This is a significant milestone for Boeings' 787 programs. More orders are being booked at this time so the 50-50 relationship will drop back closer to a 48-52 relationship unless orders are held for the Farnborough Airshow, then it remains close to 50-50 book to bill ratio (backlog to delivery ratio) or the perfect "one" most manufacturers seek.

My Blog List

Thursday, May 17, 2018

Boeing Reach Its 787 50-50 Benchmark

The 50-50 benchmark is a point where the same number of 787 delivered equals its reported backlog as shown below:

The Huge Dubai Mystery Deal For Single Aisle

Reuters broke a story in the last 48 hours. Boeing and Airbus are in talks bidding for up to 400 Single Aisle aircraft which Identifies the A-320 Neo and the 737 Max family of aircraft. It's not a winner takes all customer award but a mix coming from both mega aircraft builders. The battle is for who gets the most orders in this latest battle round. With it comes bragging rights.

This latest battle may trend the market towards who becomes the winner going forward. The Airbus offering has beat Boeing's own single-aisle offering of NG's and Max. However, in 2018, Boeing is making headway against Airbus in the bidding wars from customers in both the wide body and single-aisle category. Since this is pre-Farnborough airshow talk, I would expect the order announcements will occur during this airshow, the month of July 2018.

It would be a biased opinion to even predict an outcome. However, the price factor will play an important decider for this deal as both makers offer a very good product possibly for different reasons. The airplane efficiency is almost a push depending upon how you read the data or whom you believe is telling the correct story. The third point is what airplane best fits a Dubai business plan using maintenance numbers and commonality positions. This broad sweeping potential order will cover both makers where the stronger balance of orders will go with factors from efficiency and commonality from the airline building its fleet. No airline name was actually mentioned only just the deal-making is occurring with Dubai Aerospace Enterprise (DAE), a leasing company. Which supplies aircraft to Middle East customers. Currently, its fleet is about a 50-50 split between Boeing and Airbus.

A DAE deal is driven by what its customers want and future market projections in its region as DAE may want a build-up of backlog orders anticipating future orders. If Boeing does secure a big lead with this order, DAE sees a future demand for the Max over the NEO. If it remains a 50-50 split then status quo remains what its customers want. The unit price will drive this big deal demand. Predicting who wins is a wait and see processing. Perhaps there is an underlying factor not yet measured such as DAE has a leasing customer who wants its fleet from a certain maker.

This latest battle may trend the market towards who becomes the winner going forward. The Airbus offering has beat Boeing's own single-aisle offering of NG's and Max. However, in 2018, Boeing is making headway against Airbus in the bidding wars from customers in both the wide body and single-aisle category. Since this is pre-Farnborough airshow talk, I would expect the order announcements will occur during this airshow, the month of July 2018.

It would be a biased opinion to even predict an outcome. However, the price factor will play an important decider for this deal as both makers offer a very good product possibly for different reasons. The airplane efficiency is almost a push depending upon how you read the data or whom you believe is telling the correct story. The third point is what airplane best fits a Dubai business plan using maintenance numbers and commonality positions. This broad sweeping potential order will cover both makers where the stronger balance of orders will go with factors from efficiency and commonality from the airline building its fleet. No airline name was actually mentioned only just the deal-making is occurring with Dubai Aerospace Enterprise (DAE), a leasing company. Which supplies aircraft to Middle East customers. Currently, its fleet is about a 50-50 split between Boeing and Airbus.

DAE 2017 Fleet Report

A DAE deal is driven by what its customers want and future market projections in its region as DAE may want a build-up of backlog orders anticipating future orders. If Boeing does secure a big lead with this order, DAE sees a future demand for the Max over the NEO. If it remains a 50-50 split then status quo remains what its customers want. The unit price will drive this big deal demand. Predicting who wins is a wait and see processing. Perhaps there is an underlying factor not yet measured such as DAE has a leasing customer who wants its fleet from a certain maker.

