Boeing has produced and delivered 12 of its 787 during the month of May. The second half of the year promises to be more robust than the 53 of its 787 delivered. The end of June should rebound the Boeing Trend line when reaching for an estimated 135 of its 787 by year's end. Even though the production queue looks lean in number, it becomes a signal for how efficient the 787 program has become since 2011. Program maturity suggests if Boeing has about a thirty (see fig. 5) in its production line, it will produce and deliver about a dozen by months end where in May 2016 it may have forty-four in its production process while delivering only ten of its 787 by any months end. Boeing should exceed a twelve a month delivered for several months during the next seven months while the other five months during this period should deliver around twelve units (+/-) making for the approximate 135 unit year delivered. It needs about 12 a month (83) for seven months to reach 135-138 units delivered during 2017 and is positioned to do so.

Fig. 1

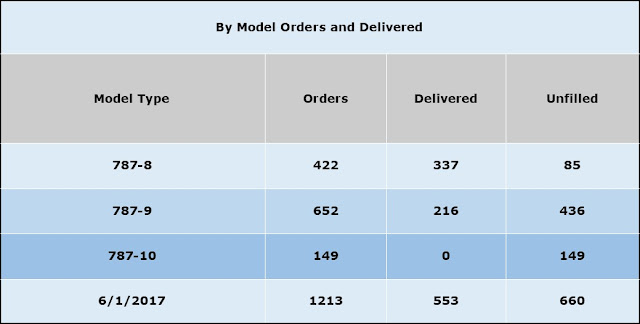

The orders portion above is an estimation since Boeing has not officially posted its order book for May which would include West Jet's 10 unit 787 order.

Fig. 2

Fig. 3

Fig. 4

Fig. 5

My Blog List

Thursday, June 1, 2017

Tuesday, May 30, 2017

Boeing Staff Meeting With Laser Pointer 10:00 AM

Yesterday some claims were made by Winging IT. The statement infers that in Airbus' first 884 days delivering its A-350 XWB, it delivered 84 units ending on May 24th 2017.

The laser pointer is now going to spot the chart on what Winging It was trying to say to the world whom does not pay attention anyways.

Boeing had its first 884 days of production and what does that look like compared with Airbus? Those who may argue the A-350 was a 787 knock off built on simpler lines of technology and that it should have surpassed Boeing in units after an initial 1,000 days of delivery production. Teething woes can see this graph and surmise.

Refer to the Chart:

Looking at the slope lines does not include units delivered after the first 884 days. Why that number in days? Because data is available for this comparison after Airbus delivered its 84th A-350-9 XWB on May 24, 2017, during the Airbus 884th day of production. This came after its first A-350 delivery on December 22, 2014 making it a 884 day span of time. In fairness, Boeing also had a first 884 days of production complete with extensive teething woes such as the battery and fastener issues. A far more complex Boeing aircraft was attempted than Airbus could muster forth.

The news improves further when going past Boeing's-February 2014 884th day out from first delivery in September 2011. Boeing now can produce 12, 787 a month when called upon. Airbus is pacing at about five or six a month, but will increase that number when possible. The great news is Boeing can extend the order book at this time without having its customers wait for aircraft too long of time rather than if a customer placed an order with Airbus. They will wait longer than three years for delivery unless an early slot opens due to a cancellation. Boeing can now promise its customers a frame under five years time within that customer's five year financial planning model typically used by most all of industry.

The thirty period range represents approximately the first thirty months of production for each Boeing or Airbus WB type offered with the 787 and A-350 class of aircraft. It's time Boeing to take the gloves off the gloves and dominate further.

The laser pointer is now going to spot the chart on what Winging It was trying to say to the world whom does not pay attention anyways.

Boeing had its first 884 days of production and what does that look like compared with Airbus? Those who may argue the A-350 was a 787 knock off built on simpler lines of technology and that it should have surpassed Boeing in units after an initial 1,000 days of delivery production. Teething woes can see this graph and surmise.

Refer to the Chart:

Looking at the slope lines does not include units delivered after the first 884 days. Why that number in days? Because data is available for this comparison after Airbus delivered its 84th A-350-9 XWB on May 24, 2017, during the Airbus 884th day of production. This came after its first A-350 delivery on December 22, 2014 making it a 884 day span of time. In fairness, Boeing also had a first 884 days of production complete with extensive teething woes such as the battery and fastener issues. A far more complex Boeing aircraft was attempted than Airbus could muster forth.

The news improves further when going past Boeing's-February 2014 884th day out from first delivery in September 2011. Boeing now can produce 12, 787 a month when called upon. Airbus is pacing at about five or six a month, but will increase that number when possible. The great news is Boeing can extend the order book at this time without having its customers wait for aircraft too long of time rather than if a customer placed an order with Airbus. They will wait longer than three years for delivery unless an early slot opens due to a cancellation. Boeing can now promise its customers a frame under five years time within that customer's five year financial planning model typically used by most all of industry.

