Let's examine a Boeing chance at this order as it is named in aviation circles as a player for this deal. Leveraging a price is done by Boeing's room presence. Airbus does not want to lose this deal and is in the throes of a production start-up with its A330-NEO. It can and will move to a competitive production mode for this type of aircraft. Any delays would make the 787 an attractive alternative.

Here is the fleet dichotomy of Malaysia's Fleet in Fig. 1 below: Available through Wikipedia data

A quick review of the fleet makes room for the 787 as it would bump out the A-330 NEO presence if Malaysia starts a fleet change with new aircraft. Boeing is still chasing the deal but has some talking points remaining.

- Boeing has production slots available

- Higher Fuel prices match future efficiency needs

- Boeing Fleet presence completes Malaysia's commonality of operations from Max-Medium Wide Body.

The current fleet of A330-300 could be replaced with either the 787-9 or 787-10 thus flipping Malaysia Air towards Boeing. If and only if Malaysia Air sees its fleet expansion moving towards longer than 6,000 mile routes. The 787-10 would slot into fleet renewal of current Malaysia Air's A330-300 (15) and then go further with the 787-9 as a fleet expansion move.

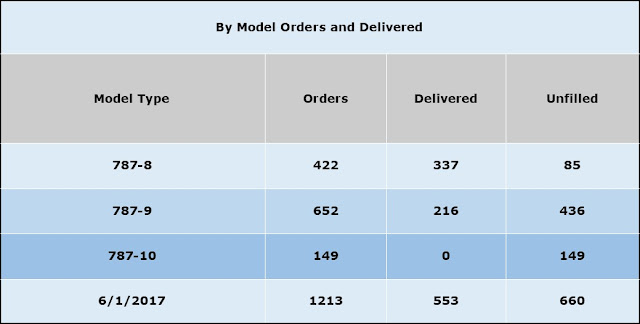

Boeing would make room for either type in its production queue as it now approaches completing its 787-8 backlog and is well established with its 787-9 output. The 787-10 backlog sits at 149 and some of those orders may seek a further out delivery time than originally requested. It is a belief if Boeing can find production slots compliant with Malaysia Air's plans it may sweep away the Airbus order out from underneath them. Boeing would have to make a price case if it can, as much as Airbus needs, and Airbus is better positioned to do so with its A330 NEO proposal.

Boeing would make room for either type in its production queue as it now approaches completing its 787-8 backlog and is well established with its 787-9 output. The 787-10 backlog sits at 149 and some of those orders may seek a further out delivery time than originally requested. It is a belief if Boeing can find production slots compliant with Malaysia Air's plans it may sweep away the Airbus order out from underneath them. Boeing would have to make a price case if it can, as much as Airbus needs, and Airbus is better positioned to do so with its A330 NEO proposal.

September 2017 is the projected deal closing with an Airbus deal by media sources. Boeing's outside shot could be aided by rising fuel prices. If Boeing makes a late genuine offer for placing wide body orders it would have to have other sweeteners such as a 797 offering as a launch customer.