Tuesday, May 15, 2018

Israel Eyes K-1 Airbase

Northern Iraq has an airbase just 100 air miles from Iran's border. The Kurds have this air base and have requisitioned the surrounding oil away from Baghdad Iraq. The air base is called K-1. Israeli based fighters cannot fly to Iran and back without tanker fueling which it does not have in abundance. The F-35 can punch a one-way ticket only for about 1,000 miles or it has a combat radius near 600 miles. Landing at K-1 with F-35's would make Israel the top dog in the Middle East and would cause Iran some severe heartburn. The US would, of course, assist via CIA with this venture.

Israel has a plan or workaround for dealing with Iran and the Kurds have a big role in this plan but the US will need an assist from the Kurds going forward for years to come. Therefore, watching the US partnership with the Kurds is the tip of the Iceberg. Back to the F-35i.

Israel needs about 25 F-35i for this venture in punishing Iran for its support of Hamas in Syria. At this time a notepad becomes handy for writing down the players. Lockheed needs to sell Israel, not 50 F-35i but twice that number once production prices reach $85 million a copy. Israel could mitigate airfield requirements with the F-35B, which it does not have on order from Lockheed at this time. Trump may advance Israel billions with defense treaty negotiations. That is how Israel has nine F-35i at this time. The US bought them for Israel via defense treaty.

K-1 Airbase, a former Iraqi-Baghdad airbase, is in Israel's crosshairs as a place to land its F-35i's, but not getting ahead of myself deals have to brokered.

The US pays the Kurds for weapons it also pays Israel for the F-35i. Once the US is divested from Iran nuclear treaty(done), Trump can make more deals with Lockheed, Israel, and the Kurds. "Poof", no more covert Iranian nuclear program the F-35i is that good.

Israel could use this Kirkuk asset when looking at Iran

Near Kirkuk K-1 base with a Soviet-era headstone

Israel has a plan or workaround for dealing with Iran and the Kurds have a big role in this plan but the US will need an assist from the Kurds going forward for years to come. Therefore, watching the US partnership with the Kurds is the tip of the Iceberg. Back to the F-35i.

Israel needs about 25 F-35i for this venture in punishing Iran for its support of Hamas in Syria. At this time a notepad becomes handy for writing down the players. Lockheed needs to sell Israel, not 50 F-35i but twice that number once production prices reach $85 million a copy. Israel could mitigate airfield requirements with the F-35B, which it does not have on order from Lockheed at this time. Trump may advance Israel billions with defense treaty negotiations. That is how Israel has nine F-35i at this time. The US bought them for Israel via defense treaty.

K-1 Airbase, a former Iraqi-Baghdad airbase, is in Israel's crosshairs as a place to land its F-35i's, but not getting ahead of myself deals have to brokered.

The US pays the Kurds for weapons it also pays Israel for the F-35i. Once the US is divested from Iran nuclear treaty(done), Trump can make more deals with Lockheed, Israel, and the Kurds. "Poof", no more covert Iranian nuclear program the F-35i is that good.

797, Then Infinity and Beyond

Buzz Lightyear said it first on toy story, "to infinity and beyond". Now the 797 exhausts Boeing's model naming convention with no Seven's left to be used. But au contraire! Buzz Lightyear had it right as far as Winging It is concerned. Hence the next big step Boeing could take after assigning the 797 designations is found in the image below:

First up would be, the 807, an upright infinity start and it goes beyond.

First up would be, the 807, an upright infinity start and it goes beyond.

The symbol of Infinity

∞07

∞17

∞27

∞37

∞47

∞57

∞67

∞77

∞87

∞97

Buzz Lightyear, you rock! Boeing, use the upright 8 and go beyond.

WTO Finds Airbus Likes To Cheat

The Airbus less advanced higher priced family of aircraft gets a consortium of cash flow from various European countries. Particularly France and Germany. The cash penalty will be about $22 billion to Airbus thus jacking the price higher in customer bid wars against the Boeing products. Speaking of Boeing, it too has its WTO findings for about 8 Billion which is a significantly less than the Airbus $22 Billion. The Boeing finding is for its 777X wing plant for which the state of Washington incentivized Boeing into building the massive 777X wing operation now residing in Everett, Washington having follow-on employment for those moving to the North of Seattle city.

