The

yet to be named Zumwalt class DDG 1000 rescues a fishing captain 40 miles to the South East of

Portland Maine during its initial sea trials. The select crew performed the

rescue in a small boat launched from the "Zumwalt class destroyer" at

3:00 am Monday last. "Rescue from other ships" now has a check mark for the DDG 1000 today. The

Navy team onboard did their job well. The stealthy-like ship gives out a radar

signature the size of a fishing boat even though its 15,000 tons is a massive

seagoing object with a crew of about 180 members. The Arleigh-Burke class

destroyer company is close to 300 members. This suggests more automations and

sci-fi efficiency.

My Blog List

Saturday, December 12, 2015

Becoming Exclusive, A Market Strategy

Often the industry looks at size and numbers as the benchmark for

market dominance. The number of aircraft in backlog is a driving impressionable

quantum. However, after looking at the insatiable growth of market backlog,

that factor begins to lose luster after it falls out of relevancy with customer

plans. How can an Airline place an order with a seven year wait? It needs money

for that order, if all goals are met in the high risk of market change over

time.

An airline also knows it can convert orders to

the next latest models during a seven-ten year backlog of waiting for its

intended order. Many Boeing 737NG orders were converted to 737 MAX under this

condition. The order placement so many years out, did not take into account an

accurate estimation the Max announcement would occur.

Airbus has raced ahead of Boeing on single

aisle orders placed in 2015. Airbus is also proclaiming a sixty per month build

rate for its A320 NEO by 2020. Boeing will try fifty-two a month produced by

2018. So yes, Boeing is keenly aware that "Backlog Matters". It is

not a glamorous number thrown around customers as some kind of dominating

number in the market place. It makes customers reconsider, reconstruct, and

renew its own five year planning in the most awkward manner. Customers can't always

adjust while its providers goes seven years out on a wait list. The condition

described above, pulls in, too much risk into an airline's "plan". Airbus has an

incredible desire for selling aircraft and being the world's largest

everything, even at the expense of its customers. Airlines may fail out and experience an opportunity

loss from a long term wait. Company "A" (Airbus Customer) may have to wait too

long for an aircraft delivery while extended time waiting will not fit its own business plan or can it adjust from market changes. Because of this exposure from more time passing, a just-in-time delivery goes out the

Airline window.

Boeing, naturally is company "B"

where they are openly seeking a production balance driven by customer opportunity.

Boeing realizes it must maintain a manageable backlog even at the expense of losing

PR points of not having the World's Largest Airplane Backlog (WLABL). Boeing

gave market guidance many months earlier, it would have an approximate 755

units placed on order for 2015. Airbus by comparison has already achieved over

1006 aircraft ordered during 2015.

737 NG Production Floor Renton, WA

Boeing has already recognized a market nullification has emerged for the single aisle market. Market nullification is a term defining that either mega manufacturer does not have a significant edge over the other from product advantage of a customer's operations, other than providing timely delivery into a customer's own business plans. In other words the defining a "choice metric" comes from a customer's own operational situation rather than the supplier's product having some market edge. The duopoly has nullified itself into a customer's operational decision tree of what would be more convenient for "Our Airline". The checklist for the operator becomes: commonality of fleet, delivery time, and market conditions. These are all out of control of the manufacturer, since they have nullified themselves through achieving many goals of commonality, excessive backlog and dynamic market conditions. The market belongs to the manufacturer's customers not the manufacturer.

Airbus went big in 2015 where Boeing went

small with its order book. The advantage over time will benefit Boeing if it

tunes its production capacity towards its customer as an exclusive

relationship. Boeing is closing in on a position of: "When do need it and

how many?" Airbus is pulling away with its single aisle just like popular

restaurants have an excessive wait time for a table on Friday night. Boeing must adjust

its backlog making an exclusive partnership with its customer, and not look over its

shoulders at the Airbus bloviating. It must make the relationship with its

customers, by containing a functional production queue. If Boeing can sell more

airplanes it must expand its production first to meet customer demand in the sales process,

as it will sell more airplanes from a commitment of productivity not the slight

differences found in it products with its competitor. It is this blog's belief Boeing has done just that, taking on a responsible mantle of taking on more orders when able to do so within a sensible delivery time for its customer.

Wednesday, December 9, 2015

American Airlines 787-9 Premium Economy

I'd buy it on long flights.

Twenty-one seats offered in three rows of 2-3-2 configuration will make "any pond jump” for a sensible price with enough extras complimenting your

extended hours of travel enjoyment.