The thirty period range represents approximately the first thirty months of production for each Boeing or Airbus WB type offered with the 787 and A-350 class of aircraft. It's time Boeing to take the gloves off the gloves and dominate further.

Monday, May 29, 2017

Airbus Makes Wide Bodies After Four Years

So, Okay I'm not in the the camp of Airbus. Therefore, fairness becomes a relative proposition when analyzing what's going on in the world of largest airplane maker. Boeing Delivered its first 787 late in 2011. Airbus delivered its first at the end of 2014. Having that demographic in play it's better to break it down into months/days of production for each builder for the 787 or the A-350 making it a fair comparison in time.

Airbus delivered its first A350 during December 22, 2014 and its most recent and last delivery on May 20, 2017. This Airbus time frame is 884 days until its 80th was delivered. What did Boeing do in its first 884 days delivering its 787 compared with Airbus? This will measure how a much more advanced one competes with the other with its production maturity. Of course this will include Boeing's battery fire, fasteners issues, and myriad number of problems during the same number of days after its first delivery in September 2011.

Here is that score card comparing the Airbus time span of deliveries made since its first on December 22, 2014.

Boeing's first 884 days ended on February 25 2015 when it delivered its 122nd, 787's in the same span of time of the Airbus 884 days of time, after which Airbus who built a less technologically complex A-350; did not suffer any technological leap hiccups from its using of untried innovations. But has only achieved 84 of its type delivered in the same number of days as Boeing. Here are the Year By Year delivery record of Airbus from the unofficial website, XWB Production List.

If any errors are included they will be minor in nature and will not materially contribute with the comparison.

Click Inside Each Chart To See Better Image When Using Windows.

Airbus 2014 A-350 Delivered:

Airbus 2015 A-350 Delivered:

Airbus 2016 A-350 Delivered:

Airbus 2017 A-350 Delivered

Airbus delivered its first A350 during December 22, 2014 and its most recent and last delivery on May 20, 2017. This Airbus time frame is 884 days until its 80th was delivered. What did Boeing do in its first 884 days delivering its 787 compared with Airbus? This will measure how a much more advanced one competes with the other with its production maturity. Of course this will include Boeing's battery fire, fasteners issues, and myriad number of problems during the same number of days after its first delivery in September 2011.

Here is that score card comparing the Airbus time span of deliveries made since its first on December 22, 2014.

Boeing's first 884 days ended on February 25 2015 when it delivered its 122nd, 787's in the same span of time of the Airbus 884 days of time, after which Airbus who built a less technologically complex A-350; did not suffer any technological leap hiccups from its using of untried innovations. But has only achieved 84 of its type delivered in the same number of days as Boeing. Here are the Year By Year delivery record of Airbus from the unofficial website, XWB Production List.

If any errors are included they will be minor in nature and will not materially contribute with the comparison.

Click Inside Each Chart To See Better Image When Using Windows.

Airbus 2014 A-350 Delivered:

Airbus 2015 A-350 Delivered:

Airbus 2016 A-350 Delivered:

Airbus 2017 A-350 Delivered

Saturday, May 27, 2017

Where is Boeing's WB Going In 2017

Boeing has a defining 2017 year. More for how it will preform against Airbus wide bodied orders than number produced. In a declared "down order year" and all things being equal, a relative good order year is beating Airbus with wide body bookings becomes a signature year. Both builders have had a substantial amount time into the market and into its production. Boeing has maintained its lead over Airbus in this division with its 787 booking 1.46 units for every One A-350 sold. In fact if considering the 777X project, Boeing has expanded that margin of wide body sales over Airbus.

During 2017, Airbus has booked 14 wide bodies through April including both the A-330, A-350 and Zero for the A-380 orders. Boeing had booked 39 wide bodies during the same time frame. This would include the; 747, 767, 777, and 787 frames.

Not included in this Boeing total is May's already noted 10 West Jet order for 787-9's and Singapore's LOI for 20 777 and 19 787-10's. There are talks going on at this time with Hainan for more 787-9's which if announced before year's end would make for a respectable Boeing Wide Body order book for 2017. Are there more Boeing surprises remaining in 2017? Only the 2017 Airshows know for sure. Airbus has little chance in catching Boeing this year for wide body orders which will help Boeing's over-all book balance comparing with Airbus. The prize is both the greatest number produced or orders booked during any given year. This year Boeing has an opportunity for both winning the production and order battle over Airbus.