Boeing has swallowed the bitter pill but Airbus will find itself less able to swallow its own $22 Billion tags the WTO has imposed.

What all this means is, an Airbus stoppage of future new widebody development going forward. A greater widebody price proposal for its customers during head to head bidding against Boeing for its wide-bodied aircraft, and a further beating from Boeing's sales team in the open market.

Why this determination against Airbus, Because it has caused irreparable damage to Boeing's market over the last decade or longer. Airbus with its subsidies has been able to compete with Boeing when it couldn't do so without the government subsidies covering financial shortfall during the development of its less advanced A350 and A380 programs. Boeing had a deferred cost of about a $30 Billion money pit when it developed its 787 families of aircraft. Airbus received roughly $22 Billion from the government when it developed a competing A350 or A380. Airbus has blatantly cheated and Boeing followed suit but to a lesser scale with its 777X program. Boeing is better positioned to pay its fine from the WTO.

Boeing has swallowed the bitter pill but Airbus will find itself less able to swallow its own $22 Billion tags the WTO has imposed.

What all this means is, an Airbus stoppage of future new widebody development going forward. A greater widebody price proposal for its customers during head to head bidding against Boeing for its wide-bodied aircraft, and a further beating from Boeing's sales team in the open market.

Why this determination against Airbus, Because it has caused irreparable damage to Boeing's market over the last decade or longer. Airbus with its subsidies has been able to compete with Boeing when it couldn't do so without the government subsidies covering financial shortfall during the development of its less advanced A350 and A380 programs. Boeing had a deferred cost of about a $30 Billion money pit when it developed its 787 families of aircraft. Airbus received roughly $22 Billion from the government when it developed a competing A350 or A380. Airbus has blatantly cheated and Boeing followed suit but to a lesser scale with its 777X program. Boeing is better positioned to pay its fine from the WTO.

Boeing's Freight Ship Comes In "survey class 101 notes"

Below is the Boeing.com freight outlook based on forecasting methods accepted by the industry. The volume of freight growing the next twenty-five years will have to accept seasonality or exponential smoothing math inputs based on historical trends over prior years.

In essence, fuel price change, market governance, and political influence have historically disrupted the outcome of a forecast in its math modeling for a financial outcome. Most forecasts take into account economic seasonality and it makes a smoothing error component for a forecast. In other words, history has indicated a recession every seven years which directly affects the subject matter of freight growth from this current time until the year 2038.

The Boeing forecast takes into account those lumpy occurrences from economic, political, and seasonal market changes when making a Freight business forecast for selling equipment into the future time period.

The Boeing outlook does its due diligence when it eliminates outlying market conditions which have little consequence for the over-arching demands from the world’s bases of commerce. Using minutia data becomes a tangled web sorting out what will occur, but any forecast must establish the highest probability that its outlook will definitely occur when all conditions are considered in that outlook

"The number of airplanes in the worldwide freighter fleet will increase by 70 percent during the next 20 years as air cargo traffic more than doubles

With air cargo traffic more than doubling by 2035, the world freighter fleet will grow by more than 70 percent, from the current 1,770 airplanes to 3,010 airplanes by the end of the forecast period. Growing demand for regional express services in fast-developing economies will increase the standard-body share of the freighter fleet from 36 percent today to 42 percent in 20 years. All new deliveries of standard-body freighters will be converted to passenger airplanes. The growth of the standard-body share of the fleet will result in a decline in the large- and medium-widebody shares of the total fleet over the forecast period, from 31 and 33 percent to 28 and 31 percent, respectively.

Of the 2,370 projected freighter deliveries, 1,130 will replace retiring airplanes, with the remainder expanding the fleet to meet projected traffic growth. More than 60 percent of deliveries will be freighter conversions, nearly 88 percent of which will be standard-body passenger airplanes. A projected 930 new production freighters, valued at $270 billion, will be delivered, of which almost 60 percent will be in the large-freighter category.

