Well, a course correction has occurred for Airbus fortunes. It is facing a North America trifecta with American, United, and Delta airlines. The first shoe dropped when American Airline ordered 47 widebody 787's last month leaving Airbus the bridesmaid once again. Airbus lost to Boeing in Hawaii when its main airline on the island switch from A330 to 10 787's on its order book.

United will have a plethora of fleet slots when it retires its last 767's numbering about 50 and Airbus once again is in a position of being slighted by those pesky Yankees. The term, "once again", pops up in this blog too many times.

John Leahy an American born business personality kept Boeing at bay for many years, while leading Airbus' most noted programs evolving in the marketplace. He was the Airbus tip of the market spear and has since retired, as all good people born in 1950 have probably done so by now. He loved to jab his spear in Boeing's side at an airshow as he sandbagged order announcements, and then announcing after Boeing would make a significant announcement. He also held customer orders in confidence until Boeing announced its final booked order for the year, then Airbus ends the year with a mass Leahy order, making it the top dog for the year. All these maneuvers agitated Boeing and made them look "secondarily" number two(hah).

It worked as the Airbus single-aisle order book soared to new heights. He forced Boeing to bring on the Max. Boeing got the Leahy message and bracketed the Airbus widebody market with three 787's and two 777X types. It now looks as if it will roll out its stepchild, the 797.

At the top, it was mentioned a trifecta and Delta completes the North American sweeping out of Airbus from Boeing's door. The 797 will make Delta whole again with North America's patriots when becoming Boeing's North American launch customer for its type. United Airlines will order Boeing 787 over Airbus as it replaces its old portion of the fleet of 767's.

John Leahy's retirement ended the Airbus market run and sealed its corporate profit doom for the time being. The NW, MW or SE airplane "top dog" is already making headway in just a few months since Leahy takes his Syracuse MBA home again. Airbus lost its dog in the fight. It is now facing the NMA without an adequate plan. The A321NEO is not positioned to both take on the single-aisle and the dual aisle Boeing onslaught at the same time. It must come up with its plan "B" with another John Leahy NEO type it hasn't found. Boeing will go North of 100, 787's ordered this year, while Airbus will have a negligible widebody order book report at year's end unless Airbus pulls one more fast one with a December mega order announcement.

John Leahy saw the writing on the wall, he was 68 and Airbus was boxed in without the means for an immediate answer for Boeing's airplane designs. However, his golden parachute is floating just fine.

My Blog List

Saturday, May 19, 2018

Friday, May 18, 2018

Why Delta Makes Sense For 797 Launch Customer

It has been an irritation to Boeing that Delta orders Airbus widebody A-350's and A-330's. Boeing also suffered a cancellation from Delta for long-held 787-8 order thus sending a second shot over Boeing's bow a second time. Boeing is not a Delta stepchild it merely did not line up with Delta's leveraging plans and struct the best value deal with Airbus using Boeing as a backdrop for low balling Airbus.

Here come the 797 and things are becoming a serious matter for Boeing. Delta has no Airbus player in place for this much-needed class of airplane and Boeing is going to offer an NMA solution soon. Delta has lost its leverage over Boeing when using Airbus for pricing value. Only a new offering and launch customer status could give Delta some bargaining chips on the table and that is why the Boeing NMA will have a North American NMA launch customer with Delta Airlines. Further examination of Delta's fleet and order book suggests the Boeing NMA will slide in neatly with the current Delta fleet. An Authorization to Offer (ATO) is pending

Here come the 797 and things are becoming a serious matter for Boeing. Delta has no Airbus player in place for this much-needed class of airplane and Boeing is going to offer an NMA solution soon. Delta has lost its leverage over Boeing when using Airbus for pricing value. Only a new offering and launch customer status could give Delta some bargaining chips on the table and that is why the Boeing NMA will have a North American NMA launch customer with Delta Airlines. Further examination of Delta's fleet and order book suggests the Boeing NMA will slide in neatly with the current Delta fleet. An Authorization to Offer (ATO) is pending

CAPA Photo chart for Delta Airline fleet Type by Model/Maker

The Delta Gap is found with its older 757 and 767 models which it has 219 Boeing frames on the flight line, and is a natural slot for the 797 model. Airbus has 100 A321 represented in Delta's backlog and has deferred 10 of its A-350 backlog a smidgeon until 2019 and 2020 delivery slots.

Delta has 41 Airbus widebody and it could defer some of its A-321 order books once Boeing's NMA issue is solved. A suspicion is Boeing and Delta are collaborating on an NMA design as a Delta ordering sweetener. The two big launch customers are each coming from Asia and North America. Delta has over two hundred frames open for an NMA slot and a reduction of the A321 backlog by 25% is not inconceivable. An order for 200 NMA's and 100 options from Delta is a real possibility. A launch customer announcement would disrupt both American's and United's flight plans.

The entry into Service date having an ATO in 2018 would place the initial NMA's batch into customer's hands by 2026, at the earliest. A second suspicion is Boeing is further along with the NMA program process than what is assumed by all aviation insiders at this time. The design is almost off the CAD board and customers are tentatively lined up where it is known what Boeing proposes is a firm concept. The process has progressed to a promising stage, "if you do this we'll do this", status. The big hold up is the institutional phase of build capacity, supplier commitments, and most of all the engine program stage. Does Boeing have a workable engine from its group of suppliers? Other hold-ups are also institutional in manner referring to financing, and cash flows before announcing. Can Boeing avoid a 787 deferred costs debacle it had with the 787 program?

All-in-all, Boeing is very busy crossing the T's and dotting the "I's" for this ATO. Every day a check item is completed and launch customers are informed if any program checks alter the original design offering since the customer verbally or by memo agreed with the original concept proposal. The normal but stressful business stuff is happening at an ever-increasing pace culminating with an all-in shout out from Boeing, usually happening at a big airshow.

Thursday, May 17, 2018

Flight Global Makes The NMA Case For Legacy Opertors

The link above makes the NMA case, Boeing has an eight-year window for its NMA build and order cycle using legacy carriers such as Delta and Chinese airlines. However, the possibility exists where emerging airline may jump in and fill the Boeing ATO (Authorize To Offer) call out announcement.

"Momentum appears to be gathering around Boeing's proposed New Mid-market Airplane (NMA) – already being referred to by some as the 797. Reports indicate a potential launch this year or in early 2019, although this is perhaps more likely to refer to an authority to offer (ATO), rather than the full industrial launch."