The key for this assumption is if "other" deals are resolved that have been lost in the recent print history of whom is doing what with orders. A Boeing optimal year (hoped for) is for 100 wide bodies ordered for all its type mentioned above. The minimalist would see Boeing only about 60 wide body orders booked.

However, Airbus needs a rabbit ups it sleeve to catch Boeing for Wide Body orders. Its April ending number of 14 includes the A-330 which is a fleet replacement or a market entry option to the A-350. The optimist sees an Airbus fifty to sixty wide bodies ordered with 20 more A-350's and two dozen more A-330's in the mix. Airbus pessimistic outlook is for a collapse of its wide body order book having only 30 ordered during 2017.

Common sense always gives way to somewhere in between. The Boeing Order Book midpoint sits at 80 wide body ordered (100-60) and the Airbus midpoint 2017 order book sits at 45 units ordered (60-30).

During 2017, Airbus has booked 14 wide bodies through April including both the A-330, A-350 and Zero for the A-380 orders. Boeing had booked 39 wide bodies during the same time frame. This would include the; 747, 767, 777, and 787 frames.

Not included in this Boeing total is May's already noted 10 West Jet order for 787-9's and Singapore's LOI for 20 777 and 19 787-10's. There are talks going on at this time with Hainan for more 787-9's which if announced before year's end would make for a respectable Boeing Wide Body order book for 2017. Are there more Boeing surprises remaining in 2017? Only the 2017 Airshows know for sure. Airbus has little chance in catching Boeing this year for wide body orders which will help Boeing's over-all book balance comparing with Airbus. The prize is both the greatest number produced or orders booked during any given year. This year Boeing has an opportunity for both winning the production and order battle over Airbus.

The key for this assumption is if "other" deals are resolved that have been lost in the recent print history of whom is doing what with orders. A Boeing optimal year (hoped for) is for 100 wide bodies ordered for all its type mentioned above. The minimalist would see Boeing only about 60 wide body orders booked.

However, Airbus needs a rabbit ups it sleeve to catch Boeing for Wide Body orders. Its April ending number of 14 includes the A-330 which is a fleet replacement or a market entry option to the A-350. The optimist sees an Airbus fifty to sixty wide bodies ordered with 20 more A-350's and two dozen more A-330's in the mix. Airbus pessimistic outlook is for a collapse of its wide body order book having only 30 ordered during 2017.

Common sense always gives way to somewhere in between. The Boeing Order Book midpoint sits at 80 wide body ordered (100-60) and the Airbus midpoint 2017 order book sits at 45 units ordered (60-30).

Tuesday, May 23, 2017

The China Syndrome Melts Boeing To The Core

In order to build a Chinese

market, many incentives have gone the Asian way. An assembly center having both

mega builders participating so it may sell immediate products to the mainland

Chinese. Shared technology when using inexpensive Chinese resources for R&D

and access to the world's markets from these exchanges. However, the goal comes

from its government, whom will in every manner possible isolate itself from

everything beyond its boarder while consuming everything beyond its boarder at

the same time.

Its

goal is a world aviation player at the expense of everything offered around the

globe. Tens of thousands of its people work every day for finding out how to

build an F-35, 787 and a Max 737. The latest foray into high tech endeavor

comes from the recent test flight of its C919 single aisle. The common denominator

for all flying programs is the engines. China would like to know how GE

developed its engine. China may reverse engineer a World product but can it

start with a white paper product and move it to the real world market?

China

is about to step up and out from its Russian engine mentors and go long with

its own rendition of a RR or GE version of engine. These non Chinese makers have been pouring everything they have known about engines into its

latest version of maximum thrust and lean burn configured engines. These engine makers have already put on its own electronic drawing board many experienced gained ideas and further refinements. This type

of advancing can not be copied by the Chinese at this time or reverse engineered.

China will have to demonstrate it can do this in ten years by what the others have

done in the last seventy years from advanced engine building.

China

has rooms full of engineers working the problem but doesn't have billions of

flight hours at its back. It may conceivably rattle the cages of both Boeing

and Airbus but it will lay-up short for the next 30 years from where the giant

engine builders are today, and where it continues forward. China can and will make

dramatic strides forward using available off the shelf advances but having

successful innovation is the missing link for all its aspirations for being world’s

largest airplane builder. If that goal is reached it will be from a base of

isolation and not inclusion. Nationalistic Pride dictates it will build and

others will have to wait and wait until given access to China's promise of

inclusion.

The

above paragraph is one dim outlook towards a three way airplane dominance. Having one

private and one co-sharing private with government will compete with one

Government directed Chinese maker. It will be an interesting world where the

market place may begin to isolate itself from one another out of survival. The

only way forward will be a free market place and not an isolated market place.