Freighter fleet will increase by more than half – Standard-body freighters gain a significant share of the market.

Monday, May 14, 2018

Air Cargo Boeing's Fifth Dimension

"To catch up with demand, operators

are buying new jets, especially large Boeing freighters. In February, UPS

ordered 14 more 747-8Fs along with four more 767Fs. In March, ANA purchased two

777Fs. This month, Qatar Airways signed a letter of intent to buy five more

777Fs. Over the past 24 months, we have sold nearly 80 freighters and there are

more campaigns in the pipeline."

The main show has always been passenger

aircraft sales and little is mentioned of the air cargo sales at an airshow.

The fifth dimension is hard to get your arms around and science wrestles

with the concept. Having said that Air Cargo is Aviation's fifth dimension. It

hauls everything from capital equipment to computer chips full of data or

programs. That sounds Fifth Dimensional when a postcard becomes air cargo and

one's arms can't quite get around it for its business case.

The Fifth Dimension

However, Boeing has recognized building freight value

into its production business model.

The 747-8F has brought the topic to the

front page and the 767-300F lurks at almost every airport in the land that

delivers FedEx or UPS packages. Airbus failed to make its A380 Freight business

case and canceled the concept. Now it has no A-380 and the A330-200F is its

main freight hope. Most A330-200F are converted from retired

passenger A-330's. All in All, Airbus has unraveled from the Fifth

Dimension's, Air Cargo Business.

Randy Tinseth has spent a considerable

amount of space on the topic on his blog, Randy's Blog. Boeing

is selling a significant amount of cargo airframes including the 777 frame. The

above quote from the article does not get into the details as his blog does but

its safe to say, Air cargo is on a steady expansion of about 5-6 percent a year

and Boeing has positioned itself to meet this steady climb. It has braced for

the Fifth Dimension of Air cargo.

An

earlier Winging IT blog piece "A Pound of Feathers or Pound

of Gold" discussed why older frames make

for a great value as a freighter. Randy's blog answers that question as older

frames can handle the Fifth Dimension freight business better than the

latest technological offerings except for the 747-8F. Its massive freight

hauling capability is flanked by older 747-400's which are predominantly in

service.

The

final idea is reading Randy's blog at the provided links and give pause to the

fifth dimension of aviation's marketplace at the next airshow.

Sunday, May 13, 2018

Saturation of The Long Thin Routes Revives the 787-8 Discussion

At some point in time, the long thin route (LTR) types like the 787-9, 777 or A-350's will saturate this portion of the aviation marketplace. The LTR is closing in on a full inventory of aircraft, hence the A380 is hard to sell and the 787-9 vs the A-350 battle is winding down. It could be predicted the 777X sales have hit a pause point in its offerings as airlines are recalculating its own aircraft needs as this market segment fills.

There was a little-noticed transaction with Boeing and American Airlines when American slipped in 22 787-8's in the order with ordering an additional 25 787-9's. After some consideration on the subject of the 787-8 and the 787-10, it is apparent the marketplace has started to re-examine medium range again for its business plan. American needs to replace its 767 class of older airplanes and it chose the 787-8 for this fleet renewal plan for older widebody fleet units.

Airbus has invested in the LTR heavily with its A350-900's and A-350-1000's programs, however, Boeing made a pivot by installing production continuity from a 787-8 production going to a 787-9. All the 787 types assemble together in the same manner so no special production consideration is needed for building the 787-8 vs the 787-9.

The second part of the Boeing pivot is the 787-10. It is not an LTR filler but a mid-distance and high-density people mover. It brings unrivaled fuel efficiency for its high passenger density. It is a natural for Singapore Airlines who ordered 49 of this type. The 787-8 and 787-10 can now work in tandem filling the 3,000-6,000 mile market, hauling a spectrum of 230-330 passengers with high-efficiency loads (fat market dynamics). Singapore just accepted its first A-350-ULR, holding about 162 passengers going the distance. This is a capstone for filling LTR market and few aircraft will be needed for the 16-20 hour aircraft endurance for which Qantas is asking the two big aircraft makers for flying from Australia to anywhere in the world under the moniker "Project Sunrise". Boeing will offer its 787-9 rendition with extended fuel capacity and less dense seating in the long body.