"Momentum appears to be gathering around Boeing's proposed New Mid-market Airplane (NMA) – already being referred to by some as the 797. Reports indicate a potential launch this year or in early 2019, although this is perhaps more likely to refer to an authority to offer (ATO), rather than the full industrial launch."

If Boeing gets 400-500 solid ATO commitments it will go with an ATO this summer. However, the commitment sources may come from emerging Airlines in the Asia region such as the Singapore or Malaysia regions. China does have several opportunities from its other regional airlines which already have 787 product.

Delta is the top of the Flightglobal's heap for the North American short list. However, a small detail is that Air Canada announced it will cancel its 787 options thus signaling a possible NMA interest. It cited financial and market conditions for the 787 option cancellation.

Airline order books should be watched closely if they trim current order commitments while signaling room for an NMA commitment. This is based upon an impending Boeing ATO announcement in 2018 that only an airline would have knowledge of since it is privileged knowledge for an impending Boeing ATO. The whole mess will sort out once the big reveal is made by Boeing's official offering of the NMA.

Boeing Reach Its 787 50-50 Benchmark

The 50-50 benchmark is a point where the same number of 787 delivered equals its reported backlog as shown below:

This is a significant milestone for Boeings' 787 programs. More orders are being booked at this time so the 50-50 relationship will drop back closer to a 48-52 relationship unless orders are held for the Farnborough Airshow, then it remains close to 50-50 book to bill ratio (backlog to delivery ratio) or the perfect "one" most manufacturers seek.

The Huge Dubai Mystery Deal For Single Aisle

Reuters broke a story in the last 48 hours. Boeing and Airbus are in talks bidding for up to 400 Single Aisle aircraft which Identifies the A-320 Neo and the 737 Max family of aircraft. It's not a winner takes all customer award but a mix coming from both mega aircraft builders. The battle is for who gets the most orders in this latest battle round. With it comes bragging rights.

This latest battle may trend the market towards who becomes the winner going forward. The Airbus offering has beat Boeing's own single-aisle offering of NG's and Max. However, in 2018, Boeing is making headway against Airbus in the bidding wars from customers in both the wide body and single-aisle category. Since this is pre-Farnborough airshow talk, I would expect the order announcements will occur during this airshow, the month of July 2018.

It would be a biased opinion to even predict an outcome. However, the price factor will play an important decider for this deal as both makers offer a very good product possibly for different reasons. The airplane efficiency is almost a push depending upon how you read the data or whom you believe is telling the correct story. The third point is what airplane best fits a Dubai business plan using maintenance numbers and commonality positions. This broad sweeping potential order will cover both makers where the stronger balance of orders will go with factors from efficiency and commonality from the airline building its fleet. No airline name was actually mentioned only just the deal-making is occurring with Dubai Aerospace Enterprise (DAE), a leasing company. Which supplies aircraft to Middle East customers. Currently, its fleet is about a 50-50 split between Boeing and Airbus.

A DAE deal is driven by what its customers want and future market projections in its region as DAE may want a build-up of backlog orders anticipating future orders. If Boeing does secure a big lead with this order, DAE sees a future demand for the Max over the NEO. If it remains a 50-50 split then status quo remains what its customers want. The unit price will drive this big deal demand. Predicting who wins is a wait and see processing. Perhaps there is an underlying factor not yet measured such as DAE has a leasing customer who wants its fleet from a certain maker.

This latest battle may trend the market towards who becomes the winner going forward. The Airbus offering has beat Boeing's own single-aisle offering of NG's and Max. However, in 2018, Boeing is making headway against Airbus in the bidding wars from customers in both the wide body and single-aisle category. Since this is pre-Farnborough airshow talk, I would expect the order announcements will occur during this airshow, the month of July 2018.

It would be a biased opinion to even predict an outcome. However, the price factor will play an important decider for this deal as both makers offer a very good product possibly for different reasons. The airplane efficiency is almost a push depending upon how you read the data or whom you believe is telling the correct story. The third point is what airplane best fits a Dubai business plan using maintenance numbers and commonality positions. This broad sweeping potential order will cover both makers where the stronger balance of orders will go with factors from efficiency and commonality from the airline building its fleet. No airline name was actually mentioned only just the deal-making is occurring with Dubai Aerospace Enterprise (DAE), a leasing company. Which supplies aircraft to Middle East customers. Currently, its fleet is about a 50-50 split between Boeing and Airbus.

DAE 2017 Fleet Report

A DAE deal is driven by what its customers want and future market projections in its region as DAE may want a build-up of backlog orders anticipating future orders. If Boeing does secure a big lead with this order, DAE sees a future demand for the Max over the NEO. If it remains a 50-50 split then status quo remains what its customers want. The unit price will drive this big deal demand. Predicting who wins is a wait and see processing. Perhaps there is an underlying factor not yet measured such as DAE has a leasing customer who wants its fleet from a certain maker.

Tuesday, May 15, 2018

Israel Eyes K-1 Airbase

Northern Iraq has an airbase just 100 air miles from Iran's border. The Kurds have this air base and have requisitioned the surrounding oil away from Baghdad Iraq. The air base is called K-1. Israeli based fighters cannot fly to Iran and back without tanker fueling which it does not have in abundance. The F-35 can punch a one-way ticket only for about 1,000 miles or it has a combat radius near 600 miles. Landing at K-1 with F-35's would make Israel the top dog in the Middle East and would cause Iran some severe heartburn. The US would, of course, assist via CIA with this venture.

Israel has a plan or workaround for dealing with Iran and the Kurds have a big role in this plan but the US will need an assist from the Kurds going forward for years to come. Therefore, watching the US partnership with the Kurds is the tip of the Iceberg. Back to the F-35i.

Israel needs about 25 F-35i for this venture in punishing Iran for its support of Hamas in Syria. At this time a notepad becomes handy for writing down the players. Lockheed needs to sell Israel, not 50 F-35i but twice that number once production prices reach $85 million a copy. Israel could mitigate airfield requirements with the F-35B, which it does not have on order from Lockheed at this time. Trump may advance Israel billions with defense treaty negotiations. That is how Israel has nine F-35i at this time. The US bought them for Israel via defense treaty.

K-1 Airbase, a former Iraqi-Baghdad airbase, is in Israel's crosshairs as a place to land its F-35i's, but not getting ahead of myself deals have to brokered.

The US pays the Kurds for weapons it also pays Israel for the F-35i. Once the US is divested from Iran nuclear treaty(done), Trump can make more deals with Lockheed, Israel, and the Kurds. "Poof", no more covert Iranian nuclear program the F-35i is that good.