Engine makers will sell to the Chinese maker while the Chinese strive to

reverse engineer but can't quite come clean sheet in its forward attempts. The

value of experience is forgotten in this case which can't be stolen.

Monday, May 22, 2017

May Is Busting out With 787's Orders

The Boeing score card for the

year is at almost a one to one book to bill ratio for its 787 family and it

goes farther than the 787. Here are the dynamic order additions so far in May

2017.

·

May 2, 2017 West jet orders 10 787-9s

·

May 22 2017 Hainan announces for 6, 787-8 and 13 more 787-9's

·

January through April various customers order 13 787-9's. The

total book for 2017 is 36 787's booked.

But

if including the Singapore LOI order, it adds another 19 of Boeing's 787-10's

making the 787 order going up to 55 of its WB type in play.

So

far Boeing has built 49 of its 787 for YTD numbers. Taking into account the

Singapore Air LOI quantity, which Boeing has high confidence the order will be

finalized by years end, a theoretical Book to Bill would exceed the preferred

ratio of one to one. At this time, Boeing would sit at with a BB 787 rate of 1.12 as it

contemplates moving production up to 14 787 next year.

Looking

at the remaining 7.5 months of 2017 leaves Boeing some calendar and airshow

opportunity. If Boeing can make a significant deals it will make the year for

the wide bodies. Singapore air signed for its promised LOI for 20 777-9X's.

This too is expected by years end for a formal booking. Without even thinking about Boeing's-Emirates hanging order chad, Boeing will have establish itself

a solid year, which should eclipse Airbus wide body efforts.

Saturday, May 20, 2017

Trudeau: "Don't cut off your nose to spite your face" Policy

A reckless game of chicken is

played with Boeing on one hand and Canada on the other hand. Trudeau, Ca. PM

canceled the Lockheed Martin F-35, then he talked Boeing into submitting a plan

for its new and advanced CA-18's in an interim replacement plan for its aging

CF-18 "Old" Hornets. Then Boeing vigorously came out from its

commercial arm objecting to the Canadian Government involvement supporting its

Bombardier scheme when entering into the commercial US aviation markets.

Boeing's

objection caused a Canadian response which threatens both the Canadian

defensive air shield and the Boeing-CA-18 Hornet deal. All assumed Canada has

studied the situation before jumping at a rebuke of Boeing's defense division.

It has progressed to a point where Canada must go elsewhere for fleet renewal

for its fighter aircraft if it maintains a staunch position. A Euro deal would

cause a tremendous retooling of its air command with using Typhoons or other

such European fighter aircraft. A move like that would keep Canada compliant

with NATO while snubbing American War Complex it had committed to earlier on in

this decade.

Trudeau

is windmill tilting at this point in his quixotic gesture towards both Boeing

and Lockheed at the same time.

What

will happen is a guess but here is that guess. Canada wants a lower F-35

price and by delaying Boeing it may get the price it needs. Using the threat of

going elsewhere for a military fleet renewal gives Canada leverage with both of

the two American manufacturers. The US government will step in with two options

for Canada. One buy an American fighter or two go fish in Europe while the US

reduces its military investments with Canada. Trudeau will have to choose, once

the gauntlet is thrown down. The F-35 has ample orders already and it doesn't

need a Canadian deal anyways. If Canada were attacked the US would come with

its F-35's anyways defending North America so thinks Trudeau.

However,

this assumption maybe flawed where the US would come en mass with its F-35's. A

very large bill would be attached for any American/Canadian defensive actions.

Trudeau is over playing his hand and Trump may call him out on his

gamesmanship. Any call out harms the relationship between the two nations. The

guess comes full circle with face saving moves. Trudeau got elected because he

stood up and now he is drifting towards a Canadian calamity because he can't

back down and buy the F-35. The US has to make an offer he can't refuse. Things

change and his first stance no longer applies as the F-35 program has morphed

itself into a Canadian compliant deal. What he ran on no longer applies. A

Boeing deal is a stop gap order supporting its aging fleet. The US will have to

help Canada assimilate the F-35 program as if it were an extended wing of the

North American defense pact. Canada wants more than just buying into the F-35,

it wants the whole tamale.

Tuesday, May 16, 2017

Boeing's Red Herring Express Is On Sale For Christmas

Airplane wars is merely a game of giant

monopoly. The path to the crown of the mountain is full of entrapment. Airbus

eyes Boeing and Boeing eyes Airbus in duopoly of board gamesmanship. If I were

in charge of the board game division at Boeing, I would sucker-punch, trick and

treat against the likes of Airbus. In the meantime Airbus seeks answers for its

every challenge from other makers for improving its design, processes, and

marketability. Boeing does likewise. The board is made up of the most elite members

of the aviation industry. Some are brilliant engineers others are brilliant

strategist with financial degrees. Let's play, I'll be the one moving the

Boeing token around the past go and Fabrice Brégier will play for Airbus.