The fat part of the market is where the 787-8 and 787-10 lives. Boeing has repositioned itself while Airbus ruminates on its LTR capability as if some kind of advertising bragging is better than reality itself. The 787-10 is built for Asia. It is also built for continental travel. The 787-8 is coming back into vogue as the LTR becomes full. It's already within five years of that happening. I would expect orders of 200 for the 787-8 and another 100 for the 787-10 over the next five years. The 787-9 ordering push winds down as the market shifts back to the fat part of commerce with people moving. It too should book another 150 787-9's over the next five years. Remember, The Emirates order for 40 787-10's has not yet shown up in Boeing's book even though Emirates refers to that 15 billion deal as a done deal.

There was a little-noticed transaction with Boeing and American Airlines when American slipped in 22 787-8's in the order with ordering an additional 25 787-9's. After some consideration on the subject of the 787-8 and the 787-10, it is apparent the marketplace has started to re-examine medium range again for its business plan. American needs to replace its 767 class of older airplanes and it chose the 787-8 for this fleet renewal plan for older widebody fleet units.

Airbus has invested in the LTR heavily with its A350-900's and A-350-1000's programs, however, Boeing made a pivot by installing production continuity from a 787-8 production going to a 787-9. All the 787 types assemble together in the same manner so no special production consideration is needed for building the 787-8 vs the 787-9.

The second part of the Boeing pivot is the 787-10. It is not an LTR filler but a mid-distance and high-density people mover. It brings unrivaled fuel efficiency for its high passenger density. It is a natural for Singapore Airlines who ordered 49 of this type. The 787-8 and 787-10 can now work in tandem filling the 3,000-6,000 mile market, hauling a spectrum of 230-330 passengers with high-efficiency loads (fat market dynamics). Singapore just accepted its first A-350-ULR, holding about 162 passengers going the distance. This is a capstone for filling LTR market and few aircraft will be needed for the 16-20 hour aircraft endurance for which Qantas is asking the two big aircraft makers for flying from Australia to anywhere in the world under the moniker "Project Sunrise". Boeing will offer its 787-9 rendition with extended fuel capacity and less dense seating in the long body.

The fat part of the market is where the 787-8 and 787-10 lives. Boeing has repositioned itself while Airbus ruminates on its LTR capability as if some kind of advertising bragging is better than reality itself. The 787-10 is built for Asia. It is also built for continental travel. The 787-8 is coming back into vogue as the LTR becomes full. It's already within five years of that happening. I would expect orders of 200 for the 787-8 and another 100 for the 787-10 over the next five years. The 787-9 ordering push winds down as the market shifts back to the fat part of commerce with people moving. It too should book another 150 787-9's over the next five years. Remember, The Emirates order for 40 787-10's has not yet shown up in Boeing's book even though Emirates refers to that 15 billion deal as a done deal.

