeing types of projects going forward, so it will rapidly turn the situation into the proverbial win/win tactic of big business.

But Boeing is playing small business instead because its pissed and it doesn't matter what others think.

It wants its pound of flesh through US tariffs attached to every Delta C-series delivered. The US government is happy when it receives hundreds of millions from Bombardier/Delta tariff money assessed.

Below: Boeing legal team jumps at Bombardier's airspace.

The tariff idea is effective but not efficient as the DoD spends billions more on each of Lockheed's F-35 contracting batches and additionally on its F-35 R&D upgrades or flawed concept corrections.

Boeing loves it when a plan comes together with its "B" team. The cheering from its legal department is deafening or is it screaming we hear as the Boeing wolves find bottom after reaching terminal velocity when biffing up its leap towards Bombardier C-series. AKA, "going off the edge".

Forbes values Bombardier at 3.6 billion US or the equivalent of about 24 Boeing 787's at list price. Just buy 51% of Bombardier then let it sell all the regional aircraft, locomotives and ATV's into infinity that it wants to. Boeing would sell more F/A 18's, Chinooks and "other Military industrial complex stuff to Canada, Ireland and Great Britain as it helps Bombardier grow in Canada. Also invite Canada to supplement more funds to Bombardier/Boeing types of projects going forward, so it will rapidly turn the situation into the proverbial win/win tactic of big business.

But Boeing is playing small business instead because its pissed and it doesn't matter what others think.

NMA- Boeing Won't Launch What It Hasn't Already Sold

All the Boeing excuses for not launching the NMA (797) comes down to one point. It needs several hundred firmed NMA sales before any announcement.

Boeing has quipped market research, design maturity or the "right moment" which has all passed in time during the last five years. The research is done and various start-up programs have reached completion. Boeing had a plan-in-hand years ago after it stopped making the 757 back in 2005. It needed to build the 787, 777X and the Max before it could devote resources to the "NMA". Most of all it needed firmed launch customer firming of sales. No MOU's, Intents or order Conversions as experienced at the Max-10 launching. It just needs a stand-alone sales number for its NMA before launch announcements, then Boeing excuses of using market research, timing and design maturity makes sense.

Boeing already knows the NMA plan as it awaits for its customer(s) for pulling the trigger. The bigger the launch in unit numbers, the greater the long term success.

Let's face it, the 737 Max-10 announcements at Paris was underwhelming with all the conversions intents and MOU's announced at the show. No one took anything away from Paris except from John Leahy's Boeing bluster comments about how few real firmed sales had during Boeing's 737-Max -10 launch announcement. Launch momentum was lost at the show by the plethora of conditional transactions where it only had less than a hundred direct and firmed 737 Max 10 sales for its launch. Quietly, Boeing is picking off one MOU at a time by turning the Intents into firm orders without much fanfare.

A new aircraft launch is all about the show and not accountant's sharpened pencils and legal pads of information telling a story having 360 737 Max 10's with firmed orders, MOU's or Intents including any options.

Boeing wants to bring clarity to any launch going forward. People in the industry walked away confused after the Paris announcements for the 737 Max 10. After months of analysis since Paris, the analyst can only factor in what has happened since the show and no one is paying attention much to the 737-Max 10 launch announcement with some of its MOU's, since firmed up.

My own data on the 737 Max Launch, indicates the following 360 or so Max 10's where agreed upon where 63 are newly firm orders classificaion, 90 remain MOU's and 214 are purchases out from Conversions classification (those from prior 737 orders booked). It remains a mess to sort out the launch other than say About 360 Max ten's are probably in play having sacrificed some of Boeing's 737 Max-8 orders to get to a 366 number.

The Boeing's NMA launch doesn't want a cluster of different announcements for its new family of aircraft (AKA 797). It just wants about 300 units ordered representing its launch customers before anything is announced!

Boeing is waiting those customer's signatures and then using this interim time period for do due diligence aircraft R & D going forward. The timing for a launch should be from 2016-2019. Some say Boeing has waited too long for an Airbus answer. and should of already been way down the road from a NMA launch date. If there is no answer to an unknown NMA configuration in the market place, time does not play into this process only to the extent of available resources and obtaining customer's firm ordering.

Boeing has quipped market research, design maturity or the "right moment" which has all passed in time during the last five years. The research is done and various start-up programs have reached completion. Boeing had a plan-in-hand years ago after it stopped making the 757 back in 2005. It needed to build the 787, 777X and the Max before it could devote resources to the "NMA". Most of all it needed firmed launch customer firming of sales. No MOU's, Intents or order Conversions as experienced at the Max-10 launching. It just needs a stand-alone sales number for its NMA before launch announcements, then Boeing excuses of using market research, timing and design maturity makes sense.