The dice are played alternating between the two players while risks are unknown and got-cha (Red) cards are drawn by the player when landing on a red card space or the opponent may lose a turn from the role of the dice (dice rolling= risks). Green cards are drawn when a piece lands on a green card place holder on the outer edge of the board. Rolling Snake eyes always loses a turn and allows the opponent a free green card draw which always advances the card drawing player and the player who rolled snake eyes (or a 1 and 1) then draws a red card. Rolling a pair (example 3 & a 3), including snake eyes results in another penalty roll which sends that piece backwards by its dice number.

There are two classes of rules Board Game

rules and Dice rules.

· The Boeing piece gets another green card when it rolls a 7or 8.

· The Airbus piece gets another green card when it rolls a 3 or

5.

The game is simple as the board directs each piece around on

the outer edge in hopes of tripping up the other competing game piece from

an unfortunate outcomes upon landing on a “bad” space. Each player awaits a

competitor’s bad roll, a low value card or the “got-cha” Red card.

It’s a game of survival. When one player circles the board 10 times and receives ten Red Herrings before the other, it wins. Or when a player roles snake eyes then rolls snakes eyes again when determining how far back they will go from the second roll the game then ends which claims a winner for the opponent.

The game will also end after a player draws the one and only “game over” red card. The "game over" red card is always the last Red Card played and is placed on the Bottom of the Red Card deck of Fifty cards. It takes consecutive snake eyes and or turning the one and only “Game over’ Red card to outright lose on game play from the dice or the Red Cards. The game also ends when a player becomes the winner through collecting 10 Red Herring pieces.

It’s a game of survival. When one player circles the board 10 times and receives ten Red Herrings before the other, it wins. Or when a player roles snake eyes then rolls snakes eyes again when determining how far back they will go from the second roll the game then ends which claims a winner for the opponent.

The game will also end after a player draws the one and only “game over” red card. The "game over" red card is always the last Red Card played and is placed on the Bottom of the Red Card deck of Fifty cards. It takes consecutive snake eyes and or turning the one and only “Game over’ Red card to outright lose on game play from the dice or the Red Cards. The game also ends when a player becomes the winner through collecting 10 Red Herring pieces.

Fifty (50) Red Cards:

· Lose an entry into service date, then go back 20 spaces and

lose a "Red Herring" token, only if Red Herring corner is

passed when going backwards (15 cards)

·

Game-over opponent wins-(1 card)

·

Test Engine failure loses two turns-(2 cards)

·

Test Technology Failure loses one turn-(10

cards)

·

FAA bulletin sanction loses one turn-(2 cards)

·

Supplier can't deliver on time loses one

turn-(10 cards)

Fifty (50) Green Cards:

· Gain an entry into service and go ahead 20 spaces collecting a

Red Herring if passing Red Herring Corner (10 cards)

·

Go forward to next Airport landing corner (10 cards)

·

The Board makes the right decision go forward

to next Airport landing (10 cards)

·

Totals single aisle sales exceeds competition

by 1000 one Red Herring token awarded (10 Green cards)

·

The whole point of the game is the using deception or

intrigue as for a subterfuge which trips up an opponent in the real airplane

world. The deception is noted by the term “Red Herring” or a false flag

operation.

Currently Boeing is hedging its announcement for a 797 by delaying a

MOM announcement. No one knows what Boeing will propose and its even driving

the Japanese bonkers, because it wants a play in a new model venture such as a

797. Airbus is eagerly waiting for Boeing to announce so it can counter with a

market pleasing offering. Boeing tosses enough Red Herrings over to its prime

competitor, it may slip an announcement in, but only after enough pre-sale

commitments are made by its customers.

In the meantime it’s time to play on a board game before any decision is made and deceive the competition with Red Herrings and 10 of those will win the day.

In the meantime it’s time to play on a board game before any decision is made and deceive the competition with Red Herrings and 10 of those will win the day.

Game Rules Notations:

If all green cards are played before a winner occurs then

the played cards are reshuffled and placed back on the board face down for continuing

the draw.

Role of the dice alternates between players unless directed

by the game cards drawn where turns are lost by either dice play or Red cards

drawn.

The decision for who will go first from the START is by each player rolling

the dice and it is decided by rolling until a player rolls a pair while alternating from one player to the other, then they

get to choose if they go first or second. Both will always have a chance to roll before starting. If both roll a

pair on the first try then it continues until a player loses against the other

when one rolls a pair and the other doesn’t. Then who goes first is decided by the winner.

A pair is when each dice equals the other. This could be 1-1

(snake eyes); 2-2; 3-3; 4-4; 5-5; and 6-6.