Israel could use this Kirkuk asset when looking at Iran

Near Kirkuk K-1 base with a Soviet-era headstone

Israel has a plan or workaround for dealing with Iran and the Kurds have a big role in this plan but the US will need an assist from the Kurds going forward for years to come. Therefore, watching the US partnership with the Kurds is the tip of the Iceberg. Back to the F-35i.

Israel needs about 25 F-35i for this venture in punishing Iran for its support of Hamas in Syria. At this time a notepad becomes handy for writing down the players. Lockheed needs to sell Israel, not 50 F-35i but twice that number once production prices reach $85 million a copy. Israel could mitigate airfield requirements with the F-35B, which it does not have on order from Lockheed at this time. Trump may advance Israel billions with defense treaty negotiations. That is how Israel has nine F-35i at this time. The US bought them for Israel via defense treaty.

K-1 Airbase, a former Iraqi-Baghdad airbase, is in Israel's crosshairs as a place to land its F-35i's, but not getting ahead of myself deals have to brokered.

The US pays the Kurds for weapons it also pays Israel for the F-35i. Once the US is divested from Iran nuclear treaty(done), Trump can make more deals with Lockheed, Israel, and the Kurds. "Poof", no more covert Iranian nuclear program the F-35i is that good.

797, Then Infinity and Beyond

Buzz Lightyear said it first on toy story, "to infinity and beyond". Now the 797 exhausts Boeing's model naming convention with no Seven's left to be used. But au contraire! Buzz Lightyear had it right as far as Winging It is concerned. Hence the next big step Boeing could take after assigning the 797 designations is found in the image below:

First up would be, the 807, an upright infinity start and it goes beyond.

First up would be, the 807, an upright infinity start and it goes beyond.

The symbol of Infinity

∞07

∞17

∞27

∞37

∞47

∞57

∞67

∞77

∞87

∞97

Buzz Lightyear, you rock! Boeing, use the upright 8 and go beyond.

WTO Finds Airbus Likes To Cheat

The Airbus less advanced higher priced family of aircraft gets a consortium of cash flow from various European countries. Particularly France and Germany. The cash penalty will be about $22 billion to Airbus thus jacking the price higher in customer bid wars against the Boeing products. Speaking of Boeing, it too has its WTO findings for about 8 Billion which is a significantly less than the Airbus $22 Billion. The Boeing finding is for its 777X wing plant for which the state of Washington incentivized Boeing into building the massive 777X wing operation now residing in Everett, Washington having follow-on employment for those moving to the North of Seattle city.

Boeing has swallowed the bitter pill but Airbus will find itself less able to swallow its own $22 Billion tags the WTO has imposed.

What all this means is, an Airbus stoppage of future new widebody development going forward. A greater widebody price proposal for its customers during head to head bidding against Boeing for its wide-bodied aircraft, and a further beating from Boeing's sales team in the open market.

Why this determination against Airbus, Because it has caused irreparable damage to Boeing's market over the last decade or longer. Airbus with its subsidies has been able to compete with Boeing when it couldn't do so without the government subsidies covering financial shortfall during the development of its less advanced A350 and A380 programs. Boeing had a deferred cost of about a $30 Billion money pit when it developed its 787 families of aircraft. Airbus received roughly $22 Billion from the government when it developed a competing A350 or A380. Airbus has blatantly cheated and Boeing followed suit but to a lesser scale with its 777X program. Boeing is better positioned to pay its fine from the WTO.

Boeing has swallowed the bitter pill but Airbus will find itself less able to swallow its own $22 Billion tags the WTO has imposed.

What all this means is, an Airbus stoppage of future new widebody development going forward. A greater widebody price proposal for its customers during head to head bidding against Boeing for its wide-bodied aircraft, and a further beating from Boeing's sales team in the open market.

Why this determination against Airbus, Because it has caused irreparable damage to Boeing's market over the last decade or longer. Airbus with its subsidies has been able to compete with Boeing when it couldn't do so without the government subsidies covering financial shortfall during the development of its less advanced A350 and A380 programs. Boeing had a deferred cost of about a $30 Billion money pit when it developed its 787 families of aircraft. Airbus received roughly $22 Billion from the government when it developed a competing A350 or A380. Airbus has blatantly cheated and Boeing followed suit but to a lesser scale with its 777X program. Boeing is better positioned to pay its fine from the WTO.

Boeing's Freight Ship Comes In "survey class 101 notes"

Below is the Boeing.com freight outlook based on forecasting methods accepted by the industry. The volume of freight growing the next twenty-five years will have to accept seasonality or exponential smoothing math inputs based on historical trends over prior years.

In essence, fuel price change, market governance, and political influence have historically disrupted the outcome of a forecast in its math modeling for a financial outcome. Most forecasts take into account economic seasonality and it makes a smoothing error component for a forecast. In other words, history has indicated a recession every seven years which directly affects the subject matter of freight growth from this current time until the year 2038.

The Boeing forecast takes into account those lumpy occurrences from economic, political, and seasonal market changes when making a Freight business forecast for selling equipment into the future time period.

The Boeing outlook does its due diligence when it eliminates outlying market conditions which have little consequence for the over-arching demands from the world’s bases of commerce. Using minutia data becomes a tangled web sorting out what will occur, but any forecast must establish the highest probability that its outlook will definitely occur when all conditions are considered in that outlook

"The number of airplanes in the worldwide freighter fleet will increase by 70 percent during the next 20 years as air cargo traffic more than doubles

With air cargo traffic more than doubling by 2035, the world freighter fleet will grow by more than 70 percent, from the current 1,770 airplanes to 3,010 airplanes by the end of the forecast period. Growing demand for regional express services in fast-developing economies will increase the standard-body share of the freighter fleet from 36 percent today to 42 percent in 20 years. All new deliveries of standard-body freighters will be converted to passenger airplanes. The growth of the standard-body share of the fleet will result in a decline in the large- and medium-widebody shares of the total fleet over the forecast period, from 31 and 33 percent to 28 and 31 percent, respectively.

Of the 2,370 projected freighter deliveries, 1,130 will replace retiring airplanes, with the remainder expanding the fleet to meet projected traffic growth. More than 60 percent of deliveries will be freighter conversions, nearly 88 percent of which will be standard-body passenger airplanes. A projected 930 new production freighters, valued at $270 billion, will be delivered, of which almost 60 percent will be in the large-freighter category.

Freighter fleet will increase by more than half – Standard-body freighters gain a significant share of the market.