Friday, May 11, 2018

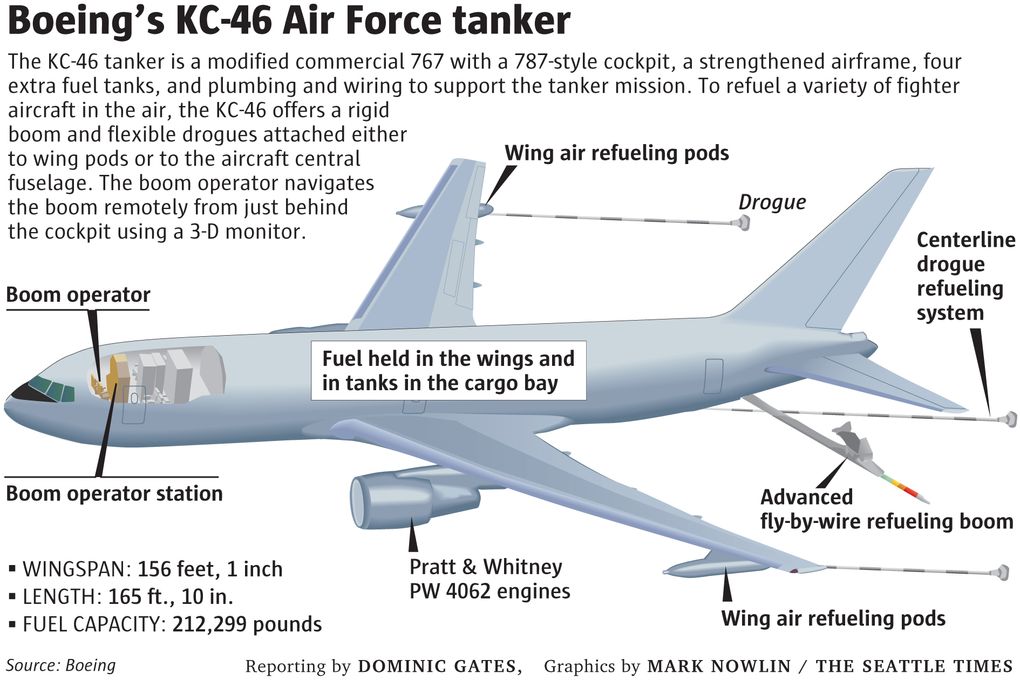

Remember that list of KC-46 problems? Here’s how they’re getting fixed.

Remember that list of KC-46 problems? Here’s how they’re getting fixed. (Link)

A copy of defense news headlines above says it best above. Otherwise, the KC-46 is on final approach before first delivery this summer or early fall. Back in 2015 Winging It features its III part discussion about the KC-46 Pegasus tanker program.

af.mil photo

Back in 2015, the tanker program had an uncertain outcome as the three links above explored. Its now becoming a reality after much refining. The whole program was never about the 767 frame or the A330 competitive bid but was about the technology for making this warfighter a winner. The A-330 and Airbus didn't have the chops to do what the military wanted and believed Boeing would do what it has now accomplished. Deliver a superior and unrivaled tanker/passenger convertible. Its primary mission is fueling the US Air Force vast fleet of aircraft.

A Seattle Times Photo

The aircraft interface with warfighters is the technological challenge and Boeing has almost solved all the myriad problems remaining that the US Air Force presented. Airbus has not demonstrated it has as capable defense program as Boeing has. The fixed cost experiment is almost completed by setting a precedence in place from which all future programs have learned valuable lessons from Boeing's KC-46 journey. The military is never satisfied, as it should not be, but the lessons learned have paved a way forward for the next fixed cost military program.

The 767 airframe has proved to be a tough airframe with advanced engineering features inherent in its original design.

The KC-46 program will complete its cycle from start to finish by this fall 2018 with the forever continued always improving model chasing it to its retirement.

It's late and over cost, but its a really good result which will be the envy of air forces around the world.

Another "Winging IT" chapter closes.

Tuesday, May 8, 2018

Boeing's April Order Report

The thumbnail chart below is the tip of the Iceberg. Boeing is going to have a robust order year. The single-aisle types should keep pace with what Airbus rounds-up. The widebody types are about to explode in numbers before years end. An example of this statement is there are many 787 orders in negotiation and the "Airshow in July may sort out some of that speculation. Boeing should book another 50 787 widebodies alone at the airshow before any surprises are added. The 777X may rear up with another big customer announcement. The chart below nets 268 over-all orders for the year which is 33% passed. Boeing is on pace for an 800 order year. Judging by a historical slow first quarter for orders and a robust December order count, the year could bear out 900 airframes booked by December 31, 2018. A larger number could be reached if the 797 is announced.

April Boeing Recap 2018

Subscribe to:

Comments (Atom)