Dice propel the playing piece around the board by the number

the dice pair produces on a roll. However there are special provision when

rolling exact pairs mentioned above. Snake eyes have a significant role

mentioned in the above rules at the top.

Example: If rolling two sixes then a player moves ahead 12

spaces and happens to land on an instruction space (Red, Green or

penalty space), then the player rolls again without having to follow the board

rules of the space. A second consecutive roll will move the player backwards by

its number because of the first outcome was a pair of sixes.

However, when going backward and landing on an instructive space, the player

must follow instructions of the space. Whether it’s a Green, Red, or penalty

space. -1 means player loses a turn and the other player then gets two

consecutive rolls before the penalized will have its next roll. A -2 situation

means a player must lose two consecutive turns when the other player gets three

rolls in a row.

·

There are four penalty spaces losing

one turn,

·

four Red card spaces (penalty),

·

and eight green card spaces (advantage).

Rolling a dice number allows the player to go forward

counter clock wise on the board by that number after which moving as directed by any board or dice rule imposed instructing a player of the result of landing on a space

or adhering with dice rules after moving.

A paired number rolled may result in a double penalty if moving

backwards from dice rules as a penalty roll and lands on a red card space

draw or penalty space.

Saturday, May 13, 2017

Will The 797 Build At Boeing Japan?

A Seattle Times offering by Dominic Gates is worth the read and offers fuel for Boeing contemplation

and mental thoughts. Gates ponders whether the 797 could be or will be built in

Japan. After-all they are significant contributors to the 787 and 777X programs

at Mitsubishi Heavy Industry. It is important to consider if Everett, Renton or

Charleston would be an efficient and profitable location for Boeing's 797's

launch site. Questions need to be solved for what location would best fit a 797

campaign, therefore starting with Mitsubishi then Washington and followed by

Charleston directs this: “what's next” conversation.

Japan

and followed by other locations talking points:

· A proven

ability to build a flying aircraft from scratch.

·

Engineering and production capability for sustaining aircraft making

for program duration.

· Boeing

oversight from ground up remains intact for a foreign enterprise.

· Profitability

margin exceeds its counterpart locations when delivering aircraft to customers.

· Future

sales enhancements exists by location placement.

Mitsubishi Heavy Industry (MHI) can do the

job as it has already handled building significant parts for the 787 program.

It has built a successful regional jet (MRJ), a smaller frame than the 797 to

its completion from 2015.

Boeing would have to swarm MHI with

engineers and production workers during its ramp up for completing a 797. Mirroring

a similar experience Boeing had with its Charleston facility when the first

copies of the 787 were completed.

The Effective and Efficient (EE) standard

exceed all options of where a 797 could be built. Would MHI make the 797

production location a winner for Boeing over Washington State and Charleston

SC? If MHI exceeds an EE test anywhere, then it would become the place of

choice for Boeing.

Finally, Japan buys the 797 in copious

quantity since it would be a Japanese based product. An over flow of orders comes

from regional partners, because of that Boeing would tip the hat for a Japanese location

building the 797. A win-win condition for Boeing exist when lower costing from MHI wins over

Boeing's own manufacturing and developmental locations in the States.

Washington

State:

Yes, Washington State is Boeing's core

engine for building airplanes from its development and production. The delimiting factor is

finding space for building a 797. Boeing may already have a plan for finding space

in the State of Washington west of Mt Rainier. Only the union chases it away

from the Washington 797 placement.

The cradle of modern American aviation has

a 981 zip code in its numbering. Colleges, Tech, and University schooling is built in

the Seattle area for making engineers, machinist, and production personnel.

Boeing in Washington builds everything with wings and is highly successful

making heavy objects fly and fly. The whole function of Renton, Seattle, and

Everett is duration of its aircraft industry.

Aircraft making oversight is a redundancy

and part of its corporate mission.

Boeing Mission Strategy

Statement:

"Run healthy core businesses

Leverage strengths into new products and services

Open new frontiers

Leverage strengths into new products and services

Open new frontiers

People working together as

a global enterprise for aerospace leadership"

Does Washington State footprint beat the

competition on enough levels?

This is a hotly debated topic with its

Charleston's counterpart capability whom is not Union at this point in time. It

is the most efficient airplane center in the world as it beats the Charleston,

SC production and development capability. The sum of its whole capability beats

Airbus' own manufacturing. Boeing has become the world's largest airplane

manufacturer because the Washington state foot print is the guide on for all of

Boeing's enterprises.

Future sales are built on Boeing's

reputation from the Northwest location. However, some analyst believe Boeing

must expand from that location to remain a viable leading builder of new flying

technology thus a consideration is on the table for building the 797 elsewhere,

as it expands its world footprint.