Monday, May 14, 2018

Air Cargo Boeing's Fifth Dimension

"To catch up with demand, operators

are buying new jets, especially large Boeing freighters. In February, UPS

ordered 14 more 747-8Fs along with four more 767Fs. In March, ANA purchased two

777Fs. This month, Qatar Airways signed a letter of intent to buy five more

777Fs. Over the past 24 months, we have sold nearly 80 freighters and there are

more campaigns in the pipeline."

The main show has always been passenger

aircraft sales and little is mentioned of the air cargo sales at an airshow.

The fifth dimension is hard to get your arms around and science wrestles

with the concept. Having said that Air Cargo is Aviation's fifth dimension. It

hauls everything from capital equipment to computer chips full of data or

programs. That sounds Fifth Dimensional when a postcard becomes air cargo and

one's arms can't quite get around it for its business case.

The Fifth Dimension

However, Boeing has recognized building freight value

into its production business model.

The 747-8F has brought the topic to the

front page and the 767-300F lurks at almost every airport in the land that

delivers FedEx or UPS packages. Airbus failed to make its A380 Freight business

case and canceled the concept. Now it has no A-380 and the A330-200F is its

main freight hope. Most A330-200F are converted from retired

passenger A-330's. All in All, Airbus has unraveled from the Fifth

Dimension's, Air Cargo Business.

Randy Tinseth has spent a considerable

amount of space on the topic on his blog, Randy's Blog. Boeing

is selling a significant amount of cargo airframes including the 777 frame. The

above quote from the article does not get into the details as his blog does but

its safe to say, Air cargo is on a steady expansion of about 5-6 percent a year

and Boeing has positioned itself to meet this steady climb. It has braced for

the Fifth Dimension of Air cargo.

An

earlier Winging IT blog piece "A Pound of Feathers or Pound

of Gold" discussed why older frames make

for a great value as a freighter. Randy's blog answers that question as older

frames can handle the Fifth Dimension freight business better than the

latest technological offerings except for the 747-8F. Its massive freight

hauling capability is flanked by older 747-400's which are predominantly in

service.

The

final idea is reading Randy's blog at the provided links and give pause to the

fifth dimension of aviation's marketplace at the next airshow.

Sunday, May 13, 2018

Saturation of The Long Thin Routes Revives the 787-8 Discussion

At some point in time, the long thin route (LTR) types like the 787-9, 777 or A-350's will saturate this portion of the aviation marketplace. The LTR is closing in on a full inventory of aircraft, hence the A380 is hard to sell and the 787-9 vs the A-350 battle is winding down. It could be predicted the 777X sales have hit a pause point in its offerings as airlines are recalculating its own aircraft needs as this market segment fills.

There was a little-noticed transaction with Boeing and American Airlines when American slipped in 22 787-8's in the order with ordering an additional 25 787-9's. After some consideration on the subject of the 787-8 and the 787-10, it is apparent the marketplace has started to re-examine medium range again for its business plan. American needs to replace its 767 class of older airplanes and it chose the 787-8 for this fleet renewal plan for older widebody fleet units.

Airbus has invested in the LTR heavily with its A350-900's and A-350-1000's programs, however, Boeing made a pivot by installing production continuity from a 787-8 production going to a 787-9. All the 787 types assemble together in the same manner so no special production consideration is needed for building the 787-8 vs the 787-9.

The second part of the Boeing pivot is the 787-10. It is not an LTR filler but a mid-distance and high-density people mover. It brings unrivaled fuel efficiency for its high passenger density. It is a natural for Singapore Airlines who ordered 49 of this type. The 787-8 and 787-10 can now work in tandem filling the 3,000-6,000 mile market, hauling a spectrum of 230-330 passengers with high-efficiency loads (fat market dynamics). Singapore just accepted its first A-350-ULR, holding about 162 passengers going the distance. This is a capstone for filling LTR market and few aircraft will be needed for the 16-20 hour aircraft endurance for which Qantas is asking the two big aircraft makers for flying from Australia to anywhere in the world under the moniker "Project Sunrise". Boeing will offer its 787-9 rendition with extended fuel capacity and less dense seating in the long body.

The fat part of the market is where the 787-8 and 787-10 lives. Boeing has repositioned itself while Airbus ruminates on its LTR capability as if some kind of advertising bragging is better than reality itself. The 787-10 is built for Asia. It is also built for continental travel. The 787-8 is coming back into vogue as the LTR becomes full. It's already within five years of that happening. I would expect orders of 200 for the 787-8 and another 100 for the 787-10 over the next five years. The 787-9 ordering push winds down as the market shifts back to the fat part of commerce with people moving. It too should book another 150 787-9's over the next five years. Remember, The Emirates order for 40 787-10's has not yet shown up in Boeing's book even though Emirates refers to that 15 billion deal as a done deal.

There was a little-noticed transaction with Boeing and American Airlines when American slipped in 22 787-8's in the order with ordering an additional 25 787-9's. After some consideration on the subject of the 787-8 and the 787-10, it is apparent the marketplace has started to re-examine medium range again for its business plan. American needs to replace its 767 class of older airplanes and it chose the 787-8 for this fleet renewal plan for older widebody fleet units.

Airbus has invested in the LTR heavily with its A350-900's and A-350-1000's programs, however, Boeing made a pivot by installing production continuity from a 787-8 production going to a 787-9. All the 787 types assemble together in the same manner so no special production consideration is needed for building the 787-8 vs the 787-9.

The second part of the Boeing pivot is the 787-10. It is not an LTR filler but a mid-distance and high-density people mover. It brings unrivaled fuel efficiency for its high passenger density. It is a natural for Singapore Airlines who ordered 49 of this type. The 787-8 and 787-10 can now work in tandem filling the 3,000-6,000 mile market, hauling a spectrum of 230-330 passengers with high-efficiency loads (fat market dynamics). Singapore just accepted its first A-350-ULR, holding about 162 passengers going the distance. This is a capstone for filling LTR market and few aircraft will be needed for the 16-20 hour aircraft endurance for which Qantas is asking the two big aircraft makers for flying from Australia to anywhere in the world under the moniker "Project Sunrise". Boeing will offer its 787-9 rendition with extended fuel capacity and less dense seating in the long body.

The fat part of the market is where the 787-8 and 787-10 lives. Boeing has repositioned itself while Airbus ruminates on its LTR capability as if some kind of advertising bragging is better than reality itself. The 787-10 is built for Asia. It is also built for continental travel. The 787-8 is coming back into vogue as the LTR becomes full. It's already within five years of that happening. I would expect orders of 200 for the 787-8 and another 100 for the 787-10 over the next five years. The 787-9 ordering push winds down as the market shifts back to the fat part of commerce with people moving. It too should book another 150 787-9's over the next five years. Remember, The Emirates order for 40 787-10's has not yet shown up in Boeing's book even though Emirates refers to that 15 billion deal as a done deal.

