Arch rival Airbus has a problem

coming to a head. Its toilets are from Zodiac, supplier of all things

reclined. The several month delay on getting its Zodiac toilets unplugged won't

be an Airbus game changer. They will get it right eventually during a sixty day

window of time for airing out the critical passenger station. Airbus expected

15 of its A350's built and delivered by year's end. However, a supplier delay of

product not meeting Airbus configurations for the A350's exist, and by years end it is in a stall at an undisclosed

Toulouse location. They will hit maybe 14 Airbus delivered and Airbus expects another 60 A350's to be delivered in 2016 where its

counterpart in North America, Boeing, will rack up another 130 plus 787 wide

bodies into customer's' hand exceeding any Airbus A350 production with an over 100%

output advantage for this type.

Zodiac’s Revolution toilet, right version.

The

supplier issue is still the critical show stopper for any program, especially

for Airbus at this time, as it turns on its wide body production pace in an attempt at

matching Boeing's head start considering its propensity of having an incredible two

plant delivery pace. The Boeing 787 backlog will slip under the Airbus backlog

before 2016 ends. Boeing is near the Airbus net 764 unit wide body backlog for the twin

aisle and twin engine type. Boeing is at 784 net Backlog for the 787 family of aircraft, having 1143 orders booked and 359 delivered. Boeing will catch Airbus backlog by end of first Quarter 2016, if all things stay the same on the order books.

In 2017

when the 787-10 will show up on the floor, suggest a buying spree for 787's will be ripe, as the diminished backlog with Boeing positions them within the magic five year plans of most airline operations for a delivery window. Boeing can now manage order syncing with a customer's five year plan maintaining a 750 unit, 787 backlog. A shrewd strategy from Boeing five years past; "get that 787 backlog

under the five year production mark!" Airbus is yet three years away from that distinction, as it

will try with supplier cooperation matching Boeing WB output in the next three years. Boeing is capable of taking on more orders and delivering faster than

its combative competitor for the foreseeable future.

Delivery timing

matters for every customer in the industry. Many a customer bloated its WB

orders earlier when it could, as a hedge against not having the best aircraft in

its respective fleet sooner rather than later. Now customers can order in stride

with business opportunity without worrying about missing out on delivery slots for a seamless fleet renewal plan, because it can take deliveries within its own five year

corporate window from Boeing.

The long order book wait period is rapidly shrinking for

Boeing even though they have booked at least 1,142, 787 orders with 354, 787

already delivered. They are on par with the Airbus' order book backlog. However, considering its a "late" Airbus production ramp-up, even as Airbus had a sub 800 order book at

the start of its initial production cycle starting in late 2014. With this consideration, "That my diligent friends is the Boeing order

book high ground!"

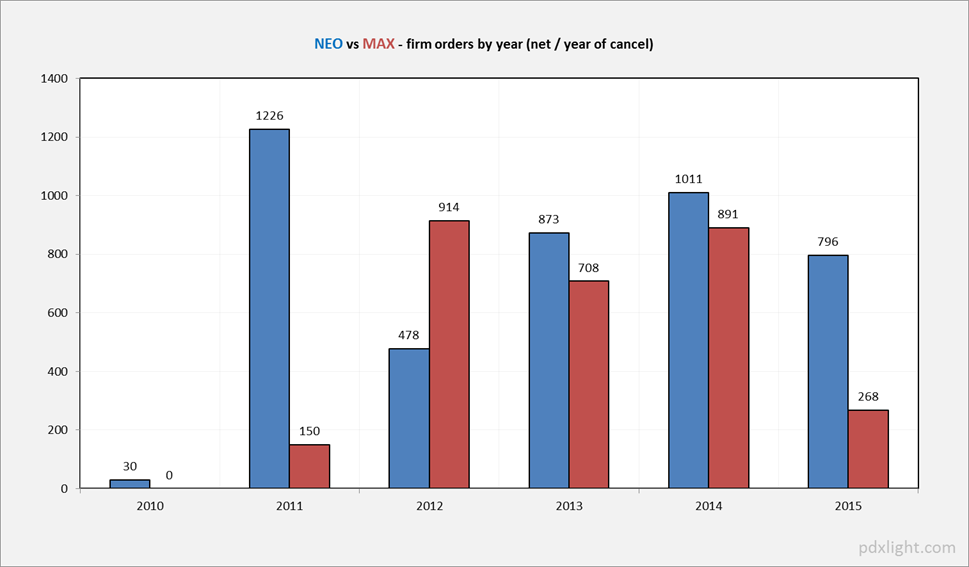

Boeing

continues to add to its WB order book as Airbus A350 order intake languishes

over the last three years compared with Boeing. Now that the 787-10 has taken

on more orders (EVA air), after two soft years from the initial 787-10 order period, Airbus is gasping for help in this segment and it isn't coming soon. Boeing

can deliver sooner than Airbus within the proverbial "Corporate Golden period", or a customer's five

years of planning and opportunity period. Boeing has taken in a net of 294, 787 orders since January 2013 where Airbus has netted 193, A350 orders sine January 2013 where these last two years are a minus 37 net A350's removed from the books.