Charleston

SC:

Charleston has proven over and over again it can build the

world's most advanced airplane in the 787. It also builds ancillary parts for

the 787 program. Charleston is equipped for absorbing Boeing growth from its

own growing aerospace functions in the area. Therefore, Charleston is a serious

contender for developing and building a 797.

However, its recently produced a flying 787-10 and it moved to

Seattle for its test campaign even though Charleston already had a vast experience for

making the 787 family from its first two model types. The inference suggests Boeing

Northwest maintains the lead testing center for all future air-frames because of its

human Resource, Experience and Corporate controls.

Charleston is here to stay until notified otherwise. The

duration of a project campaign is unlimited as it has matured to the level of

having the highest confidence for producing new airplane types. It is

positioned well for the next step of making a whole new air-frame such as a 797 middle of the market aircraft.

Charleston is not a foreign enterprise and beats any foreign

competition in this category. Only Northwest Boeing is the head of the class

for this consideration. In Fact the Boeing Northwest swarm of engineers and

airplane builders made the initial Charleston 787 product. But much to its

credit, Charleston has followed on, by relentlessly succeeding in every challenge

given by the corporate mandate.

Profitability from Charleston is from several factors such

as a Non-union environment and flexibility of space consideration. It has

enough space or land to enhance Boeing efficiency. It can make it cheaper

because of its favorable production environments.

There is no future benefit for sales from a Charleston location. It is

only convenient for some of its European customers and going eastward. A

location condition is only effective when it benefits the customer over a long

period of time or it mutually benefits both Boeing marketing and the hosting

nation at the same time such as MHI deal would make for making a Boeing decision. The Boeing

reputation comes from the Seattle area not Charleston.

A summary conclusion would make this a horse race at the end

of it all. MHI for orders, Seattle for reputation and expertise, and Charleston

for flexibility and lower costs. The Japan option is awkward for Boeing's corporate

involvement, but it can be done if Japan makes it worth it. The Charleston

option is limited by over-all program experience such as MHI has where Charleston

has limited program experience, but cost controls are attractive to Boeing

stockholders.

The always faithful Northwest Boeing centers are most

attractive but for its rising costs plaguing corporate investors thinking. In

this horse race sales will drive the decision process.

MHI will get the nod if the Japan region goes for buying 500 of the 797, otherwise, it may only order 200 initially as Boeing goes elsewhere with a decision.

The Northwest is in the middle, having reputation, know how, and a proven track record. It would get the initial production nod where Boeing then would branch out once the program is set in a delivery stream. Japan will get a promise for production participation if it will wait five years allowing time to prove out this type as it would get the Asian market share for production.

Depending on sales quantity, Charleston could conceivably get a substantial production share depending on sales of all Boeing types during the next ten years forward. The sales would require a rising Max and 777X order book, then Charleston could take on about 20 797 a month pace where Boeing would have an equal portion for delivery. If sales are soft across the board then the Northwest R&D wins the horse race.

MHI will get the nod if the Japan region goes for buying 500 of the 797, otherwise, it may only order 200 initially as Boeing goes elsewhere with a decision.

The Northwest is in the middle, having reputation, know how, and a proven track record. It would get the initial production nod where Boeing then would branch out once the program is set in a delivery stream. Japan will get a promise for production participation if it will wait five years allowing time to prove out this type as it would get the Asian market share for production.

Depending on sales quantity, Charleston could conceivably get a substantial production share depending on sales of all Boeing types during the next ten years forward. The sales would require a rising Max and 777X order book, then Charleston could take on about 20 797 a month pace where Boeing would have an equal portion for delivery. If sales are soft across the board then the Northwest R&D wins the horse race.

Monday, May 8, 2017

A Delta Delay of its 10 A350-900 Changes Everything.

Delta airlines is pondering delaying 10-A350's as it restructures its fleet requirements. Too much too soon may sink Delta values. However, a Boeing opportunity may emerge as Delta's management continues its normal turnover at upper levels. New thinking is evident by the A350 delay consideration. Delta is working on a buying pause with its fleet renewal or expansion plans. An Airbus order delay would signal Delta's caution because of the fluid and dynamic nature of changing markets and strategy for assigning inventory for both opportunity and efficiency when using its existing inventory.

Boeing lost a bitter sales campaign to Airbus when it signed on for twenty-five A-350-900's several years back. It would love to have that loss back with another try. This is were a speculative sales offer would come into view. How could Boeing take advantage of Delta's changing management? It would depend on who comes into Delta and who retires. Boeing could not get a second chance at all but the recent discussion are centered on an A350 delivery delay for ten of its type.