Friday, May 11, 2018

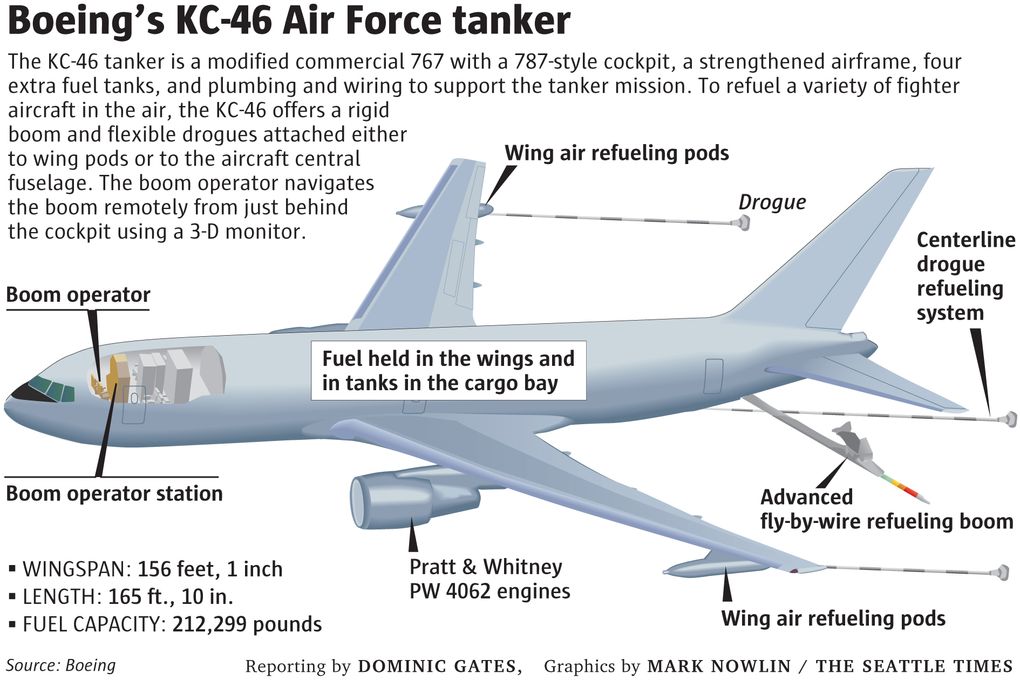

Remember that list of KC-46 problems? Here’s how they’re getting fixed.

Remember that list of KC-46 problems? Here’s how they’re getting fixed. (Link)

A copy of defense news headlines above says it best above. Otherwise, the KC-46 is on final approach before first delivery this summer or early fall. Back in 2015 Winging It features its III part discussion about the KC-46 Pegasus tanker program.

af.mil photo

Back in 2015, the tanker program had an uncertain outcome as the three links above explored. Its now becoming a reality after much refining. The whole program was never about the 767 frame or the A330 competitive bid but was about the technology for making this warfighter a winner. The A-330 and Airbus didn't have the chops to do what the military wanted and believed Boeing would do what it has now accomplished. Deliver a superior and unrivaled tanker/passenger convertible. Its primary mission is fueling the US Air Force vast fleet of aircraft.

A Seattle Times Photo

The aircraft interface with warfighters is the technological challenge and Boeing has almost solved all the myriad problems remaining that the US Air Force presented. Airbus has not demonstrated it has as capable defense program as Boeing has. The fixed cost experiment is almost completed by setting a precedence in place from which all future programs have learned valuable lessons from Boeing's KC-46 journey. The military is never satisfied, as it should not be, but the lessons learned have paved a way forward for the next fixed cost military program.

The 767 airframe has proved to be a tough airframe with advanced engineering features inherent in its original design.

The KC-46 program will complete its cycle from start to finish by this fall 2018 with the forever continued always improving model chasing it to its retirement.

It's late and over cost, but its a really good result which will be the envy of air forces around the world.

Another "Winging IT" chapter closes.

Tuesday, May 8, 2018

Boeing's April Order Report

The thumbnail chart below is the tip of the Iceberg. Boeing is going to have a robust order year. The single-aisle types should keep pace with what Airbus rounds-up. The widebody types are about to explode in numbers before years end. An example of this statement is there are many 787 orders in negotiation and the "Airshow in July may sort out some of that speculation. Boeing should book another 50 787 widebodies alone at the airshow before any surprises are added. The 777X may rear up with another big customer announcement. The chart below nets 268 over-all orders for the year which is 33% passed. Boeing is on pace for an 800 order year. Judging by a historical slow first quarter for orders and a robust December order count, the year could bear out 900 airframes booked by December 31, 2018. A larger number could be reached if the 797 is announced.

April Boeing Recap 2018

Monday, May 7, 2018

Reviewing Boeing's NMA Timing

It has been talked about for the last few years or longer with those who know what is up with the Boeing plan for an NMA aircraft. Boeing got the message a long while ago that Airbus was here to stay until put down by some economic maelstrom or a worthy competitor. Boeing prefers the competition option over economic devastation because that too would close Boeing's vast doors.

Hence, Boeing has a plan for timing its 797 inaugural announcements of who, what and when the 797 airplanes come. The timing can't come too soon or too late. Coming soon will strap Boeing with years of trial and error or its building up of plant capability without a firm backlog. Coming too late will increase the risk of market indifference because its competitor may answer Boeing's idea with an NMA creating a divided market. Boeing will avoid 797 deferred costs as it experienced on the 787 program. It has to be spot on from the initial announcement and that announcement must come in 2018. A lot of work is being done at this time by Boeing. It will have to live with its NMA decision for the next 50 years.

The NMA must replace the 757 and 767 at the same time. It must also strike a balance with the Max and the Dreamliner at the same time while not hurting other of Boeing's types share of sales. Most of all it must excite and motivate customers into presenting new business plans for its respective airlines, using the NMA model. It has already achieved exciting its customer base but has not confirmed how it will deal the final 797 look.

Asia wants freight with passengers. North America wants passengers and its luggage. The compromise is modest between market worlds is having less passenger room and freight space but not to the extent a 767 frame could carry but only to the extent, the Asian market would carry nominal regional freight along with its passengers' luggage.

Boeing will dither with that problem after it announces the 797. It will have North American Launch customers, yes, like Delta. It will have European launch customers like BA or Norwegian and possibly Ryan Air, who may convert some single-aisle orders into a launch customer duo aisle order.