Boeing already knows the NMA plan as it awaits for its customer(s) for pulling the trigger. The bigger the launch in unit numbers, the greater the long term success.

Let's face it, the 737 Max-10 announcements at Paris was underwhelming with all the conversions intents and MOU's announced at the show. No one took anything away from Paris except from John Leahy's Boeing bluster comments about how few real firmed sales had during Boeing's 737-Max -10 launch announcement. Launch momentum was lost at the show by the plethora of conditional transactions where it only had less than a hundred direct and firmed 737 Max 10 sales for its launch. Quietly, Boeing is picking off one MOU at a time by turning the Intents into firm orders without much fanfare.

A new aircraft launch is all about the show and not accountant's sharpened pencils and legal pads of information telling a story having 360 737 Max 10's with firmed orders, MOU's or Intents including any options.

Boeing wants to bring clarity to any launch going forward. People in the industry walked away confused after the Paris announcements for the 737 Max 10. After months of analysis since Paris, the analyst can only factor in what has happened since the show and no one is paying attention much to the 737-Max 10 launch announcement with some of its MOU's, since firmed up.

My own data on the 737 Max Launch, indicates the following 360 or so Max 10's where agreed upon where 63 are newly firm orders classificaion, 90 remain MOU's and 214 are purchases out from Conversions classification (those from prior 737 orders booked). It remains a mess to sort out the launch other than say About 360 Max ten's are probably in play having sacrificed some of Boeing's 737 Max-8 orders to get to a 366 number.

The Boeing's NMA launch doesn't want a cluster of different announcements for its new family of aircraft (AKA 797). It just wants about 300 units ordered representing its launch customers before anything is announced!

Boeing is waiting those customer's signatures and then using this interim time period for do due diligence aircraft R & D going forward. The timing for a launch should be from 2016-2019. Some say Boeing has waited too long for an Airbus answer. and should of already been way down the road from a NMA launch date. If there is no answer to an unknown NMA configuration in the market place, time does not play into this process only to the extent of available resources and obtaining customer's firm ordering.

Thursday, September 28, 2017

Ryan Air Re-positions Vacations Like A Cruise Ship's Makes Seasonal Changes

A seasonal adjustment not caused by climate but by under planning has caused Ryan Air to cancel flights through March 2018. This affects about 400,000 of its passenger customers over the same period of time. Since Ryan Air has captured a market for 129 million travelers in its vast airline system, the impact affects only a small percentage of its customers over the next six months. The margin of customers inconvenienced is amounts to .62% of its customer base for the next six months or about 99.4% of its passenger will not be affected.

The problem stems from scheduling adequate vacation time slots for it pilots and crews. The perfect work storm has occured and there is no way out of the fix until it sorts out vacation schedules while at the same time expanding new staffing resources. The flight cancellations directly affects Ryan Air's revenue stream for those estimated 400,000 customers who will not travel with the airline during the next six months. This lost revenue stream has altered several of Ryan Air's aspirations for fleet expansion and further canceling a merger with Alitalia from Italy.

The set back should be a one -off problem during 2017-2018 flying season. Ryan Air expects to resume its full-on growth program by 2019 as it finds more pilots, crews and air frames for its growth. Having a better control for its vacation scheduling by March of 2018 should right its operational ship.

Ryan Air is no longer considered a small player in the airline business as any kind of operational mishaps of this nature tend to spell big financial impacts, if not addressed ahead of time.

The problem stems from scheduling adequate vacation time slots for it pilots and crews. The perfect work storm has occured and there is no way out of the fix until it sorts out vacation schedules while at the same time expanding new staffing resources. The flight cancellations directly affects Ryan Air's revenue stream for those estimated 400,000 customers who will not travel with the airline during the next six months. This lost revenue stream has altered several of Ryan Air's aspirations for fleet expansion and further canceling a merger with Alitalia from Italy.

The set back should be a one -off problem during 2017-2018 flying season. Ryan Air expects to resume its full-on growth program by 2019 as it finds more pilots, crews and air frames for its growth. Having a better control for its vacation scheduling by March of 2018 should right its operational ship.

Ryan Air is no longer considered a small player in the airline business as any kind of operational mishaps of this nature tend to spell big financial impacts, if not addressed ahead of time.

Subscribe to:

Posts (Atom)