American

Airlines 787-8 seating chart.

The American Airline 787-9 delivery in 2016 will have this

intercontinental flair for its passengers. Judging by what others are doing,

American will make a slightly more expensive ticket than an Economy Plus worth

on price for long legged routes.

Leg room six inches more room (37" pitch estimation). Seats

having a significant width wider than economy in comparison (about 22"). Upgrades on in-flight amenities and boarding privileges. Viola, your trip

from Seattle to Paris becomes remarkable on the 787-9 for the price significantly

less than business class pampering.

This American Airline rendition should carry about 260 passengers.

United has 252 seats on its 787-9 for comparison. Winging It estimates about

260+ for American Airlines until seating is announced late in 2016, before

American Airline first delivery.

Tuesday, December 8, 2015

Creating The Max

Boeing's website is open for

business concerning the 737 Max. It has rolled from its factory to the paint shop

and back for final preparations for first flight testing.

Monday, December 7, 2015

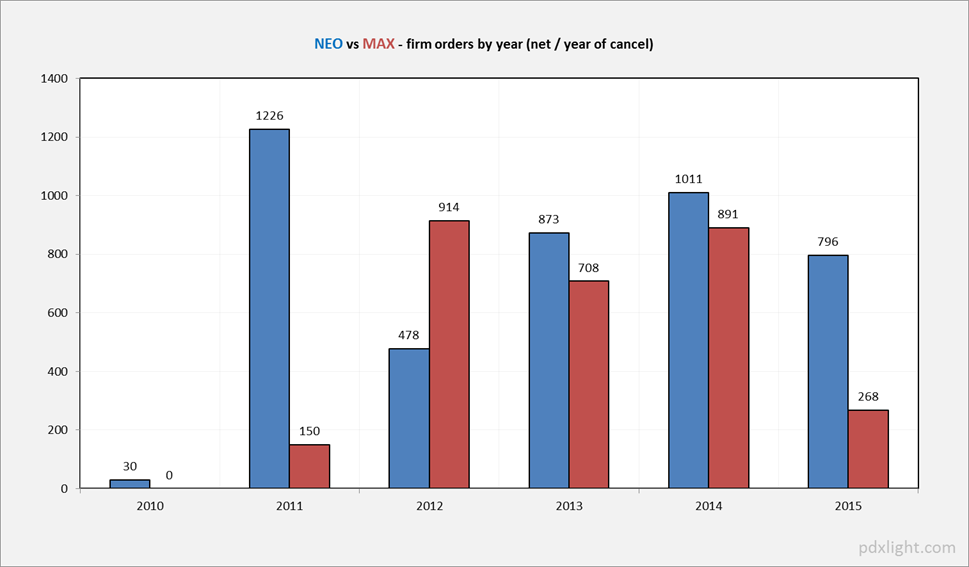

Single Aisle At The Climax (Updated new 737 Oders)

Boeing has long proposed its 737 MAX is the undisputed winner of

the Single Aisle Airplane Wars. Airbus says not so fast people, the A320 NEO

reigns supreme. Who is correct in this assumption?

The answer is in sales numbers for various reasons.

- Fleet renewal

opportunity

- Commonality

Curve

- Oil Prices

become a non-purchase factor

- Time

- Paper vs Metal, Flying version wins orders.

Airbus had an eleven month jump in time over Boeing announcing in

2011 its NEO single Aisle. Boeing lost the advantage of time and was set

backwards by about 1200 NEO's ordered in the first year. The first 787 was

delivered in 2011 and Boeing was flummoxed by an early 787 debacle and couldn't

counter punch Airbus at that time until the next year when orders came surging

in for the MAX.

However, Airbus was in perfect sync with market realities. They

kept going forward with its customers filling its order book.. Boeing could

only try to stay on the same lap around the development stage with orders.

So far, so good until 2015. Airbus is ready to lap Boeing on

single Aisle orders. This leads me to ponder that oil prices do not make a case

for Boeing, for buying its MAX over the NEO. The fuel efficiency difference for

the two is a non-decider.

Commonality found in Airbus product is further along, than Boeing's

conversion towards its theme of "fly like a 787" on all models.

Customers new to Airbus, may have bought into the price offering from a single aisle

discount. Boeing strapped for program profit may have held firm with its

pricing in order for it to avoid any development hit on its bottom line for the

MAX.

Airbus stole the march on Boeing in 2011 and timed the world fleet renewal

window perfectly. The lower oil prices have just began shrinking purchase power

in 2015. Boeing drew the short straw when leasing aircraft becomes a tool and side

effect from lower fuel prices.