ANA or JAL would be leading candidates for Asian Launch customers. China at this time is a wait and see, "customer", as it finds its way through future business models. The China market has not caught the NMA mission Boeing proposes.

There are enough players to launch an NMA at this time! Boeing hasn't finished dotting the "i" and crossing the NMA "t". The year "2018", is the time and the year is almost half over. An Airshow is needed for this grand announcement. The target is Europe because it suits North America to go and make a splash at Farnborough. Boeing would have seven years ahead for beating deadlines and making advertising headway over milestones reached. The announcement year 2019 begins to squeeze the 2025 delivery schedule. Boeing is already working on the NMA as this is being written. A 2020 announcement year allows Airbus into the discussion and anything after is not doable for meeting a 2025 first delivery.

Boeing is already building the NMA but configuration designs are not firmed. My own crazy take comes into play at this point. Boeing will not build an oval-shaped body but will make a hybrid of an ovoid shaped body. The top half is an ovoid shape for passenger room across starting at the seat level and the bottom half of the body is somewhat circular, resembling current aircraft shapes at the landing gear level.

The design would allow for some freight and give passengers duo aisle space at seven across. The hybrid change gives both North America and Asia a look at its own business needs without going extreme within its concepts.

Hence, Boeing has a plan for timing its 797 inaugural announcements of who, what and when the 797 airplanes come. The timing can't come too soon or too late. Coming soon will strap Boeing with years of trial and error or its building up of plant capability without a firm backlog. Coming too late will increase the risk of market indifference because its competitor may answer Boeing's idea with an NMA creating a divided market. Boeing will avoid 797 deferred costs as it experienced on the 787 program. It has to be spot on from the initial announcement and that announcement must come in 2018. A lot of work is being done at this time by Boeing. It will have to live with its NMA decision for the next 50 years.

The NMA must replace the 757 and 767 at the same time. It must also strike a balance with the Max and the Dreamliner at the same time while not hurting other of Boeing's types share of sales. Most of all it must excite and motivate customers into presenting new business plans for its respective airlines, using the NMA model. It has already achieved exciting its customer base but has not confirmed how it will deal the final 797 look.

Asia wants freight with passengers. North America wants passengers and its luggage. The compromise is modest between market worlds is having less passenger room and freight space but not to the extent a 767 frame could carry but only to the extent, the Asian market would carry nominal regional freight along with its passengers' luggage.

Boeing will dither with that problem after it announces the 797. It will have North American Launch customers, yes, like Delta. It will have European launch customers like BA or Norwegian and possibly Ryan Air, who may convert some single-aisle orders into a launch customer duo aisle order.

ANA or JAL would be leading candidates for Asian Launch customers. China at this time is a wait and see, "customer", as it finds its way through future business models. The China market has not caught the NMA mission Boeing proposes.

There are enough players to launch an NMA at this time! Boeing hasn't finished dotting the "i" and crossing the NMA "t". The year "2018", is the time and the year is almost half over. An Airshow is needed for this grand announcement. The target is Europe because it suits North America to go and make a splash at Farnborough. Boeing would have seven years ahead for beating deadlines and making advertising headway over milestones reached. The announcement year 2019 begins to squeeze the 2025 delivery schedule. Boeing is already working on the NMA as this is being written. A 2020 announcement year allows Airbus into the discussion and anything after is not doable for meeting a 2025 first delivery.

Boeing is already building the NMA but configuration designs are not firmed. My own crazy take comes into play at this point. Boeing will not build an oval-shaped body but will make a hybrid of an ovoid shaped body. The top half is an ovoid shape for passenger room across starting at the seat level and the bottom half of the body is somewhat circular, resembling current aircraft shapes at the landing gear level.

The design would allow for some freight and give passengers duo aisle space at seven across. The hybrid change gives both North America and Asia a look at its own business needs without going extreme within its concepts.

Is The A-350 Dying Or Dead?

This question becomes speculative when considering all aspects of the marketplace including. The price of each aircraft as the main driver for this class and followed its advanced technological efficiency. Passengers become an afterthought. The 787 has captured the standard with sure numbers of ordered and delivered 787's. The big view gives a better look at what could be expected. During 2013 both the A350-1000 and 787-10 made an appearance with its respective first orders. Today the order count for both types are at a deadlock with a net 168 A-350-1000's ordered and Boeing's 171 787-10 ordered. There is a subterfuge order for forty more 787-10's with Emirates yet to be confirmed with a signature as negotiations move to a closure.

The above chart suggests an order trend more than an answer for the A-350's future. During 2013 was Airbus last good order year when the A-350-1000 was first introduced with bulk orders. The Airbus order years for the A350 during 2014, 2015 and currently 2018 were disasters where cancelations rue the day. The overall recap of a five year period. Boeing leads Airbus by a wide margin with more 787's awaiting a final confirmation as mentioned before. Boeing stands at 1,365 orders while Airbus stands at 832 ordered the type within respective classes of 787 and A-350. But the real market is the delivered units which Boeing has and will not relinquish to Airbus within the next decade.

Airlines have assimilated its 787's in a massive and effective manner setting the airline industry towards the 787 as the leader. Airbus will take twice as long to reach Boeing's current pinnacle in the marketplace. The A-350 could just die from inability to answer the 777X, 787, (797) charge. It may just recede into a single aisle master similar to what Bombardier and Embraer have done with its regional single Aisle offerings. Bold prediction, but entirely possible if Boeing achieves permanent dominance with its extensive widebody offerings.

The Airbus widebody effort is dying from the A-330 to the A-380 family of aircraft line-up and the A-350 is dead center in Boeing's Bulls Eye.

The above chart suggests an order trend more than an answer for the A-350's future. During 2013 was Airbus last good order year when the A-350-1000 was first introduced with bulk orders. The Airbus order years for the A350 during 2014, 2015 and currently 2018 were disasters where cancelations rue the day. The overall recap of a five year period. Boeing leads Airbus by a wide margin with more 787's awaiting a final confirmation as mentioned before. Boeing stands at 1,365 orders while Airbus stands at 832 ordered the type within respective classes of 787 and A-350. But the real market is the delivered units which Boeing has and will not relinquish to Airbus within the next decade.

Airlines have assimilated its 787's in a massive and effective manner setting the airline industry towards the 787 as the leader. Airbus will take twice as long to reach Boeing's current pinnacle in the marketplace. The A-350 could just die from inability to answer the 777X, 787, (797) charge. It may just recede into a single aisle master similar to what Bombardier and Embraer have done with its regional single Aisle offerings. Bold prediction, but entirely possible if Boeing achieves permanent dominance with its extensive widebody offerings.

