With limited financial resources Canada caves for the

F-18. A populist leader will make popular decisions of the people not

necessarily the correct decision for the people. Trudeau is such a leader

leading from behind the Canadian sentiment of no F-35’s because the perceived

opinion of the F-35 is too expense while having multiple developmental glitches

and will possibly be ineffective against adversarial incursions into Canadian

airspace. All well intended ideas against having the F-35.

The best case scenario for the Canadian F-35 would be a

wait and see if costs, defects, and lack of operational capabilities are

mitigated. This is the position of Trudeau leading from behind the public

sentiment. Yes, the F-35 is in a chaotic phase of development, and it appears

wise to “can” the Conservative opinion of buying the F-35 fighters.

However, leading from the front suggests buying the F-35 en mass as Canada faces a vast front on the Arctic Circle with many possible

incursions from many adversarial combatants. The Canadian front may be North America’s Achilles heel, which will bode unwell for Canada and the US sitting smug with

its F-18 fighter squadrons.

Whose interest is it defending North America? The Canadians

or the US?

The answer is a mutually acceptable agreement because both need the

best defense is a great offense and the F-35 will offer a fundamental solution

being able to strike and defend. The multi role fighter does both at once when all its

attributes are turned on.

Trudeau made a political statement with a no F-35’s response

to Canada’s conservative sentiments. The Canadian voters were swallowed up in

popular agreement making Canadian tax dollars available for other civil

programs such as cheese inspections coming in from the US. It’s a Canadian

tradition after all, having neatly pressed uniforms for the mounted police when

defending by riding horse back along its southern border.

The following items have just been covered:

·

- Political

Progressive Populism

- · F-18’s

fit the budget

- · F-35

is not ready for prime time

- · Leading

from the wake of public sentiment

- · Billions

is not in the Canadian lexicon

What the US government, in behalf of its people need to

do, defending the Lower 48, Alaska and Hawaii is go back to the World War II

sphere of influence through several tactics. It needs the Canadian Shield

protecting its cheese industry and other North American cultural oddities such

as Hockey and the NHL.

America and Israel have a plan which should expand to all

loyal allies to America. In post war Europe it was called the Lend/Lease treaty.

Wikipedia information:

“The Lend-Lease policy, formally titled "An Act

to Promote the Defense of the United States", (Pub.L. 77–11, H.R. 1776, 55 Stat. 31, enacted March 11, 1941)[1] was a program under which the United States

supplied Free France, the United

Kingdom, the Republic of China, and later the USSR and other Allied nations with food, oil, and materiel between 1941 and August 1945.”

The US needs to form an alliance with all

its F-35 current partners and customers. Israel set the standard as a crucial

ally in the Middle Eastern part of the word.

They just plain get a budget from the US with no visible strings

attached when buying the F-35.

In Canada who is so strapped with Canadian

dollar type cash, It should/could “buy” a fifth generation fighter for the price of a

fourth generation fighter where US acts as a middle man on the purchase from

Lockheed. The US military purchasing with its own contract price from Lockheed would

then buy for any "Ally" an F-35 and then sell-back that

F-35 to the same “Ally” with a current fourth generation replacement price.

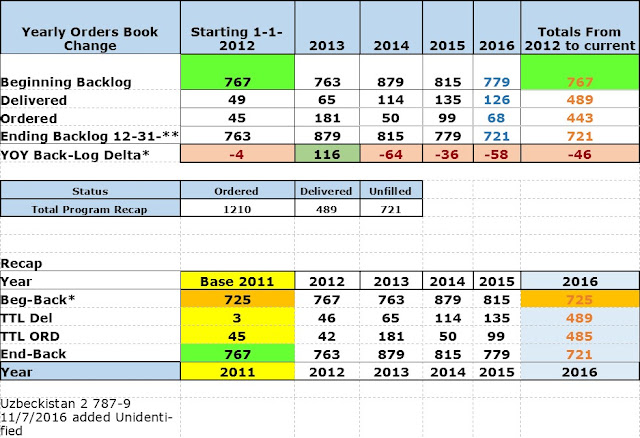

Graphically charting a transaction with a

Canadian would flow like this:

Canada buys 50 F-35’s to assist defending

North America and its own nation (already by treaty). It has been often been recognized

of its aging F-18’s and needs the F-35. The current market price of an F-18 (is

$60 Million US each?). The current market price to the US of an F-35 from Lockheed

is $100 million US. The US will buy an F-35 for Canada in behalf of North

America’s over-arching defense at its own contract price and then sell back to

Canada that same F-35 using a fourth generation price (i.e. the sixty million

mentioned above).

Of course there are other expenses

supporting the program and an ally who already has a support structure for its

fourth generation fighters who would role that expense into a fifth generation

budget support. This resource example is for; parts, maintaining and training of

flight and ground operations.

It isn’t lend-lease but it does go a long

way defending this nation and North America and other parts of the world. Israel

has a sweet deal, because they are at the tip of the spear when defending

American security in an active war region. Israel is essentially given an F-35

out of the US defense budget when the US allocates to Israel a defense award from each US budget year for F-35's.

The Canadian example mapped out above

would give Canada a strong value for having its F-35 fighters. At full price,

Canada would have to pay $100 million per aircraft from Lockheed at current conditions or pay $60 million to the US Government for its defense of North America using F-35's. It would then get

Trudeau off his political hook he had set when he proclaimed “no F-35’s not on

my watch”.

Fifty F-35’s at $60 million would then

would cost Canada $3 Billion instead of $5 Billion at current full price. The

difference of $2 Billion is a fair price to pay having Canada guarding the DEW

line.

.jpg)