One consideration by Delta would be pricing for new equipment with open delivery dates. That would satisfy a Delta goal of having a flexible fleet change when expansion and renewal dynamics are in play. It is possible the Delta/Airbus A350 contract is not flexible enough taking on its large of order during the next 10 years. A delivery pause would allow a counter from Boeing to offer just in time 787's leading-in with the 787-10 model.

The 787-10 doesn't fly as far as the A350-900. It may only need to go 6,000 miles in Delta's network. The A350-900 maybe an overcapacity type aircraft that can go 8,000 miles but having only those few routes for the distance capability available, Delta wouldn't fill-up 25 aircraft with paying passengers. If the A350-900 holds 325 passengers it would not fly 8,000 miles nor could Delta fill those seats up for its long thin route capability. Perhaps the 787-10 is more efficient than the A350-900 going just 6,000 miles where 90% of the market resides. A Boeing sales pitch suggest this point.

Delaying the A350-900 would signal a rethink of Delta's strategy and Boeing could re-pitch its 787-10 which wasn't complete at the time of the last go round. It was all about the 787-9 at that time and Airbus made its A350-900 more attractive where Delta finds itself working to find routes for long range heavy haulers. There is no A350-800 on the boards and its A350-1000 does not match Boeing's 777-9X capabilities. Delta knows this and it must find a home for its Airbus order. When the deal was struct back in November 2014 Delta just signed with Airbus. The 777X was a paper airplane and the 787-10 was just in a Boeing Dream mode. Now it flies every day in test mode.

Delta could opt for a Boeing deal four years out for delivery and fit Delta's plans better than taking on 25-A350's starting now and dropping the Airbus purchase for 25 A330's later. A Delta delay on the A-350 may suggest its Airbus purchase for another 25-A330's may be dropped. Boeing could offer 10 and 10 of its 787-10 and 7779X delivered during the year 2020 and beyond using a flexible delivery schedule at Delta's own need. Also the 787-8 or 787-9 may also be a better fit than the A-330 for its operations.

Either way, Boeing has a slim shot at making a deal with Delta as it considers buying either the NEO or Max single aisle. In that deal making process, Delta may experience a sea change for its planning of its fleet.

Boeing lost a bitter sales campaign to Airbus when it signed on for twenty-five A-350-900's several years back. It would love to have that loss back with another try. This is were a speculative sales offer would come into view. How could Boeing take advantage of Delta's changing management? It would depend on who comes into Delta and who retires. Boeing could not get a second chance at all but the recent discussion are centered on an A350 delivery delay for ten of its type.

One consideration by Delta would be pricing for new equipment with open delivery dates. That would satisfy a Delta goal of having a flexible fleet change when expansion and renewal dynamics are in play. It is possible the Delta/Airbus A350 contract is not flexible enough taking on its large of order during the next 10 years. A delivery pause would allow a counter from Boeing to offer just in time 787's leading-in with the 787-10 model.

The 787-10 doesn't fly as far as the A350-900. It may only need to go 6,000 miles in Delta's network. The A350-900 maybe an overcapacity type aircraft that can go 8,000 miles but having only those few routes for the distance capability available, Delta wouldn't fill-up 25 aircraft with paying passengers. If the A350-900 holds 325 passengers it would not fly 8,000 miles nor could Delta fill those seats up for its long thin route capability. Perhaps the 787-10 is more efficient than the A350-900 going just 6,000 miles where 90% of the market resides. A Boeing sales pitch suggest this point.

Delaying the A350-900 would signal a rethink of Delta's strategy and Boeing could re-pitch its 787-10 which wasn't complete at the time of the last go round. It was all about the 787-9 at that time and Airbus made its A350-900 more attractive where Delta finds itself working to find routes for long range heavy haulers. There is no A350-800 on the boards and its A350-1000 does not match Boeing's 777-9X capabilities. Delta knows this and it must find a home for its Airbus order. When the deal was struct back in November 2014 Delta just signed with Airbus. The 777X was a paper airplane and the 787-10 was just in a Boeing Dream mode. Now it flies every day in test mode.

Delta could opt for a Boeing deal four years out for delivery and fit Delta's plans better than taking on 25-A350's starting now and dropping the Airbus purchase for 25 A330's later. A Delta delay on the A-350 may suggest its Airbus purchase for another 25-A330's may be dropped. Boeing could offer 10 and 10 of its 787-10 and 7779X delivered during the year 2020 and beyond using a flexible delivery schedule at Delta's own need. Also the 787-8 or 787-9 may also be a better fit than the A-330 for its operations.

Either way, Boeing has a slim shot at making a deal with Delta as it considers buying either the NEO or Max single aisle. In that deal making process, Delta may experience a sea change for its planning of its fleet.

Subscribe to:

Posts (Atom)