The Airbus widebody effort is dying from the A-330 to the A-380 family of aircraft line-up and the A-350 is dead center in Boeing's Bulls Eye.

Sunday, May 6, 2018

I'm Guessing I Guess, Etihad will

Currently, Etihad is reviewing its fleet requirements and purchasing commitment with both Airbus and Boeing. The outstanding orders are the talk for both makers. A quick and dirty order round-up show this:

A split fleet with both Airbus and Boeing making headway into the Etihad stable. Etihad has 62 Airbus A350-900's on order with zero delivered thus reflecting a notation as 62/0. It also has 40 787-9's ordered with 19 787-9's delivered noted as 40/19.

The fleet dichotomy can follow these notations from http://www.etihad.com/en-us/about-us/corporate-profile/our-fleet/

A320- 32/32

A330- 24/24

A350- 62/0

A380- 10/10

787-9 40/19

787-10 30/0

777-ER 22/22

777X's 25/0

Airbus fleet equals 66 units with 62 undelivered A350-9's

Boeing fleet equals 41 units. with 76 undelivered wide-bodied aircraft

Etihad is stuck with offending one aircraft supplier over the other if it cuts its fleet backlog during its fleet order and reduction mode.

The thoughts on the table have a few questions surrounding those ideas.

Does the A350-900 have an unused range of its current fleet strategy?

Does the undelivered 787-10 fill the A-350's future purpose?

Does the undelivered 787-10 fill the A-350's future purpose?

Can the 787-9 backlog fill the remainder of the A350-900's purpose if it were introduced into its fleet?

There are more questions than plausible answers at this time, but it has already received 19, 787-9's, and that makes it harder for the Airbus A350 portion of its back orders to be delivered when it hasn't taken even one delivery for its type. It can be "assumed", Etihad will trim its widebody backlog with only one airframer. If it does, it will order more frames from the other unaffected airframer who has already delivered. Both Airbus and Boeing have delivered A330 and 787 types. There will be no new A380 orders. The 777X is the lynch-pin in this discussion. Etihad has both the 777-8x and 9X ordered and it signals the Airbus order for 62, A350-900's may go the way of the Dodo bird?

Having yet added the 787-10 and with 21 more 787-9's on the books makes sense Etihad can cover the Boeing spread of types over the market when eliminating the Airbus A350 order.

Yet to be received from Boeing are as follows:

787-9 21

787-10 30

777-8X 8

7779X 17

Total: is 76 units from 280 seats to 405 seats per unit with the range and efficiency required by Etihad.

Airbus become the loser in this situation as it will become too expensive for Etihad to have 62 More A350's when the Boeing family already ordered can cover an unfilled order gap if the Airbus order for the A350 is canceled. It still can opt for more A330's until Etihad grows into its orders with the 787-10.

Saturday, May 5, 2018

A Pound Of Feathers Or A Pound Of Gold?

A question I have is, why does the new technology aircraft just feature passenger service when the less inefficient aircraft become freighters? In this example, the 787's and A-350's are sold by the passenger trainload where the 767-300F and the A330F's are even being sold at all. Fed-Ex/UPS is building a freight fleet out of the 767's and almost no-one wants the A330-200F unless it's converted from its already built passenger status. There are several reasons for a freight business buying older technology airframes. To name a few below:

A 767 will profitably operate with its:

· Its deadweight capacity

· Its space carrying volume

· Seats removed

· Service crew removed

· Cup holders tossed overboard

Passengers in this example are a pound of feathers requiring environment, supplies, and amenities so the most efficient 787 freight offering would become a wasteland of extravagance. The 767F has space and thrust for dead weight sans overhead bins. A pound of gold is what it needs to haul as a freighter, therefore, a 6,000-foot cabin pressure is not needed. Fuel costs on a 767 are its most deadweight it may carry on any particular trip which is factored into its freight bill of lading costs. The buy price of a 767 freighter must be significantly less than a passenger jet to make the whole scheme work well for the profit-minded.

Boeing's 767 offering for freight commerce seems to be the best choice at this time in the industry because it has space, thrust, and range charging the customer the appropriate amount for the fuel burn. Fuel economy is not listed above because dead weight doesn't complain much about fuel prices. The 767 purchase price is a bargain not requiring electronic window shades. The US military saw an opportunity to make it a freighter-fueler even when the A330 was bidding against it. The A330 was already sold as a military tanker at that time.

Cargo Facts Chart Below:

The freight business is becoming back in vogue as we write. Fed-ex and Amazon are the usual suspects with its respective movement of fleets with 767's. The A-380 was built for passengers and not freight. The A330 was built likewise engineered towards passenger service. Boeing always had a duopoly in mind with its aircraft as it built in tandem a 737, 747, and 767. Including those fabulous 777 freight versions. Only the 787 is not destined for the freight haul because it has a $30 billion deferred cost pit it can't climb out of until enough passenger models are delivered.

A prediction may be coming for a 787F when its program debts are paid-off. However, Carbon Reinforced Plastic process is way too expensive for dead weight. The 767F has just got its freight legs in the meantime.

Thursday, May 3, 2018

Wednesday, May 2, 2018

Boeing's 1st QTR 2018 Earnings Call

Caution with optimism as typical as a stockholder wants the long-term stockholder to hear with an early this year pronouncement.

· The 777 production is covered without Iran's order.

· The 797 announcement remains a pipe dream.

· Boeing lands the 767 KC-36 tankers just over the Rainbow near Seattle (Oz).

· China who?

· The Boeing 787-8 becomes plug and play in Boeing's assembly flow.

Winging It, Counter Points:

· 777X development Irons out its stuff slowing its process by six months

· The 797 will blow your mind at Farnborough

· Dorothy does land her first tanker at McConnell Air Force Base, Ks.

· China Buys More 787 because it can.

· More 787-8 orders emerge as Boeing's rate production increases to 14.

Tuesday, May 1, 2018

Could Rising Jet A Price Begin A...

... An onslaught of new widebody orders? Low fuel prices became the premise for large older generation airframes for the industry back five years ago thus suffocating buying large wide-bodied aircraft like the 787. Using an opposite rationale could start a surge for new general widebody orders, specifically the 787 families of aircraft in 2019.

The old thought said buy, lease or borrow low priced inefficient aircraft because fuel cost became so low. Now that fuel is rising, a pent-up demand for the 787 could explode on the market scene by 2019 because of airline profit need. Fuel prices are going higher therefore, it is required to own efficient aircraft like the Max or Dreamliner?