However, as dismal as the 2015 period appears for Boeing Single Aisle

purchase orders, it has built a significant internal construct for its

marketing. The multitude of 787 sold, and the 777X launch success will make the

case for having a top to bottom family of Boeing aircraft. Boeing's out of sync fleet "renewal

opportunity surge", will catch-up by 2018 to the NEO book numbers. The year 2015

is bottom hitting for Boeing's Single Aisle effort. In fact Boeing will book some more

MAX this month but won't catch Airbus. Boeing will have aligned its timing, commonality

factor, and fleet renewal windows by 2018.

The flying version wins orders for Airbus as Boeing sketches out the Max on the CAD, its paper version loses momentum with orders during 2015. The third round of this fight will begin with Boeing having bloody cuts and bruises from the fight. The Boeing metal version rolls towards towards its corner in the shop awaiting the next round.

The flying version wins orders for Airbus as Boeing sketches out the Max on the CAD, its paper version loses momentum with orders during 2015. The third round of this fight will begin with Boeing having bloody cuts and bruises from the fight. The Boeing metal version rolls towards towards its corner in the shop awaiting the next round.

Update:

Boeing jumps some net orders for

the 737 before year's end, and slightly closes single aisle gap. It is a good

indicator Boeing is in the fight to win it.

| 2015 Net Orders | 563 | 2 | 49 | 58 | 71 | 743 |

Saturday, December 5, 2015

The Boeing Order Book Graphed

Boeing has amassed orders for a

seamless transition from it production floor going from NG to Max effort. The

only gap found in the order book is the 747-8i has stalled as the new found

twin solution makes it obsolete. A 747-8i doesn't die because of Airbus, it

dies because of the 777X concept.

Owning

two 405 seat 777-9X can fly more destinations than one 500 seat A380. The A380

is also a dead concept no matter how luxuriously appointed the Gulf States make

it.

A

Business Finance News Chart

With over 4,000 single aisle and over 1,000 Wide Bodies

backlogged, Boeing has its work scheduled in a envious position. Comparing with

Airbus who has a larger backlog it will be difficult for Airbus to fit more

orders in a timely manner. Boeing has synced its production slots closer to

market demand, and it will serve them well when marketing for more orders. Airlines

who are expanding or are newly forming can fit its fleet expansions for single

aisle ordering with Boeing, an important consideration when matching financial

resources with business plans.

Friday, December 4, 2015

DDG 1000 Zumwalt Goes To Sea Trials Possibly December 7th

My favorite destroyer is going all out, maybe

this Monday. The billions planted on board will make way for testing its

systems under full operations with its crews and BIW expertise for the big

shakedown. In case you have been living under an anchor, the Zumwalt is the

equivalent of the Air Force F-35 when it comes to innovation and technology

applications.

The massive destroyer is just bigger and

faster than the Arleigh Burke class destroyer. It is stealthier and contains

more firepower than most fighting ships found in the world. A projectile from

the Zumwalt could sail 60 miles to its target, where the "round"

applies inertia and mass obliterating buildings, ships and other wartime

objects, and all while coming in at the speed similar to a meteor from space

(via rail gun). It could manage the ocean battlespace for both air support and

coordinate other ships by using satellite connectivity with multi military

systems. It may be invisible from electronic sweeps from its design features.

Three will be built, maybe that is all that is needed, one for each Ocean.

Thursday, December 3, 2015

How Did Airbus Get To 787?

That is right, the Airbus order

count had to play some serious tricks to its order book for totaling a net of 787 A350's

to date. When the A350-800 died(ugh), Airbus orders slumped down to a net total of 787 A350's since it had only 787 units ordered and had no other choice. Oh my, not 787 units on order, somehow, it’s Order Book

Karma! Since it is also getting near the winter solstice, and I am ready for more

valuable information, I am sharing outrageous observations during the season making a new Winging It Christmas tradition. Hours

of Darkness improves my lucidity? Just think only 22 shopping days before I go

broke.

Airbus needs to desperately sell one more A350, any takers?

Starting with 817 net A350's ordered "Winging It" considers these A350-800 adjustments! Subtract the net thirty Airbus loss over the A350-800 cancellations and transfers to other A350 aircraft, Viola its 787 time on the books.

Airbus needs to desperately sell one more A350, any takers?

Starting with 817 net A350's ordered "Winging It" considers these A350-800 adjustments! Subtract the net thirty Airbus loss over the A350-800 cancellations and transfers to other A350 aircraft, Viola its 787 time on the books.