Boeing has already considered this market paradigm and it has many orders options on hand just from fuel efficiency demanded with operations from fuel prices climbing.

The old thought said buy, lease or borrow low priced inefficient aircraft because fuel cost became so low. Now that fuel is rising, a pent-up demand for the 787 could explode on the market scene by 2019 because of airline profit need. Fuel prices are going higher therefore, it is required to own efficient aircraft like the Max or Dreamliner?

Boeing has already considered this market paradigm and it has many orders options on hand just from fuel efficiency demanded with operations from fuel prices climbing.

Monday, April 30, 2018

Boeing's Big Bite, The 797

Boeing has started then stopped and then started the 797 talk over the last several years. Western sensibilities want an aircraft centered on passengers and it luggage requirements. Asian wants are centered on both passengers and freight. The Boeing Company first researched a viable mid-range middle of the market aircraft that became everything the 787-300 was supposed to be but had not enough takers for the concept. That was back in 2010 when the 787-300 went up in smoke.

Now comes the 220-270 type mid-range aircraft were Asia or China holds immense clout over Boeing's design parameters. The 797 is in a holding pattern while Boeing engineering is trying to please both western and eastern sensibilities. China wants the freight function and Boeing wants its 797 design motif to remain intact of a smaller hold than typical.

China wants passenger density that the 797 concepts is offering, but is squeamish over the Boeing conceptual freight capacity from Boeing's first designs having a smaller freight space than what western sensibility desires with Boeing's initial proposal. This brings the matter to a head. Having a two-body model type 797. One called the "E" and the other called the "W" type 797.

If Asia can commit to a 250 seat dual aisle 5,000-mile range holding enough freight space they will get an "E" ticket 797 for any Eastern type. If American and United have influence with Boeing (I think they do) then expect a 250 seat slim bodied 797 type called the 797-W for western sensibilities. If Boeing can easily build both types sharing 797 commonalities using same technologies for both types then both types could be built by snapping together its barrels according to the work order submitted at its assembly plant.

What's taking so long for Boeing to announce the 797? Well, it's going to commit to building what the customer wants or needs first and they must assure themselves it can do it without costing another money pit like the 787 program created with its deferred costs of almost $30 billion.

The west is west song comes to mind when thinking about this matter. Asia would have to order at least 400 797-E's before Boeing gives in while having a like number 797-W's also in the books from "other" customers like United. Plastics and computer modeling is the answer and that is what is taking Boeing so long. It can and will do the 797 but the order book it has collected on the 797 is governing the manufacturing headache it now faces.

Now comes the 220-270 type mid-range aircraft were Asia or China holds immense clout over Boeing's design parameters. The 797 is in a holding pattern while Boeing engineering is trying to please both western and eastern sensibilities. China wants the freight function and Boeing wants its 797 design motif to remain intact of a smaller hold than typical.

China wants passenger density that the 797 concepts is offering, but is squeamish over the Boeing conceptual freight capacity from Boeing's first designs having a smaller freight space than what western sensibility desires with Boeing's initial proposal. This brings the matter to a head. Having a two-body model type 797. One called the "E" and the other called the "W" type 797.

If Asia can commit to a 250 seat dual aisle 5,000-mile range holding enough freight space they will get an "E" ticket 797 for any Eastern type. If American and United have influence with Boeing (I think they do) then expect a 250 seat slim bodied 797 type called the 797-W for western sensibilities. If Boeing can easily build both types sharing 797 commonalities using same technologies for both types then both types could be built by snapping together its barrels according to the work order submitted at its assembly plant.

What's taking so long for Boeing to announce the 797? Well, it's going to commit to building what the customer wants or needs first and they must assure themselves it can do it without costing another money pit like the 787 program created with its deferred costs of almost $30 billion.

The west is west song comes to mind when thinking about this matter. Asia would have to order at least 400 797-E's before Boeing gives in while having a like number 797-W's also in the books from "other" customers like United. Plastics and computer modeling is the answer and that is what is taking Boeing so long. It can and will do the 797 but the order book it has collected on the 797 is governing the manufacturing headache it now faces.

Winging It Made A 787-10 Case Back in 2012

2012: Paraphrased, "The program will start when Boeing books at least 150 orders". They made that number with 171 units booked and have delivered two units six years after the Winging It prediction, to Singapore Airlines.

Winging It has made another prediction true.

Winging It has made another prediction true.

View From The Top: of a 777X Flight Deck

Boeing inches closer to the first flight of its proposed 777X airframe and here is proof its design is firmly in engineers hands with a "Go" card pinned to the 777X engineering door.

Okay, let's go!!!

Sunday, April 29, 2018

787 Program Numbers Crunched

Its been a while since numbers have been discussed. Sometimes terminology is used as in "Book to Bill" ratio needs to reach a theoretical "1". Or more commonly described as for every order there is one delivered within the same said period of time. Below is a Winging It Chart of 787 production and orders during the whole program to date not respecting any one year or month, but from the programs start of production/delivery in 2011 when the first 787's were delivered late in that year.

This recap has about 688 units in a backlog status until built and delivered. Program to date reports about 1,365 units ordered making the book to bill program ratio derived from 1365/677 thus equaling 2.02 BB rate. Another interesting note the deliveries are almost equal to it backlog comparing a 50/50 status. Boeing is announcing many more 787 bookings this year as it hopes to match its delivery pace with new orders by year's end in a 2018 BB rate of 1. An optimistic view, indeed. The rate production is jumping to 14 a month or 168 units a year for 2019. That number becomes an indicator it also hopes to match 787 booking by the same number. By year's end, Boeing will be hoping for around 140 units booked for maintaining of "1" BB Ratio by meeting its goal of 140 deliveries.

This recap has about 688 units in a backlog status until built and delivered. Program to date reports about 1,365 units ordered making the book to bill program ratio derived from 1365/677 thus equaling 2.02 BB rate. Another interesting note the deliveries are almost equal to it backlog comparing a 50/50 status. Boeing is announcing many more 787 bookings this year as it hopes to match its delivery pace with new orders by year's end in a 2018 BB rate of 1. An optimistic view, indeed. The rate production is jumping to 14 a month or 168 units a year for 2019. That number becomes an indicator it also hopes to match 787 booking by the same number. By year's end, Boeing will be hoping for around 140 units booked for maintaining of "1" BB Ratio by meeting its goal of 140 deliveries.

Subscribe to:

Posts (Atom)