Wednesday, December 2, 2015

787-10 Seals Design Completeness. Lock and Load Time

Boeing just signaled the long

journey in the design shop has ended for the 787-10. The mega builder learned

from its 787-8 process how not to go there and there. It then built the 787-9

without missing a step. The mishap trail disappeared in the development weeds.

The 787-9 was an opus effort for all things good and all things perfect. Sales

kept soaring for the 787-9 (Below).

The

excitement for the 787-10 climbed because of the 787-9 tests and delivery to

New Zealand Air's "all black ops" entry into service excited the

world. The giddy Boeing team knew it had validated the 787 concept coming from

disastrous 787-8 days to the heady 787-9 march through designing, freezing, and

successful first flight. All the 787-8 bogies were shot down by the 787-9

program.

It comes

to the 787-10 with all the "how to" confidence and billions of

experiential knowledge points on a new frame that is 95% 787-9 based.

Continuous improvement has hit the big leagues with the 787-10 effort. It will

fly forward without mishap. It will fly loaded for about 7,400 miles. It will seat up to forty more passengers than the 787-9, which is already comfortably outfitted with about 290 seats. Call it targeted for 330 seats for ocean busting covering 90% of the world market. If you want more

then buy the 777-9X for 100% world market coverage and 405 seats.

Boeing

Quote: Via E Turbo News

"With

the 787-10, we are building upon our experience and the 787-9 design itself to

create this newest member of the super-efficient 787 family," said Ken

Sanger, vice president of 787 Airplane Development. "Through our dedicated

team and our disciplined processes, we have optimized the design for the needs

of the market and are excited as we look forward to production."

Using the word "excited" is an understatement

from Ken Sanger. The first level order book stands at 164 787-10 sold. No one

expected 164 before entry into service. It may rise in order number once it

flies during the testing phase.

One more Boeing PR Quote:

"The

787-10 is the third and longest member of the 787 family. With a range of 6,430

nautical miles (11,910 km), the 787-10 will cover more than 90 percent of the

world's twin-aisle routes at a whole new level of fuel efficiency: 25 percent

more fuel efficient than the airplanes it will replace and at least 10 percent

better than anything offered by the competition for the future."

Tuesday, December 1, 2015

Predictive Nature Of Boeing Blogging

It's always important foreseeing future trends based on current

and past efforts while making an assumption out of whole paper tissue.

Currently Boeing and Airbus has already made its 2015 statements representing

many months of activity and preparation. Airbus holds the order book advantage

going into December 2015. Boeing holds a few more calculated surprises which in no means will overtake the Airbus lead, but will demonstrate a market position in

both the wide body and narrow body markets.

The scorecard is important to Airbus as an arm of its marketing

scheme. They have achieved a draining of its order swamp this year going into

the end of 2015 with its 910 gross order book count.

It beats Boeing in count by a wide margin which has mustered 647

Boeing aircraft booked in a gross count way. The question becomes what does this all mean

in a snapshot.

Assumptions:

- Boeing drained

its order swamp in 2014

- Airbus pricing

is favorable with neutral leaning customers

- Boeing Wide body

has gained market separation over Airbus Wide body

- Airbus A320NEO

keeps on keeping on

- Boeing Max comes

in late after the single aisle market bubble ordering pops.

Just

looking at these few ideas about the Boeing order book is enough realization,

Boeing knew 2015 would softened its bookings, and not to worry about what

Airbus does in 2016. For them (Airbus) it will be tough to double down on its ordering

pace for two years in a row.

Boeing

has achieved a benchmark that Airbus doubted when the first A350 was delivered.

There should be no continuation of 787 order dominance. Airbus believes that

once the A350 was delivered it was game over for the 787. Not so fast my

friend! The 787-9 and 787-10 keeps up with orders while the A350 family of

orders has languished in 2015. Boeing takes in a net of 71 (97 gross) 787

orders in 2015 while Airbus only has seven (oops) A350 during the same period of time.

Those

numbers suggest a serious separation for competing programs. The Boeing

stretches out its order and delivery lead even though the A350 has put its best

foot forward with Qatar deliveries. The Arab state isn't drawing many

comparison between the two types of competitors it now owns. Being the Airbus A350

launch customer, you would think its own pride of choice would deem some

disheartening remark towards the 787 in its fleet, as positioned as the Premier Airbus A350 Launch

customer.

Subscribe to:

Comments (Atom)